USDx has been launched by dForce as the first monetary protocol, which is a decentralized and synthetic indexed stablecoin. USDx is pegged by a basket of constituent stablecoins at a pre-determined weighting, which can be adjusted via on-chain governance.

As we launched USDx protocol, the initial reserve comprises of four constituent stablecoins, with the following weighting: 30% USDC, 30% TUSD, 30% PAX and 10% DAI. As a decentralized stablecoin protocol, constituent portfolio and their respective weighting can be adjusted by DF holders via governance poll.

We proposed a USDx weighting adjustment on 9 Nov, 2019, where we removed DAI from the reserve basket and adjusted constituent stablecoins weighting to USDC 35%, PAX 35% and TUSD 30%.

Subsequently, we introduced DIP001 into USDx, which is a yield enhancement proposal to implement USDx Saving Rate (USR). But due to the depreciation of Lendf.Me, we have yet to implement USR.

With the imminent launch of our yield aggregation protocol dToken, we now have another chance to implement USR by supplying the underlying constituent stablecoins to dToken pools to earn yield.

The stablecoin market grew substantially since the launch of USDx late last year. Today the total outstanding volume of stablecoins crossed $11bn, representing 3x growth from early 2020.

The composition and market shares of our constituent stablecoins also changed dramatically. With yield market support, we see that a number of regulated stablecoins take substantial market shares.

Here is a recap on the market cap of our constituent stablecoins, USDC ($1.1b), PAX($245m), TUSD($134m). USDC is gaining substantial market share. In consideration of outstanding market cap, number of exchanges supported, DeFi integrations, and yield market accessibility (i.e USDC is the most popular fiat-back stablecoin across DeFi yield markets, whilst PAX has none so far and TUSD has only one market support), we thereby propose the following weighting adjustments:

-

Adjust USDC’s weighting from 35% to 80%, in response to its growing market share;

-

Adjust down PAX’s weighting from 35% to 10%, reflecting its market share and taking into account of the lack of yield market supported.

-

Adjust down TUSD’s weighting from 30% to 10%, reflecting its market share and taking into account of its weak market liquidity and limited yield market support.

IMPORTANT: Implications

This proposal is an attempt to improve yielding opportunity of USDx’ underlying constituent stablecoins. No action is required from existing USDx users — you will not be forced to redeem USDx, or withdraw constituents. This proposal only represents a change to reserve constituents and the weighting of underlying reserve of USDx which has no inherent impact on its dollar peg.

· Current weighting: 1 USDx = 35% USDC + 35% PAX + 30% TUSD

· Proposed weighting: 1 USDx = 80% USDC +10% PAX + 10% TUSD

Implication and Process Explained:

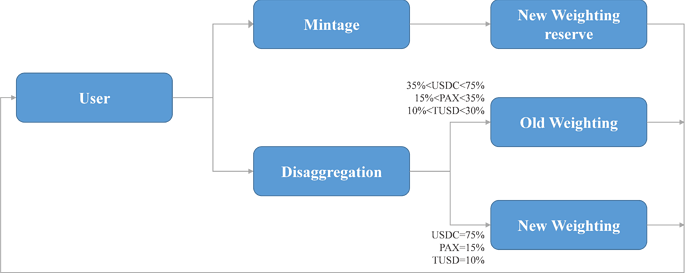

After activation of the proposal, all new mintage of USDx will follow the new proposed weighting (80% USDC + 10% PAX+ 10% TUSD), i.e., deposit 80 USDC, 10 PAX, 10 TUSD will mint into 100 USDx.

On disaggregation, i.e., if you disaggregate 100 USDx, it will return with 35 USDC, 35 PAX, 30 TUSD, until the old weighting inventory fully consumed.

The following diagram elaborates the process:

Voting Mechanism

-

The governance poll will last for 3 days from 9:00pm UTC+8, 22 July to 9:00pm UTC+8, 25 July.

-

All DF holders will have the opportunity to signal your preference (for, against or abstain) for the reserve adjustments for USDx;

-

Proposal will be implemented if the following requirements are satisfied:

-

Given only 11.8% DF token circulating, the required quorum is: >2% of total DF tokens at the end of the voting period need to have participated in the voting

-

Threshold: >50% of the DF tokens that participated in the voting need to have voted ‘Yes’ for the proposal (If the voting result is tied, the proposal won’t be implemented.)

-

-

Governance decision will be disclosed through Medium and Twitter before 9:00pm UTC+8, 27 July.

Execution Plan

In the event of an approved proposal, reserve constituent adjustments will be carried out accordingly:

-

Before 6:00pm UTC+8, 30 July (inclusive), users will have the right to get back your reserves at pre-determined weightings (35% USDC + 35% PAX + 30% TUSD)

-

From 6:00pm UTC+8, 30 July onwards, new mintage attempts will be automatically switched to adjusted weightings (80% USDC + 10% PAX + 10% TUSD).

-

Effective from 6:00pm UTC+8, 30 July, exiting constituent inventories will be consumed on a First-In-First-Out (FIFO) basis during the process of disaggregation, which means, a user should expect the return of 30% USDC + 35% PAX + 30% TUSD for the disaggregation of 100 USDx, until complete consumption of existing inventory.

Join us for an online discussion! We’d love to hear your voice!

Twitter: https://twitter.com/dForcenet

Telegram: Telegram: Contact @dforcenet

Website: https://dforce.network/