MAI Stablecoin

MAI is a USD stablecoin backed solely by decentralized tokens. Its target peg is 1% within the US Dollar. MAI can only be minted by users through overcollateralized debt positions.

MAI has existed for over 2 years and has been integrated by most major platforms, such as Aave, Balancer, Chainlink, Stargate, and many more.

Benefits of listing MAI

Users

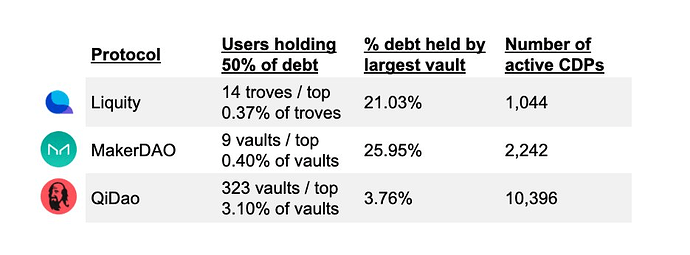

The protocol behind MAI, QiDao, has the largest user base of any CDP stablecoin (over 10k users). This makes MAI a great addition to dForce, as it can bring more users to the platform.

Liquidity

MAI is available on all major chains and is native to all chains where it is present. This makes it easier for users to bridge value from any chain into dForce.

Token velocity

MAI is used more than most stablecoins. On average, it is traded more per day than other major stablecoins. The graph below (in comments due to dforce forum rules) shows daily volume as a percentage of total market cap.

Stability

MAI is one of the most stable stablecoins, seeing below-average volatility compared to other decentralized stablecoins (see link in reply).

Security considerations

QiDao has been audited twice: Security - Mai Finance

QiDao vaults have been tested through several market downturns, such as June 2021, January 2022, and May 2022. Despite these market events, liquidations have worked as intended and MAI remains overcollateralized.

Oracles

Chainlink maintains price oracles for MAI on Arbitrum, Polygon, Optimism, and Avalanche. These oracles can be used for listing MAI on dForce.

Below are the addresses for Chainlink oracles for MAI on the chains where deployment would occur.

- Arbitrum: 0x59644ec622243878d1464A9504F9e9a31294128a

- Optimism: 0x73A3919a69eFCd5b19df8348c6740bB1446F5ed0

- Polygon: 0xd8d483d813547CfB624b8Dc33a00F2fcbCd2D428

Suggested parameters

- Max LTV: 85%

- Borrow cap: 1M MAI per chain