Summary

This proposal presents the community an opportunity to add rETH to dForce Lending.

Motivation

Rocket Pool is a next generation decentralised staking pool protocol for Ethereum, offering dForce users an alternative to Lido’s wstETH.

Rocket Pool ETH (rETH) is the Rocket Pool protocol’s liquid staking token. The rETH token represents an amount of ETH that is being staked and earning rewards within Ethereum Proof-of-Stake. As Rocket Pool node operators, stake Ethereum on Proof-of-Stake the resulting rewards increase the value of rETH relative to ETH. Rocket Pool’s liquid staking token allows holders to benefit from the returns of the Ethereum Proof-of-Stake.

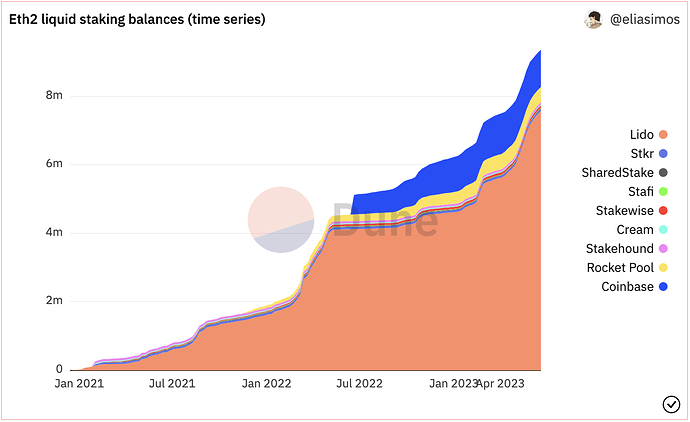

rETH is now the 3rd largest ETH liquid staking derivatives by market cap (Source: Dune Analytics), with more than $924m (or 450K ETH) locked by Rocket Pool, and 24H trading volume of $2.6m at the time of writing.

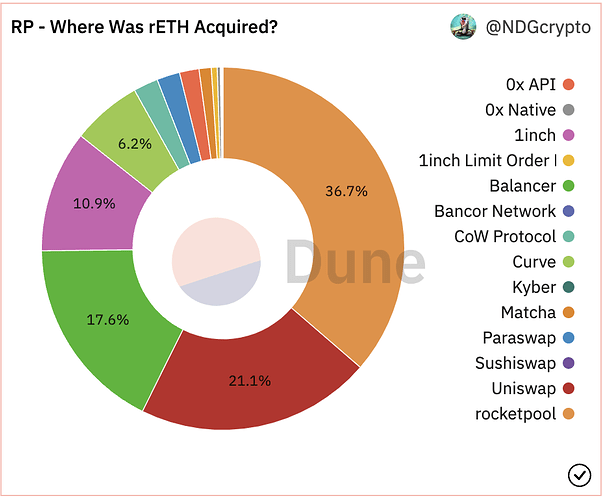

rETH is trading mostly on Uniswap, Balancer, 1inch, and Curve (Source: Dune Analytics)

By listing rETH as collateral, users benefit from staking rewards whilst taking out a loan. There are a range of yield maximising strategies that users could leverage to improve their yields. For example, users are able to supply rETH as collateral to borrow ETH for leveraged staking yields, or borrow rETH and participate in yield strategies beyond lending protocols.

Specification

Technical specifications

A comprehensive technical analysis has been conducted by the Maker DAO technical team here is their report:

Security considerations

RocketPool smart contracts have been independently audited by three audit firms:

- https://rocketpool.net/files/sigma-prime-audit.pdf

- Rocketpool | ConsenSys Diligence 1

- publications/RocketPool.pdf at master · trailofbits/publications · GitHub

There is currently an active bug bounty program on Immunefi:

- bug bounty: Rocket Pool Bug Bounties | Immunefi 1

Risk analysis

A comprehensive risk analysis has been conducted by the Maker DAO risk team here is their report:

Risk parameters

- Collateral enabled: Yes

- Supply cap: 10,000

- Borrow cap: 10,000

- LTV: 82.5%

- Borrow factor: 100%

- Reserve factor: 15%

- Close factor: 50%

- Liquidation incentive: 7%