We always believe that DeFi is blockchain-agnostic. Today, we are thrilled to announce that users of Binance Smart Chain can now access DeFi protocols developed by dForce, starting with dToken, a yield aggregator aiming to harvest the best risk-adjusted returns on your stableasset holdings.

With lower transaction fees and a growing list of assets available on Binance Smart Chain, dForce is able to expand its portfolio of protocols to accommodate more diversified demands, further adapt its offerings catering to average users.

Driving DeFi evolution with dForce on Binance Smart Chain

Binance Smart Chain is a sovereign smart contract blockchain delivering programmability that’s compatible with the Ethereum Virtual Machine (EVM). Designed to run in parallel with Binance Chain, Binance Smart Chain retains the high performance of the native DEX blockchain and to support a friendly Smart Contract function at the same time.

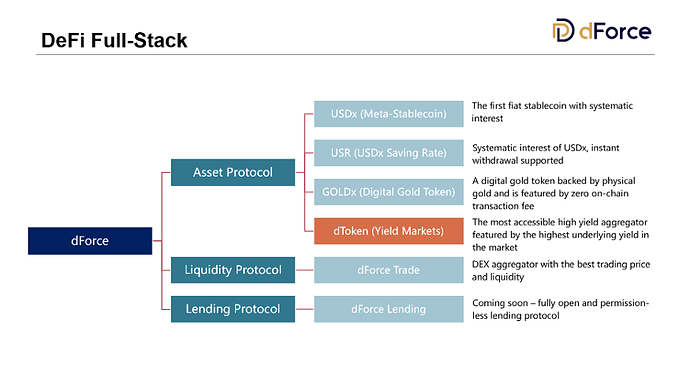

dForce provides a one-stop-shop decentralized finance protocol matrix covering asset protocols (USDx, GOLDx, dToken), liquidity protocols (dForce Trade), and lending protocol (fully open and permission-less), enabling users to earn attractive market interest rates against their cryptoassets, trade with the best available price for assets of their chosen, and lower the cost of borrowing with their crypto loans.

Starting with dToken, dForce will deliver a holistic offering for users of Binance Smart Chain to obtain the best risk-adjusted yield and one-click access to a variety of DeFi protocols. Following dToken, we also plan to bring dForce Trade (DEX aggregator) and the soon-to-be-launched dForce Lending to BSC.

Introducing dToken ( dForce Yield Markets)

dToken (dForce Yield Markets) is the most accessible yield aggregator farming the most attractive risk-adjusted yield across DeFi protocols. Users will receive dToken on a pro rata basis when they deposit supported tokens (i.e. deposit USDT to receive dUSDT). dToken now supports stableassets (BUSD, USDT, USDC, DAI) and can be redeemed at any time.

dToken can attend to a variety of yielding protocols (either dForce-native, eco-system projects or third-party protocol).

dToken is featured by the following merits:

- Steady and robust return: dToken is firstly deployed on Ethereum and is presently the best place to obtain the highest risk-adjusted yield in the market. It mines governance token and automatically converts into underlying tokens (BUSD, USDT, USDC, DAI) with much higher underlying yield.

- High liquidity: Instant withdrawal supported.

- Low friction to acquire: Users will receive dToken instantly on a pro rata basis when they deposit supported tokens into dForce Yield Markets.

- Cost-efficient: Gas optimized by having an internal pool for batching deposit and withdrawal and rebalancing;

- Security audit: dToken is audited by Trail of Bits, a top-ranked blockchain security company.

- Strong composability: dToken is capable of supporting a broad range of DeFi farming strategies for maximized risk-adjusted yield.

Introducing dForce ( https://dforce.network/)

dForce advocates for building an integrated and interoperable open finance and monetary protocol matrix, including asset protocols (USDx, GOLDx, dToken), liquidity protocol (dForce Trade), and lending protocol (dForce Lending).

dForce Token (DF) is the utility token that facilitates governance, risk buffers and interest alignment across the dForce Network.

Our team includes both crypto veterans and professionals from Goldman Sachs, Standard Chartered Bank, Hony Capital. dForce is backed by investors including CMBI (China Merchants Bank International), Multicoin Capital and Huobi Capital (the investment arm of Huobi Group).

Check out more about dForce and dToken through:

• Twitter: https://twitter.com/dforcenet

• Telegram: https://t.me/dforcenet

• Medium: https://medium.com/dforcenet

• Website: https://dforce.network/

• Whitepaper: https://github.com/dforce-network/documents/blob/master/white_papers/en/dForce_Whitepaper_V1.pdf