The dForce ecosystem is constantly growing. To help you keep up-to-speed, each month we will bring you updates on all our recent product launches and developments.

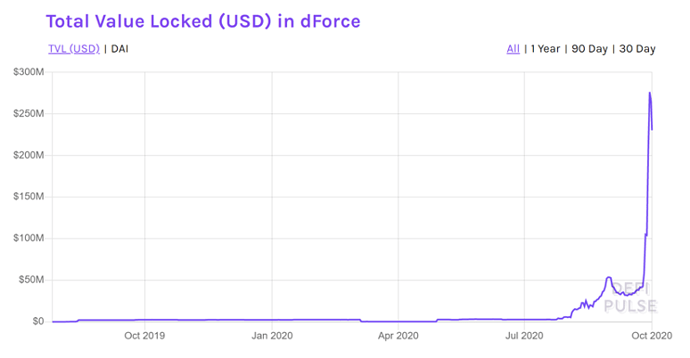

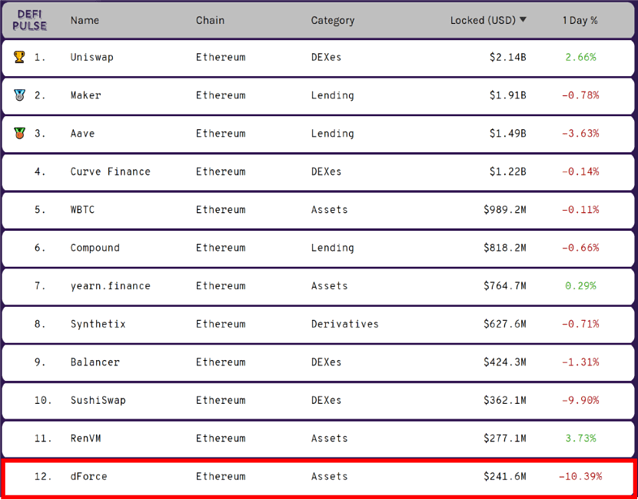

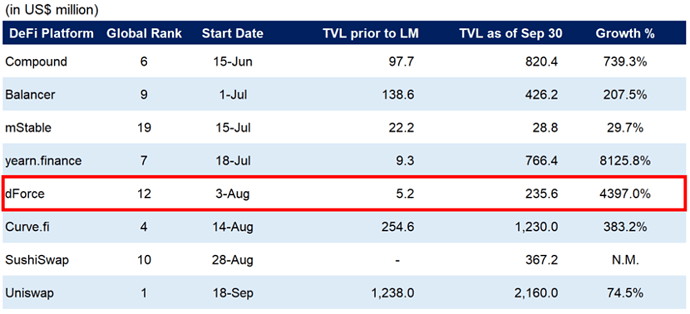

dForce now ranks #12 globally in terms of TVL (total value locked) with $235.6M as of 30 September 2020, representing an increase of 4397% from 3 August.

(Source: https://defipulse.com/)

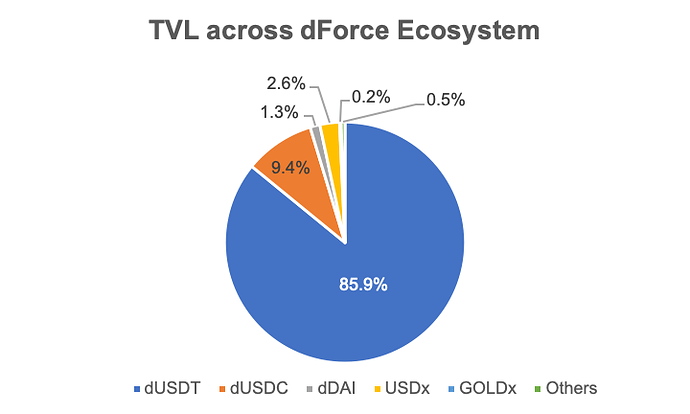

The spike in TVL is mainly contributed by dTokens (85.9% by dUSDT, 9.4% by dUSDC, 1.3% by dDAI), following by USDx (2.6%) and GOLDx (0.2%). Others refer to constituents of USDx (PAX and TUSD) as reserves to secure the price peg of USDx.

Total supply of dToken grew from $52.3m to $228.9m as of 30 September, representing a 337.7% increase from August, or 2189% from its launch in early August.

(Data Source: https://debank.com/projects/dtoken)

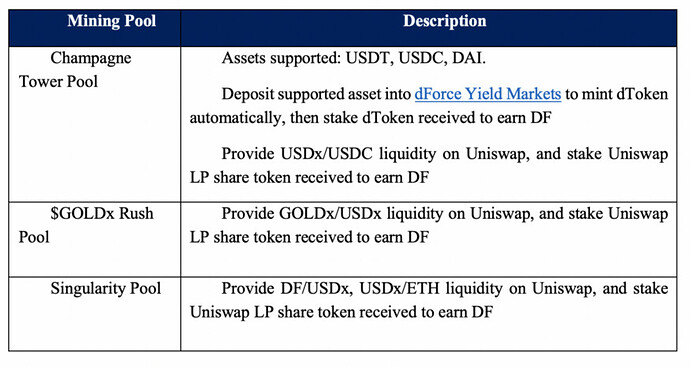

dForce (DF) Liquidity Mining

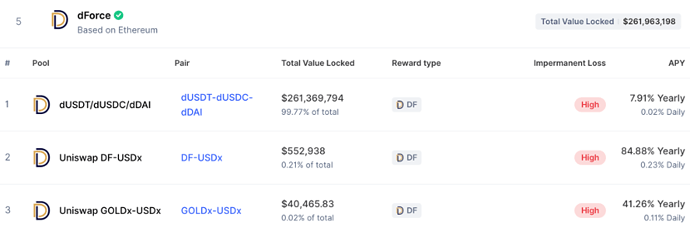

We launched dForce (DF) Liquidity Mining since 3 August, with three pools that boosted the total lock-up value across dForce Network up by 4397% since its launch in early August, moving dForce to rank #12 globally on DeFi Pulse.

Among all yield-farming DeFi projects (including Uniswap, Curve, Yearn, etc), dForce ranks #5 globally in terms of TVL as of 30 September, 2020, according to CoinMarketCap.

(Source: https://coinmarketcap.com/yield-farming/)

In respect of TVL growth rate, dForce ranks #2 following yearn.finance, as of 30 September, 2020.

(Data Source: https://defipulse.com/)

Presently, we have three pools catering to holders of different assets and of different risk tolerance:

Further Readings:

· dForce Kicks off Liquidity Mining

· How to Participate in dForce Governance Token (DF) Liquidity Mining

Product Launch

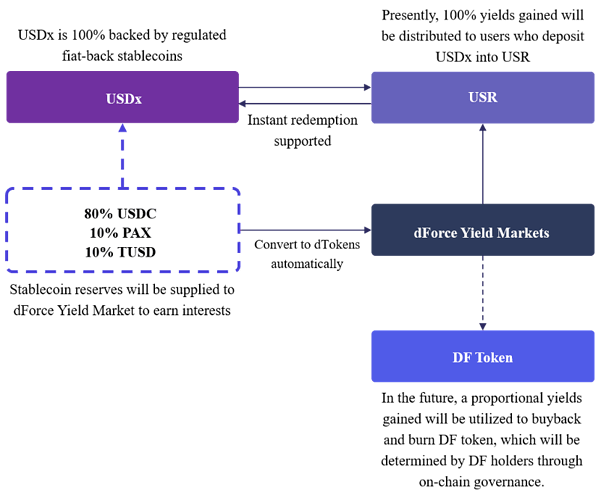

USR (USDx Saving Rate)

USR(USDx Saving Rate) is the systematic interest saving rate of USDx. With the launch of USR, USDx will become the first fiat-back stablecoin implementing systematic interest. Users can earn interest income on their USDx holdings by simply depositing USDx into the USR contract. Instant redemption of principal plus interest earned is also supported.

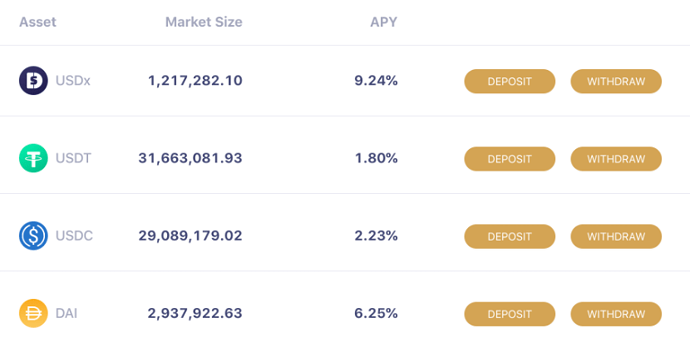

USR is funded by interests earned by constituent stablecoins of USDx, which are automatically converted to dTokens upon each mintage and sequentially supplied to dForce Yield Markets to earn interests. Presently, interests collected by constituent stablecoins are 100% redistributed to USDx holders who deposit USDx into the USR contract.

Real-time APY of USR is 9.24%.

![Image for post|830x412]

Product Development

dForce Trading (Version 2.0)

With dForce Swap (Trading v1.0) focusing on exchanges between selected stablecoins of ERC-20 standard. The v2.0 upgrade will add support to a wide range of cryptoassets by integrating liquidity from mainstreamed DEXes, with the best available price in the market.

· Expected launch in October

dForce Hybrid Lending

dForce will collaborate with CeFi partners to launch lending facilities catering to users with specific needs. They hybrid model allows dForce’s lending protocols to address the widest possibility while maintaining great flexibility. The hybrid lending protocol itself still operates in a fully verifiable, on-chain, automatic and open manner.

· Product development in progress

· Expected launch in the fourth quarter

dForce Decentralized Lending

dForce Lending is a fully permission-less and open DeFi lending protocol with more built-in risk parameters (i.e. debt ceiling for each of its collaterals) and diversified sources of capital supply (dToken pool and other sources).

· Architecture review and assessment in progress

· Expected launch in the fourth quarter

dForce Governance System

dForce token (DF) is platform utility token that enable protocol governance, fee payment, staking, incentive and insurance pool. Users can participate in governance proposal by on-chain voting and claim for airdrop rewards through the dForce governance system.

· The airdrop system is now alive.

· The governance function is expected to go live in the fourth quarter.

DeFi Integrations

![Image for post|830x430]

On 31 August, dForce proposed to add a dToken pool (dUSDx/dDAI/dUSDC/dUSDT) on Curve.Fi. dToken is a yield aggregator launched by dForce, featured by harvesting the highest underlying yield in the market, as well as gas optimization through a set of strategies that is anticipated to save at least 60% of gas consumption associated (compared to direct interactions with underlying lending protocol for asset supply and sale of governance token mined). By providing liquidity to dToken Pool on Curve.Fi, LPs will have access to:

- The highest underlying yield in the market (all governance token farmed, including COMP, will be automatically converted into underlying stablecoin and added to underlying yield).

- Participate in dForce (DF) Liquidity Mining

- Mine CRV simultaneously if the proposal is supported.

- Receive fees that come from trading volume.

The integration is underway and is expected to go live in October.

Further Readings

· dForce Proposes to Add dToken Pool on Curve.Fi

dForce is willing to assist DeFi projects integrating with USDx, GOLDx, dToken to bootstrap early adoption, including (but not limited to) early liquidity provisioning, various yield farming collaboration, and leverage our brand awareness for our elite eco-system partners to access local market (dForce has one of the largest DeFi communities in China). Incentive plan will be evaluated and carried out on a case-by-case basis.

Further Readings

· dForce Launches DeFi Farming Collaboration Initiative

Marketing

· On Sep 1, Jeff Chang, Community Manager of dForce, was invited by Cailu TV to talk about the latest progress and prospects of dForce protocol matrix.

· On Sep 4, Mindao Yang, founder of dForce, joined a panel hosted by Ccvalue with MakerDAO and SparkPool to share his views on the impact of high gas fee on Ethereum fueled by the boom of DeFi, and possible solutions.

· On Sep 5, Mindao Yang, founder and CEO of dForce attended the Open Finance Conference, and shared his views on the prospect of DeFi and the latest updates of dForce in the talk.

· On Sep 9, Mindao was invited to Mars Finance’s broadcast to talk about how DeFi transacts value more efficiently than traditional finance.

· On Sep 10, Mindao was invited to an interview by Huobi Fasttrack by Mandy, CEO of Odaily and talked about how to the advantage of DeFi and how DeFi and CeFi can integrate to offer better solutions for retail investors.

· On Sep 20, Mindao was invited to attend the Entrepreneur Power Conference held by Jinse Finance, and shared his views on “How far is DeFi from the mainstream?”

· On Sep 29, Mindao was invited to the DeFi Innovator Conference and shared his opinions on the possible integration of CeFi and DeFi in a panel.

DF Platform Token

Currently, there are 32 exchanges supporting the trading of DF, including (but not limited to):

· Huobi (https://www.huobi.com/zh-cn/exchange/df_usdt/)

· Gate.io (https://www.gate.io/trade/DF_USDT)

· MXC Exchange (https://www.mxc.com/trade/easy#DF_USDT)

· HBTC Exchange (https://www.hbtc.com/exchange/DF/USDT)

· Hotbit (https://www.hotbit.io/exchange?symbol=DF_USDT)

IMPORTANT REMINDER : The dForce Ecosystem Update aims to help our community catch up on the latest progress and product developments of dForce. Information provided does not constitute, and should not be construed as, investment advice or a recommendation to buy and sell cryptocurrency. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

Welcome to join our community to participate in related discussions:

dForce Official Website: https://dforce.network/

Twitter: https://twitter.com/dForcenet

Telegram: https://t.me/dforcenet

Medium: https://medium.com/dforcenet