Welcome back to the Ecosystem Update of dForce Network, where we will recap the month of December and what’s next to come in the first quarter of 2021.

dForce now ranks #22 globally with $46.4M TVL (Total Value Locked) as of December 28, 2020, up 40% since the launch of dForce Yield Market (dToken) in early August 2020. dToken constitutes 90% of dForce’s TVL with $41.7M, followed by USDx with a TVL of $4.3M, accounting for 9.0% of the TVL.

Source: https://defipulse.com/dforce

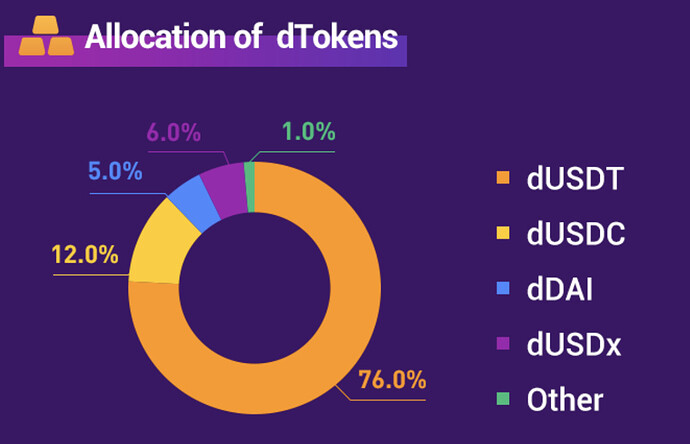

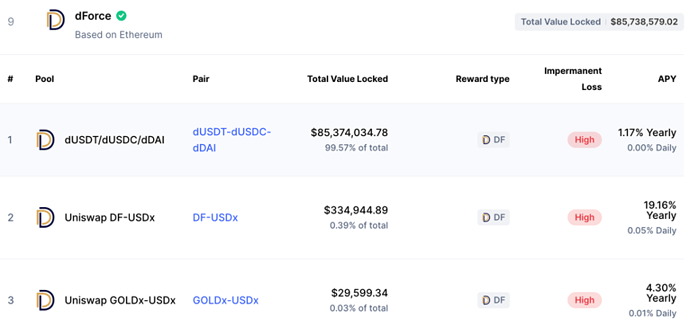

Among dToken assets, dUSDT still dominates with $32.5M TVL, accounting for 76% of the total pie, followed by dUSDC with $4.9M TVL accounting for 12%. dDAI represents 5% of the pool with a TVL of $2.1M.

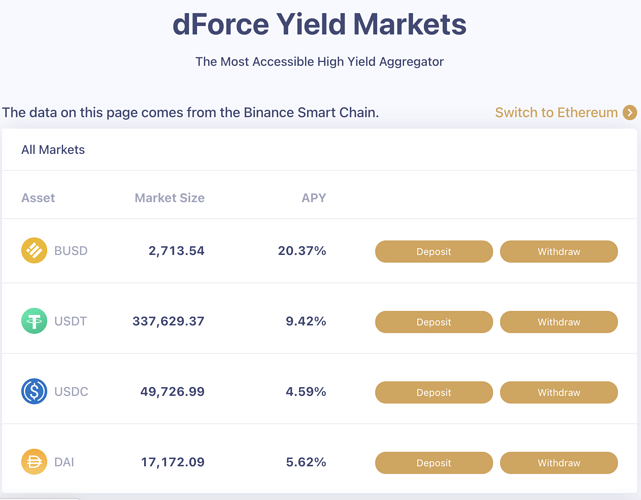

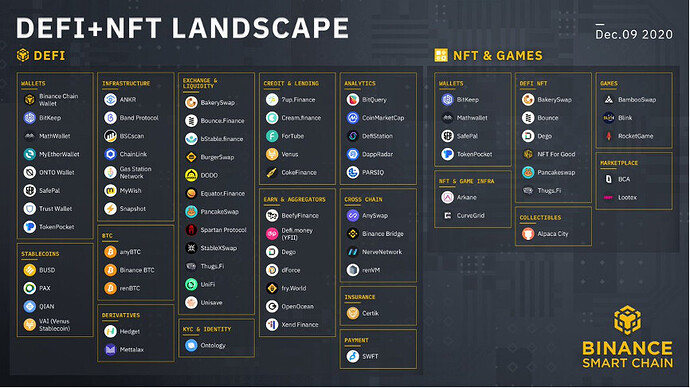

As a blockchain-agnostic DeFi platform, we deployed dToken on Binance Smart Chain in December 2020 to further grow the ecosystem. At the time of writing, dToken on BSC boasts an APY of 18.7%. Users can opt in easily from both the website or DApp in a number of wallets that support Binance Smart Chain (TokenPocket, MATH, BitKeep, and Ontology).

Source: https://markets.dforce.network/

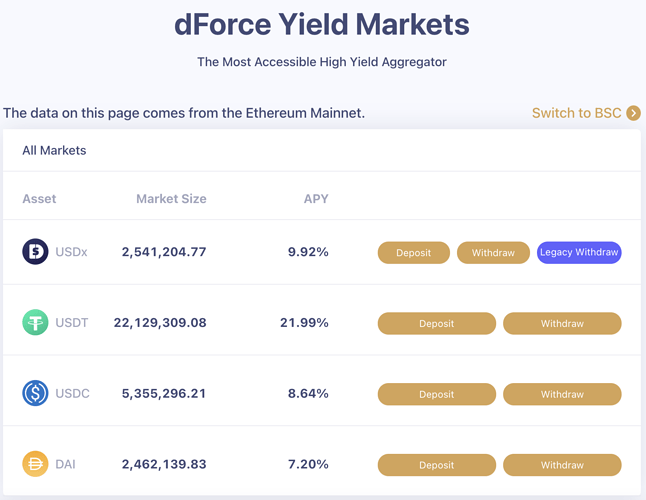

USDx is now traded on various platforms including dForce Trade, Uniswap, S.Finance, and Unisave. USDx holders can earn interest (APY 10.69 % at the time of writing) by simply depositing USDx into USR (aka USDx Saving Rate). Instant withdrawal is also supported.

Source: https://markets.dforce.network/

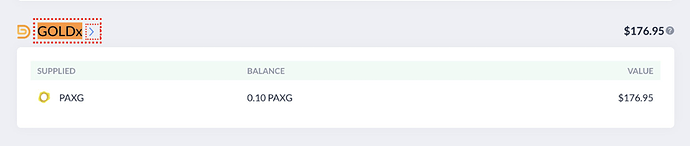

GOLDx, a digital gold token featuring zero on-chain transaction fee denominated in grams, is currently traded on dForce Trade, Uniswap, SENBit and DigiFinex. The soon-to-be-launched dForce Lending will support GOLDx with yield.

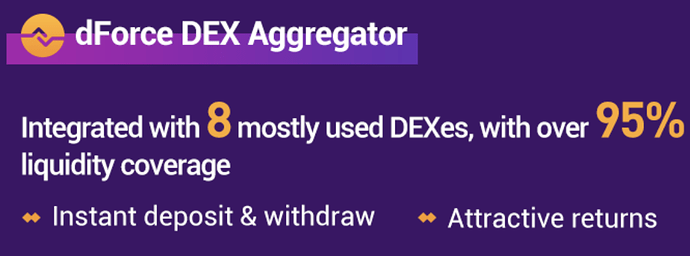

Sushiswap was the most recent addition to dForce Trade. dForce Trade is now connected to 8 mostly used DEXes including Uniswap, Balancer, Curve, Sushiswap, Unisave, etc., and covers more than 95% of ERC20 token swaps by aggregating proper liquidity and best available price across multiple platforms to facilitate large-volume trades.

dForce is one of the very few DeFi protocols that offer incentivized plans over an extended time horizon, serving as a strategic incentivization to promote long-term retention and community engagement. Among all yield-farming DeFi projects (Uniswap, Curve, Yearn, etc), dForce Liquidity Mining ranks #9 globally in terms of TVL, according to CoinMarketCap, with Champagne Tower Pool accounting for the biggest slice of the pie.

Source: https://coinmarketcap.com/yield-farming/

Product Development

dForce Lending

dForce Lending is a fully decentralized and permission-less lending protocol, similar to much of the market lending protocols, but with more innovative features and enhanced risk models.

- Code has been completed and submitted for security audit

- In process of formal verification

- Plans to engage at least 3 world-class security companies for smart contract audit.

- Expected launch in 2021 Q1 (subject to audit process)

dForce Trade (DEX aggregator)

dForce Trade monitors liquidity across 8 decentralized exchanges on Ethereum and 2 on Binance Smart Chain, enabling users to access the best available price for token swap of their choice.

- Recently integrated with Sushiswap and Unisave on Ethereum

- Deployed on Binance Smart Chain and integrated with Pancake and Unisave

- Contract architecture and gas optimization in process

- Currently developing various features such as off-chain data feeds and web APIs to facilitate lower price, less gas consumption, and better liquidity

- Expected launch date is 2Q 2020

Binance Smart Chain

We always believed DeFi is blockchain-agnostic. In December 2020, we successfully announced deployment of dForce Yield Marketsand dForce Trade on Binance Smart Chain.

With lower transaction fees and a growing list of assets available on Binance Smart Chain, dForce is able to expand its portfolio of protocols to accommodate more diversified demands and further adapt its offerings to retail users.

Extended Reading:

· dForce Deploys on Binance Smart Chain

· dForce Labs launched with $25m Fund to Support Ecosystem

· dForce Trade, the First Multi-Chain DEX Aggregator Supporting Binance Smart Chain

dForce Labs launched with $25m Fund to Support Ecosystem

dForce announced the launch of dForce Labs, with $25 million committed capital to support and build the dForce ecosystem and invest in DeFi related infrastructure. dForce Foundation and dForce Labs will operate independently of each other.

A total of $25 million have been committed by core dForce token holders, investors, ecosystem stakeholders, and liquidity providers. dForce Labs will be a strategic supporter to DeFi projects with potential synergies with dForce’s protocols, through primary and secondary market investments, liquidity provision, bootstrapping and liquidity mining participation.

Marketing

On December 2, 2020, Mindao Yang, Founder of dForce was invited by 499+ Block, one of the most popular crypto communities in China, to host an AMA session and introduce the value proposition of protocol matrix.

On December 15, dForce hosted a community meetup in Beijing, China. Mindao Yang, Founder of dForce, shared what we have achieved in 2020 as well as our roadmap in 2021. According to Mindao, the soon-to-be-launched dForce Lending will play a vital role in the networked matrix of dForce. V1 is expected to go live in Q1 subject to audit progress.

On December 20, Margaret, Operation Director of dForce, was invited by BitMax Exchange to participate in a panel to share her views on what to expect from DeFi in 2021 and the roadmap of dForce in the next 12 months to come.

On the same day, Chao, Director of Business Development of dForce, talked about the recent hype and future challenges of DeFi in a panel discussion at the annual conference hosted by Huoxun.com.

On December 21, 2020, Chao, Director of Business Development of dForce, shared his views on DeFi innovation, value of liquidity mining, and the potential of DeFi governance token at a panel during ‘Blockchain Finance New Infrastructure Summit 2020’ hosted by Honeycomb Finance.

On December 22, 2020, Mindao, was invited by imToken to talk about the growth potential and challenges faced by decentralized exchanges at a press release for the launch of Tokenlon 5.0 in Hangzhou, China

On December 23, dForce was awarded as one of the most promising DeFi protocols in 2020. Mindao, Founder of dForce, shared his views on how DeFi is expected to disrupt traditional finance.

On December 28, 2020, Mindao was invited by BB News to talk about DeFi composability and risk over a panel discussion during the “1st Blockchain Innovators Assembly”.

dForce Governance Token (DF)

Currently, over 30 exchanges support trading of DF, including:

- Binance (https://www.binance.com/en/trade/DF_ETH)

- Huobi (https://www.huobi.com/zh-cn/exchange/df_usdt/)

- Gate.io (https://www.gate.io/trade/DF_USDT)

- MXC (https://www.mxc.com/trade/easy#DF_USDT)

- HBTC (https://www.hbtc.com/exchange/DF/USDT)

- Hotbit (https://www.hotbit.io/exchange?symbol=DF_USDT)

Friendly reminder: The dForce Ecosystem Update aims to help our community get up-to-date on the latest progress and product developments of dForce. Information provided does not constitute, and should not be construed as, investment advice or a recommendation to buy and sell cryptocurrency. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

We welcome you to join our community to participate in related discussions:

· dForce Official Website: https://dforce.network/

· Twitter: https://twitter.com/dForcenet

· Telegram: https://t.me/dforcenet

· Medium: https://medium.com/dforcenet

· Forum: https://forum.dforce.network/