Welcome to dForce Ecosystem Update — a full recap of dForce activities in February 2021 and a peek into the next several weeks.

Overview

dForce Lending

After months of endeavor, dForce has rolled out version 1 (V1) of dForce’s Multicurrency Asset & Lending Protocol, a pool-based lending protocol with built-in over-collateralized multicurrency stable debt (MSD, to be released in version 2). The roll-out of dForce Lending will be the final piece of the puzzle to complete the dForce Network— protocol matrices covering asset, trading, and lending.

dForce Lending V1 is a conditional offering with fundamental features of a decentralized lending protocol with tightened risk control over assets. Two critical features, Multicurrency Stable Debt (MSD) and flashloan will be unveiled in V2. ***Multicurrency Stable Debt (MSD)***is a feature where users can mint stablecoins of different currencies against their crypto collaterals to serve as an effective hedge against foreign exchange risk. More features including Public-Private Pool (PPP), Fix-Term/Fix-Rate Borrowing, Unsecured Loans, and Credit-Line Sharing will be progressively released in future upgrades in second quarter of this year.

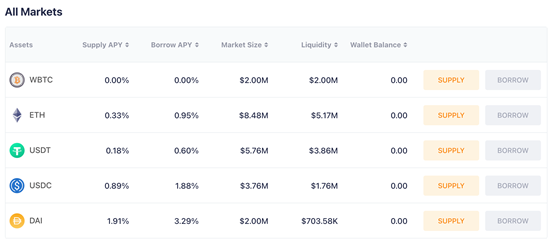

Under dForce’s Risk Assessment Framework, new assets and collateral will be added through a process of on-chain governance voting by DF token holders. The first batch of assets supported by dForce Lending was approved through governance proposal DIP005, including WBTC, ETH, USDC, USDT, and DAI. We have performed risk analysis for all proposed assets (please click here to view details). At the initial phase of the launch, borrow cap and supply cap for each asset has been limited as a safety measure to further improve the level of stability of the protocol.

(Source: https://app.dforce.network/#/lending)

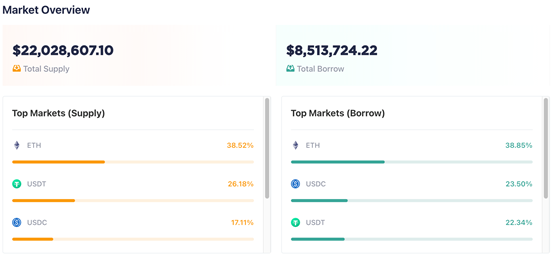

Within 24 hours after launch, dForce Lending has reached a total supply of $22m and a total borrow of $8.5m.

(Source: https://app.dforce.network/#/lending/Markets/mainnet)

With a target to build dForce Lending into the most flexible and adaptable lending protocol catering to diversified use cases, we want to give users greater choices with a wide range of cryptoassets. Members of our community are welcome to share or make proposals of their favorite assets through Forum.

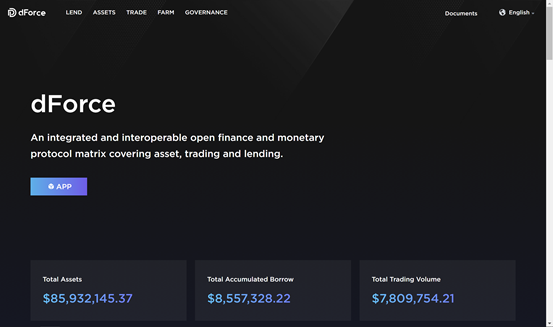

Website Revamp

Along with the launch of dForce Lending, we are thrilled to announce the launch of our newly Along with the launch of dForce Lending, we are thrilled to announce the launch of our newly revamped website. The new design has an improved UI/UX that make it easier to navigate. You can find FAQ and useful information about dForce protocols in the documents section in the upper right-hand corner.

Yield Markets

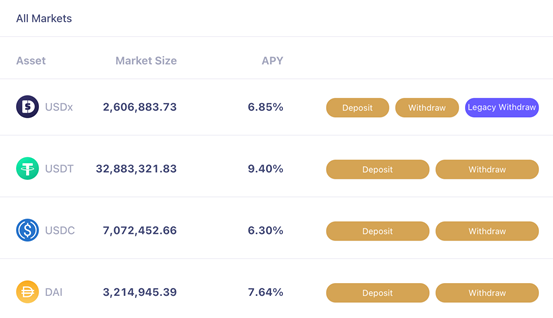

At the time of writing, depositing stablecoins in dForce Yield Markets would earn interests ranging from 6.3% to 9.40% APY. It has also been approved through governance proposal DIP006 for dForce Yield Markets to add new handler and strategy support for dForce’s Lending protocol for all its supported assets.

(Source: https://markets.dforce.network/)

dForce Trade

dForce Trade is now connected to 8 mostly used DEXes including Uniswap, Balancer, Curve, and Sushiswap, covering more than 95% of ERC20 token swaps by aggregating liquidity and best available prices across multiple platforms, with a total trading volume of $7.8 million at the time of writing.

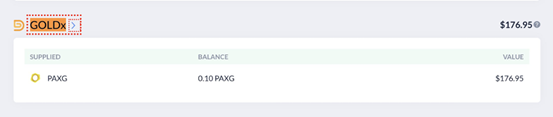

GOLDx

GOLDx, a digital gold token featuring zero on-chain transaction fee denominated in grams, is currently traded on dForce Trade, Uniswap, SENBit and DigiFinex. Yield markets for GOLDx will be introduced to allow users to earn interest or use it as collateral to support a crypto loan.

USDx

USDx is a fiat-back stablecoin (through constituents) implementing systematic interest. By depositing USDx into USR (USDx Saving Rate) protocol, users can earn 6.85% APY at the time of writing. Anyone can use the protocol to mint USDx or disaggregate USDx in exchange for constituent stablecoins at a pre-determined ratio (1 USDx = 0.8 USDC + 0.1 PAX + 0.1% TUSD) at any time.

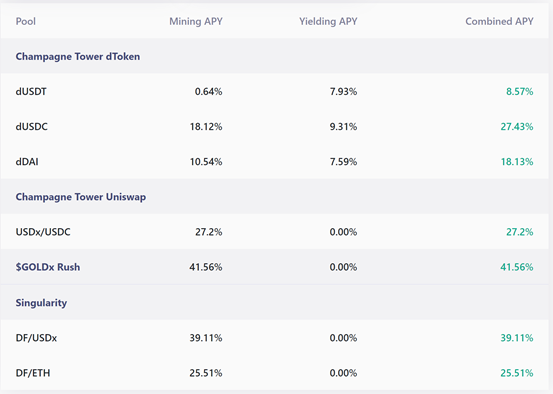

dForce (DF) Liquidity Mining

dForce is one of the very few DeFi protocols offering incentivized plans over an extended time horizon, to promote long-term retention and community engagement, with APY ranging from 10% to 43.3% at the time of writing.

(Real-time APY can be viewed from dForce Staking Portal)

Product Development

dForce Lending``

• Trail of Bits and ConsenSys Diligence have been performing smart contract audit for dForce Lending V2, including Multicurrency Stable Debt and Flashloan.

• Formal verification is in process simultaneously.

• V2 of dForce Lending is expected to launch in mid-April (subject to results of audit result)

dForce Trade

• Nearing completion of development of PMM.

• Test runs for PMM in process

• Development of AMM is in process (expected launch in April)

All-in-One Interface

• Optimization of UI/UX

• Consolidation of all dForce native protocols into one simple interface

• Expected launch in Q2

Marketing

On February 5, Mindao, Founder of dForce was invited to a panel hosted by Binance Smart Chain (BSC). dForce is entering into conversations with multiple CeFi and TraFi about how we can take advantage of blockchain technology to offer more cost-efficient and decentralized alternatives. The newly launched protocol will introduce many innovative features including unsecured loans, fix-term/fix-rate borrowings, and public-private pool through different levels of collaboration with our CeFi and TraFi partners.

dForce Governance Token (DF)

Currently, over 30 exchanges support trading of DF, including:

• Binance (https://www.binance.com/en/trade/DF_ETH)

• Huobi (https://www.huobi.com/zh-cn/exchange/df_usdt/)

• Gate.io (https://www.gate.io/trade/DF_USDT)

• MXC Exchange (https://www.mxc.com/trade/easy#DF_USDT)

• HBTC Exchange (https://www.hbtc.com/exchange/DF/USDT)

• Hotbit (https://www.hotbit.io/exchange?symbol=DF_USDT)

Friendly reminder : The dForce Ecosystem Update aims to help our community get up-to-date on the latest progress and product developments of dForce. Information provided does not constitute, and should not be construed as, investment advice or a recommendation to buy and sell cryptocurrency. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

We welcome you to join our community to participate in related discussions:

• dForce Official Website: https://dforce.network/

• dForce Forum: https://forum.dforce.network/

• Twitter: https://twitter.com/dForcenet

• Telegram: https://t.me/dforcenet

• Medium: https://medium.com/dforcenet