Welcome to another dForce monthly update. We keep our community up-to-date about what to expect in the coming months.

Highlights

- dForce approved 50m USX limits for POO operation: Learn more

- dForce updated risk parameter for stablecoins: Learn more

- dForce introduced a new USX/2CRV pool on Curve

Overview

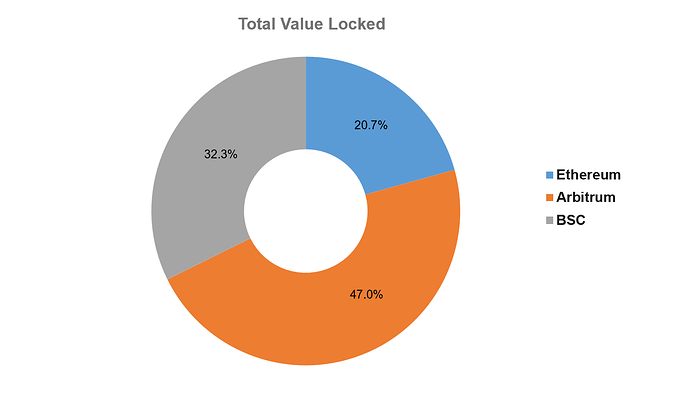

In February, dForce recorded a TVL of $259m, with 47.0% parked on Arbitrum, 32.3% on Binance Smart Chain, and 20.7% on Ethereum.

USX

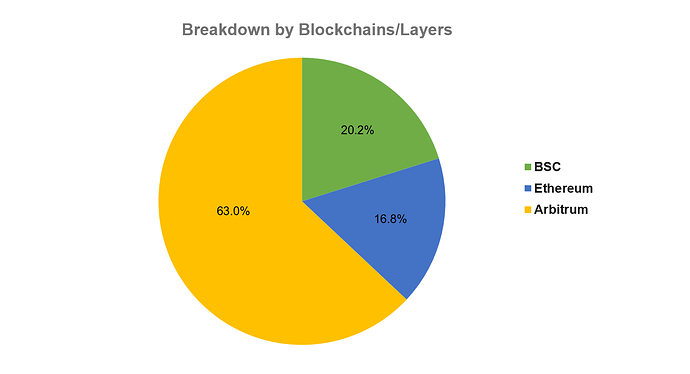

As of 28th February, 2022, total circulating supply of USX is $175.6m, with 63.0% of liquidity currently parked on Arbitrum, 20.2% on BSC and 16.8% on Ethereum.

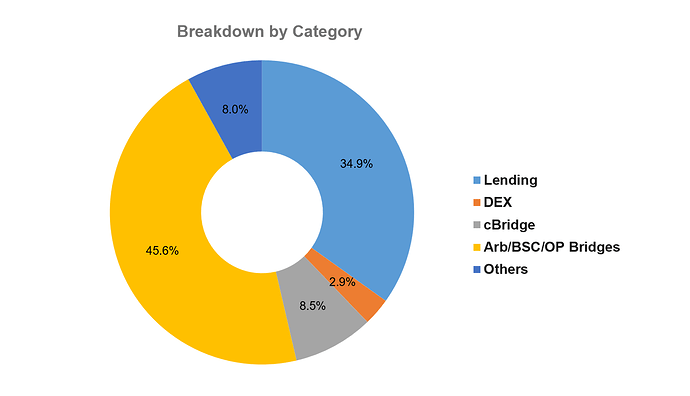

Approximately 45.6% of USX liquidity has been allocated to facilitate cross-chain expansions on Arbitrum, BSC and Optimism, 34.9% to lending, 8.5% to cBridge (cross-chain swap), 8.0% sitting in wallets with market participants, and 2.9% to DEXes.

Lending

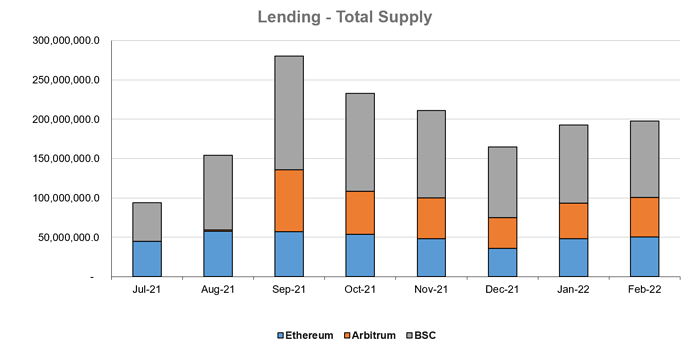

In February, dForce Lending recorded a total supply of $197.7m, representing a slight growth of 2.6% from January. Binance Smart Chain constituted 49.0%, Arbitrum 25.6%, and Ethereum 25.5%.

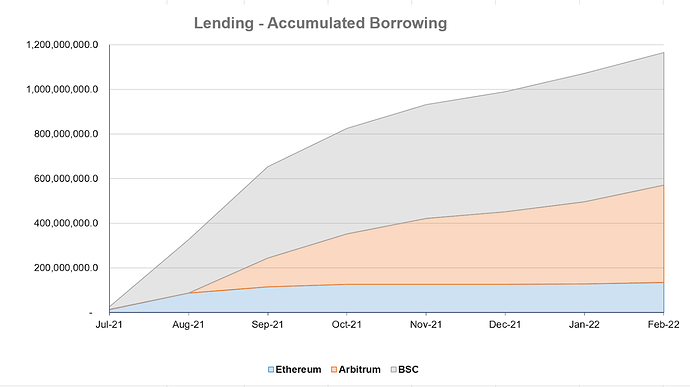

Total accumulated borrowing grew to $1.2b, representing an upward trend of a whopping 8.7% from the previous month in new loan originations.

Revenue

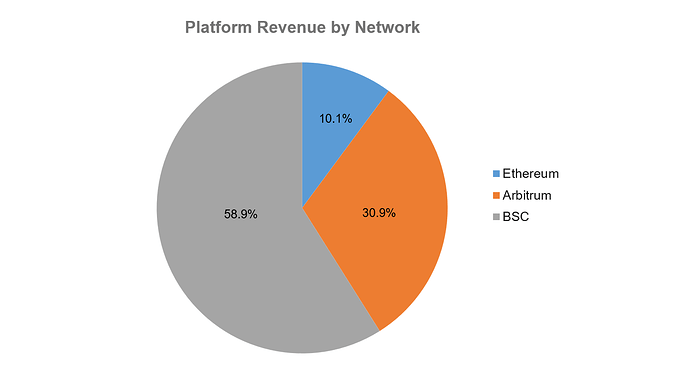

dForce recorded an Annualized Platform Revenue of $1.3m in February, with 58.9% generated on Binance Smart Chain, 30.9% on Arbitrum, and 10.1% on Ethereum.

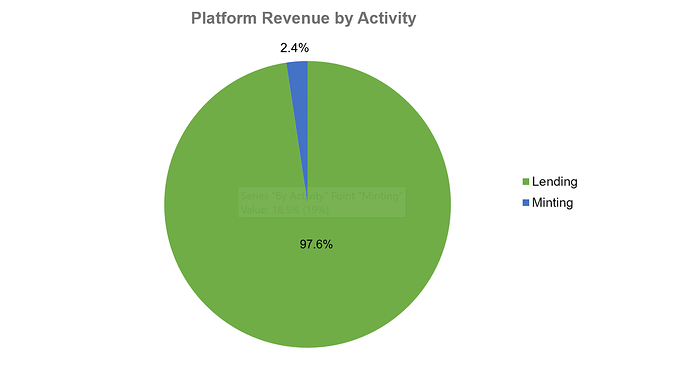

Approximately 97.6% revenue were generated from lending activities, and the remaining 2.4% from stablecoin minting.

Liquidity Mining

dForce have ongoing liquidity mining initiatives on Ethereum, Arbitrum, and Binance Smart Chain. In February, a new USX/2CRV pool on Curve was introduced to participants on Arbitrum. Please visit dForce Forum to view the gauge (update on a weekly basis) and click here to see related tutorials.

Product Development

- dForce launched our newly revamped website featuring a refreshed look, improved navigation and a handful of information that clearly states who we are and what we do.

- Completed audit review for DF staking by PeckShield. We are now in the process of optimizing User Interface with target launch in March. This will allow DF holders to capture all fee incomes generated from dForce protocols and implementation of POO (Protocol-Owned-Operation) strategies. Target to launch in March.

- Powered USX liquidity on cBridge (Ethereum/Arbitrum/BSC) and dForce Lending (Ethereum) through PDLP (Protocol-Direct-Liquidity-Provision).

- Target to engage a couple of POO strategies through POO in March. This will help to increase organic use of USX, generating yield from multiple sources for DF holders.

- Integrated with cBridge, powering cross-chain transfers of DF and USX in a liquidity-pool-based model with lower fees and faster transaction speeds.

- In the process of developing dForce Dashboard, providing a summary of dForce performance with more quantitative analysis around assets and operation efficiency. Target to launch in March.

- In the process of developing customized routes to further power the dForce Bridge.

- We are evaluating the opportunity to deploy dForce protocols to more blockchains including EVMOS and a couple of others. Join our community to learn more!

Governance

DIP022 — Proposal for POO Limits and Disabling of Synthetic Asset [Passed]

It was proposed to approve 50m USX limits for POO operations, which engage mostly in risk-neutral strategies from providing stablecoin liquidity and interacting with lending protocols, to yield arbitraging between underlying assets (i.e., ETH) and staking assets (i.e., wstETH).

It was also proposed to disable new minting and lending of dForce synthetic assets including xTSLA, xAMZN, xAAPL, xCOIN, xBTC, xETH on Ethereum and BSC.

DIP023 — Risk Parameter Update for Stablecoins [Passed]

This proposal seeks approval to further enhance capital efficiency by adjusting the LTV (Loan-To-Value) Ratio for USDC, USDT, BUSD, DAI, USX across Ethereum, Arbitrum, Optimism, BSC, as well as future deployment on other blockchains or layers.

Marketing

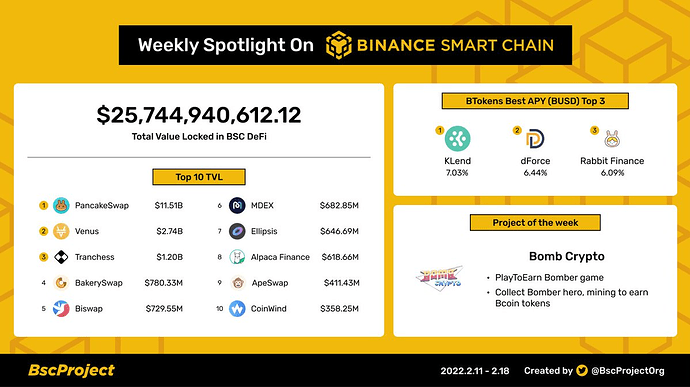

dForce ranked #2 by BUSD APY on BSC, according to Weekly Spotlight on BSC.

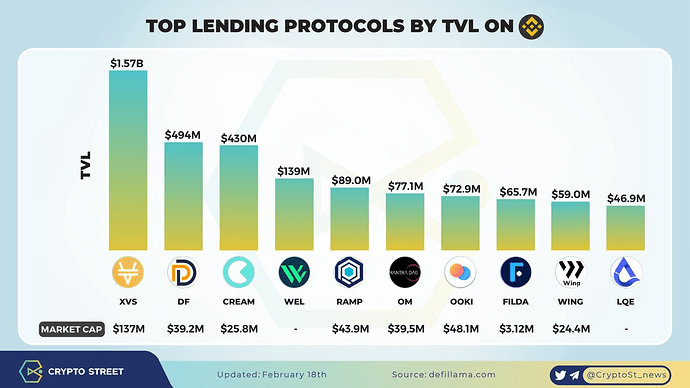

dForce is the second largest lending protocol on BSC by TVL, according to Crypto Street.

We welcome you to join our community to participate in related discussions.