Welcome to dForce Ecosystem Update — a full recap of dForce activities from January 2021 and a sneak peek into the next several weeks.

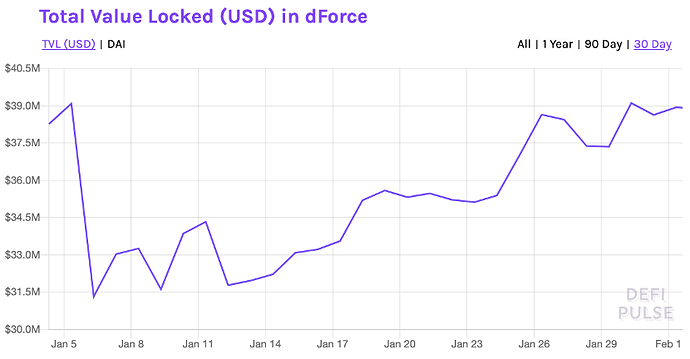

TVL(Total Value Locked) of dForce has grown to over $45.5M as of January 31, 2021, with dToken constituting 89% (US$40.4mil) of this TVL .

Source: https://defipulse.com/dforce

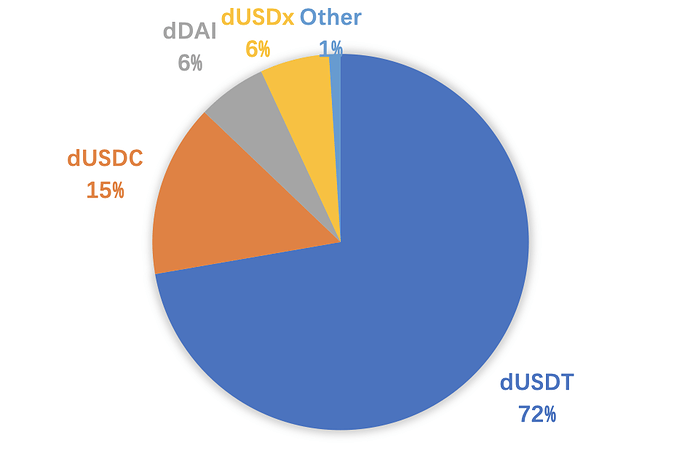

dUSDT accounts for the largest portion of locked value in dToken assets, accounting for 76% of the TVL (US$29.5mil), followed by dUSDC with US$6.0mil (15% of TVL), and 6% dDAI with a locked value of US$2.5mil. dUSDx from S.Finance and dToken from Yield Markets on Binance Smart Chain (BSC) makes up for 7% of the total TVL.

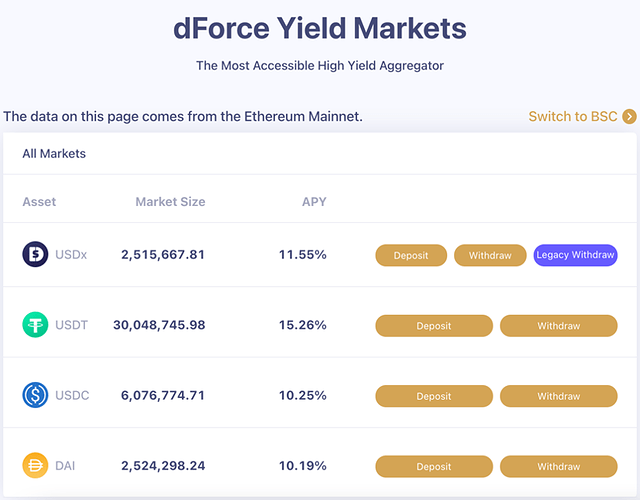

At the time of writing, users are able to earn yields north of 10% on stablecoins through dForce Yield Markets. Depositing USDT would earn the highest interest of 15.25%. dToken features one of the most popular yield markets, characterized by its steady and robust returns, strong composability, and easy access.

Source: https://markets.dforce.network/bsc

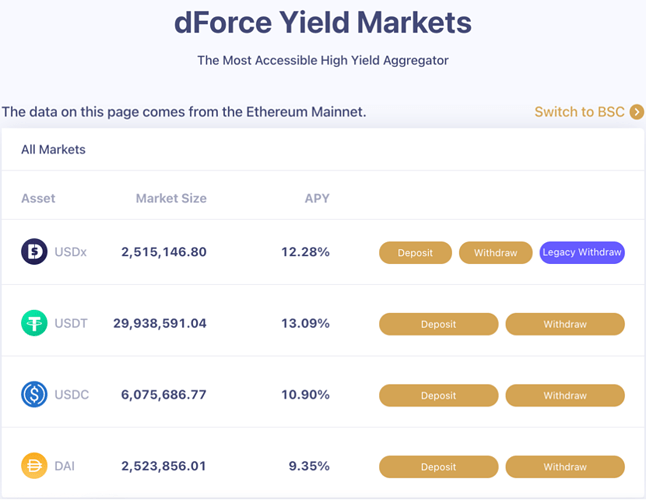

USDx holders can earn an APY of 12.28% at the time of writing by simply locking in USDx into the USR (USDx Saving Rate) protocol. Instant withdrawal is supported.

Source: https://markets.dforce.network/

dForce Trade is now connected to 8 mostly used DEXes including Uniswap, Balancer, Curve, Sushiswap, and Unisave, covering more than 95% of ERC20 token swaps by aggregating liquidity and best available prices across multiple platforms to facilitate large-volume trades. Besides BSC, we are also planning to bring more accessibility to users of public chains.

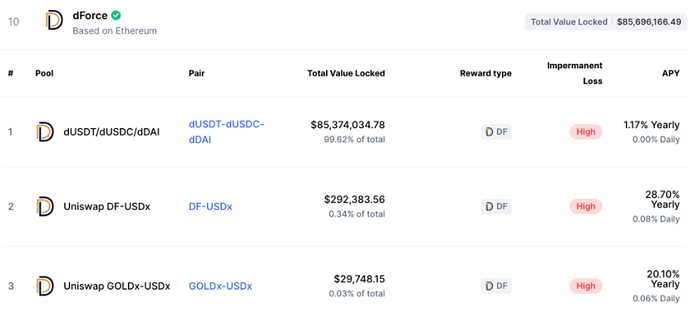

dForce is one of the very few DeFi protocols offering incentivized plans over an extended time horizon, to promote long-term retention and community engagement. Among all yield-farming DeFi projects including Uniswap, Curve, and Yearn, dForce Liquidity Mining ranks #10 globally in terms of TVL. According to CoinMarketCap, Champagne Tower Pool being the most popular choice with no impermanent loss .

(Source: https://coinmarketcap.com/yield-farming/)

Product Development

dForce Lending

dForce Lending is a pool-based lending protocol, with its interest rate dynamically driven by market supply and demand. This is also a novel lending protocol with built-in over-collateralized multicurrency stable debt protocol, which could extend to fund the fractional reserve of an algorithmic stablecoin.

In layman’s terms, the protocol is: General Lending + Multicurrency Collateralized Stable Debt + Fractional Reserve Algorithmic Stablecoin.

Key highlights of dForce Lending’s offerings include: enhanced risk monitor, MSD (Multicurrency Stable Debt), Fixed Term/Fixed Rate loans, PPP (Public-Private Pool), Flashloan, etc.

Here’s a sneak peek into what’s next:

- Smart contract audit performed by Certik in process, with two more world-class blockchain security firms engaged prior to formal launch

- Formal verification in process

- MSD (Multicurrency Stable Debt) development and verification in process

- Approaching the end of test runs and optimization

- Soft launch: in late February, 2021

- Formal launch: in April, 2021

You can read more about the dForce Lending protocol in the articles below:

- Introduction of dForce’s Multicurrency Asset and Lending Protocol

-

dForce’s Risk Assessment Guideline

dForce Trade (DEX aggregator)

dForce Trade monitors liquidity across 8 decentralized exchanges on Ethereum and 2 on Binance Smart Chain, enabling users to access the best available price for token swap of their choice.

- Nearing completion of various features such as off-chain data feeds, web APIs to facilitate lower price, less gas consumption, and better liquidity

- Development of PMM & AMM in process

Marketing

On January 5, 2021, Yana, dForce community manager was invited to an AMA session by BiBull Exchange and shared dForce’s roadmap in 2021.

On January 13, Mindao, founder of dForce participated in a panel hosted by Nervos and shared his view on the evolution and perspectives of DeFi

On January 15, Mindao was invited to talk about the current status of public chains and possible solutions to the bottleneck over the inauguration of OKExChain.

On January 20, Mindao was invited by Mars Finance to share his views on DeFi investment opportunities and future DeFi revolution at a DeFi panel. Mindao reiterated dForce network’s goal to build a protocol matrix covering asset, lending, and DEX, interoperable between assets with maximum liquidity levels.

On January 22, Mindao was invited to a panel hosted by Bishijie and shared his views on DeFi development and opportunities in 2021. According to Mindao, DeFi TVL in 2021 demonstrates exponential growth potential compared to 2020, powered by the launch of Layer 2 which is expected to greatly enhance overall performance.

On January 26, Mindao was invited by Star Consulting’s broadcast to talk about the booming DeFi and 2021 trends.

On January 28, Mindao was invited to Binance Smart Chain’s community call and talked about DeFi risk management and the risk model of the soon-to-be-launched dForce Lending.

dForce Governance Token (DF)

Currently, over 30 exchanges support trading of DF, including:

• Binance (https://www.binance.com/en/trade/DF_ETH)

• Huobi (https://www.huobi.com/zh-cn/exchange/df_usdt/)

• Gate.io (https://www.gate.io/trade/DF_USDT)

• MXC Exchange (https://www.mxc.com/trade/easy#DF_USDT)

• HBTC Exchange (https://www.hbtc.com/exchange/DF/USDT)

• Hotbit (https://www.hotbit.io/exchange?symbol=DF_USDT)

Friendly reminder : The dForce Ecosystem Update aims to help our community get up-to-date on the latest progress and product developments of dForce. Information provided does not constitute, and should not be construed as, investment advice or a recommendation to buy and sell cryptocurrency. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.

We welcome you to join our community to participate in related discussions:

• dForce Official Website: https://dforce.network/

• Twitter: https://twitter.com/dForcenet

• Telegram: https://t.me/dforcenet

• Medium: https://medium.com/dforcenet

• Forum: https://forum.dforce.network/