Welcome to another dForce monthly update. We keep our community up-to-date about what to expect in the coming months.

Highlights

- dForce launched liquidity mining initiatives on Polygon and Optimism. Learn More.

- dForce deployed a full set of DeFi protocols including lending and stablecoin $USX on KAVA. Learn More.

- dForce’s thought leadership publication on stablecoins and $USX was published Learn More.

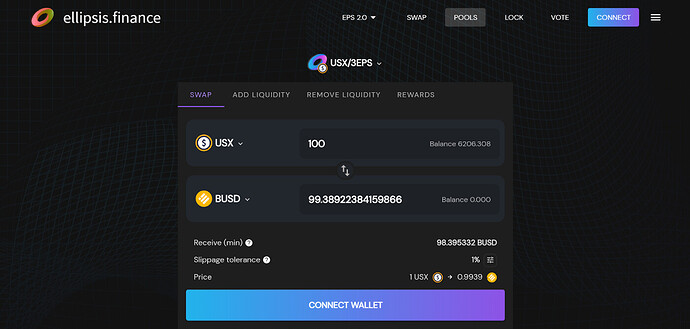

- You can now trade $USX on Ellipsis Finance.

- DeFiLama is now tracking $USX on stablecoin dashboard. Learn More.

- dForce integrated TokenTerminal, which allows users to view the Revenue Breakdown in the Dashboard

- $DF is now listed on Crypto.com and Tokocrypto.

Overview

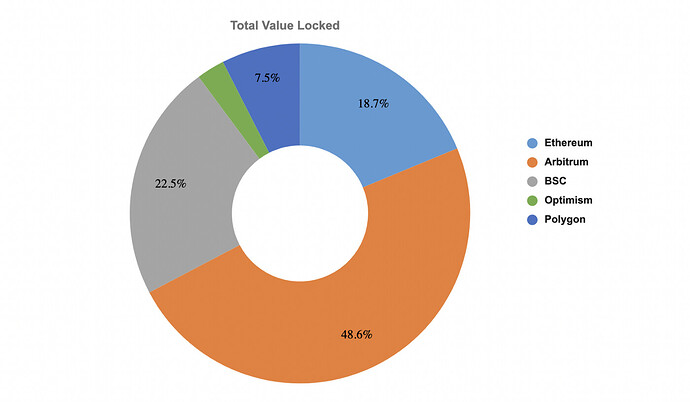

In June, dForce recorded a TVL of $236.4m, with 48.6% parked on Arbitrum, 22.5% on Binance Smart Chain, 18.7% on Ethereum, 7.5% on Polygon, and 2.7% on Optimism.

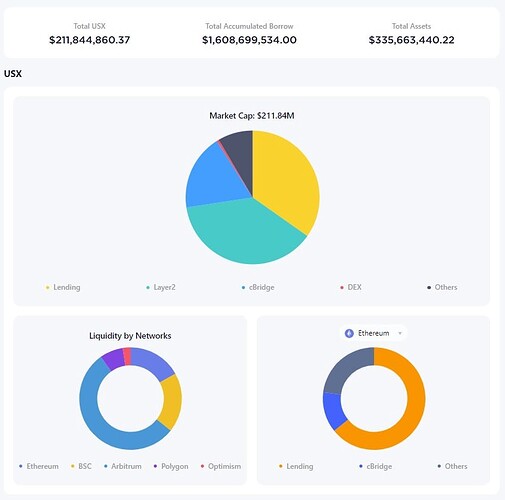

USX

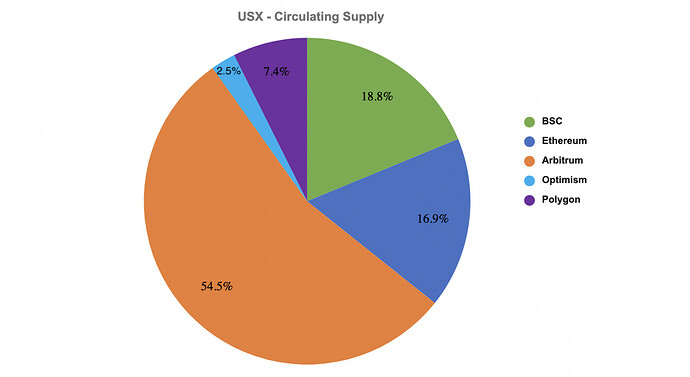

As of 30th June, 2022, total circulating supply of USX is $203.8m, with 54.5% of liquidity currently parked on Arbitrum, 18.8% on BSC, 16.9% on Ethereum, 7.4% on Polygon, and 2.5% on Optimism.

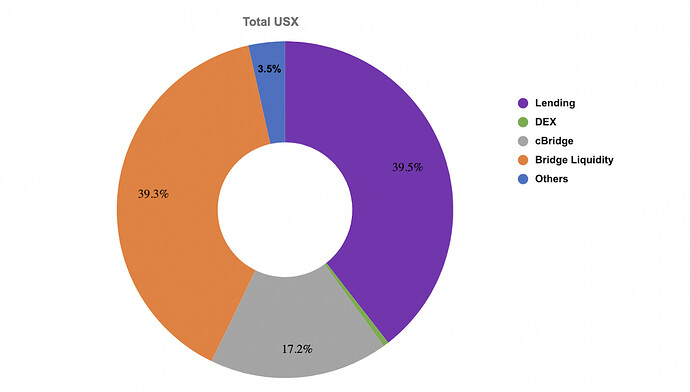

Approximately 39.5% of USX liquidity has been allocated to lending, 39.3% to facilitate cross-chain expansions on Arbitrum, BSC and Optimism, 17.2% to cBridge (cross-chain swap), 3.5% sitting in wallets with market participants, and 0.5% on DEX.

Lending

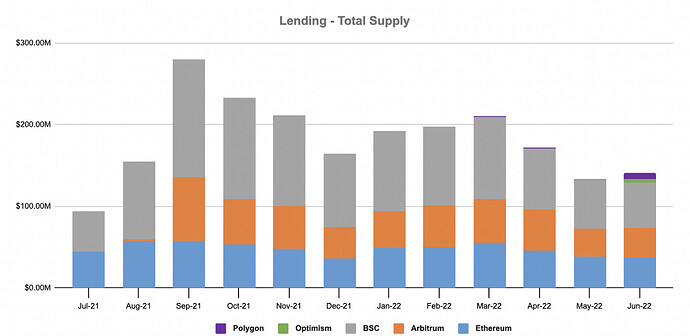

In June, dForce Lending recorded a total supply of $141.3m, representing an increase of 5.9% from May. Binance Smart Chain constituted 38.9%, Ethereum 26.7%, Arbitrum 25.6%, Polygon 5.8%, and Optimism 2.8%.

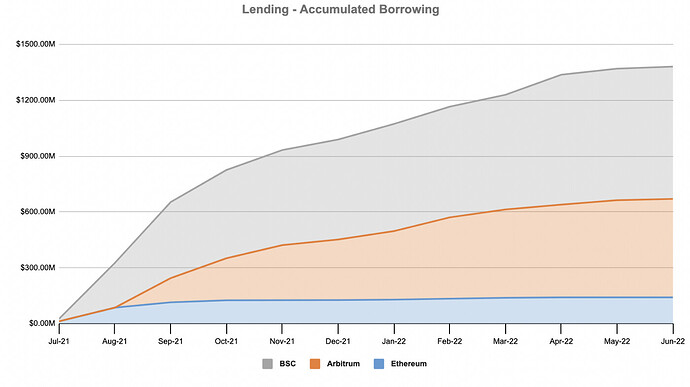

Total accumulated borrowing grew to $1.3b, representing an upward trend of 0.8% from the previous month in new loan originations.

Revenue

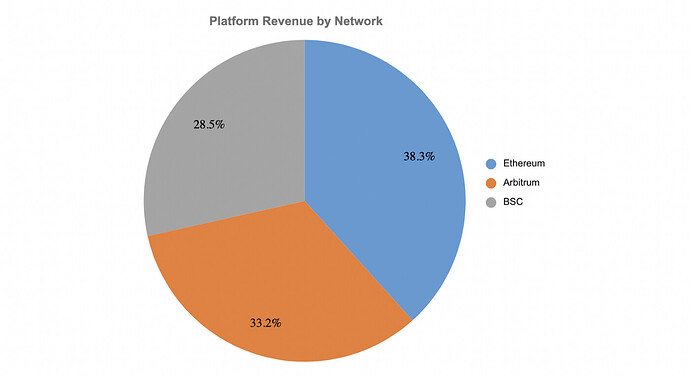

dForce recorded an Annualized Platform Revenue of $614K in May, with 38.3% generated on Ethereum, 33.2% on Arbitrum, and 28.5% Binance Smart Chain.

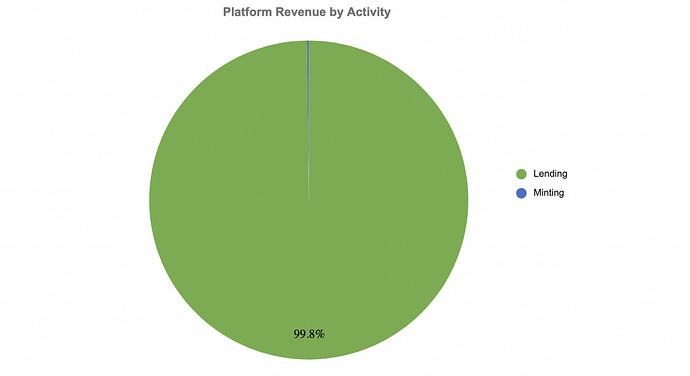

Approximately 99.8% revenue was generated from lending activities, and the remaining 0.2% from stablecoin minting.

dForce Staking

dForce pioneers in staking by introducing a hybrid model featuring both Free Staking (stake and unstake at any time) and Lock-up Staking (veToken model with a lock-up period from 1 week up to 4-year), which is the first of its kind in DeFi.

Compared with Free Staking, veDF token holders (participants in Lock-up Staking) will receive a boost on both staking rewards and voting weights.

Currently, around 29% of total circulated DF tokens (or 124m DF tokens) has entered into the dForce Staking Portal (available on the Ethereum mainnet only). Free Staking has a total of US$100 mil Free-Staked with APY of 4.92%, and Lock-up Staking has a total of US$23 mil staked with average lock-up period of 1.23 years and APY of 26.34%.

Liquidity Mining

dForce has added Polygon and Optimism to the existing ongoing liquidity mining initiatives on Ethereum, Arbitrum, and Binance Smart Chain (BSC). Please visit dForce Forum to view the gauge (update on a weekly basis) and click here to see related tutorials.

Product Development

We’ve had some exciting product updates in June. List include the following:

- Dashboard: After connecting wallets on dforce.network, users can access the Dashboard to see various statistical data of different dimensions in the dForce protocol, including modules such as USX stablecoin, DF token, and income (platform, protocol). Also, dForce integrated TokenTerminal, which allows users to view the Revenue Breakdown, also in the Dashboard. See screenshot below!

- dForce Lending and USX Stablecoin Protocol have been deployed to the Kava EVM Chain.

- Optimism and Polygon Mining Liquidity Mining: Lending and mining on Optimism and Polygon networks via the dForce Lending Protocol

- Loan liquidation tool optimization: add new filters, history record for liquidators to better manage their liquidation process.

- In preparation for the deployment on the Avalanche network (expected launch in Q3).

- DEX aggregator: aggregate liquidity across different platforms and blockchains with the best price and liquidity (expected launch in Q3).

- POO: develop new strategies for EUX (expected launch in Q3).

- LSR (Liquid Stability Reserve) module for USX (expected launch in Q3): Maker DAO introduced PSM to enable zero slippage and zero fee swap between DAI and USDC. We innovate on Maker’s PSM model and propose a LSR (Liquid Stability Reserve) module, as a great addition to our existing USX minting mechanism (Vault-based and pool-based overcollateralized minting) (expected launch in Q3).

DeFi Integration

USX is now listed on Ellipsis Platform (BSC network).

Marketing

- dForce rolled out its full set of DeFi protocols on KAVA in June. KAVA and dForce carried out a series of co-marketing activities, including Medium announcements, Twitter co-marketing, and KAVA adding dForce into its Ecosystem Page website.

- dForce kicked off Liquidity Mining on Optimism and Polygon in June. Series of exciting campaigns are lined up, make sure you follow us to receive more information!

- $DF was listed on two reputable platforms — Crypto.com and Tokocrypto!

- dForce has kickstarted its series of awareness building airdrop campaigns for its various new business initiatives. One of such was an airdrop campaign for supporters for USX/3EPS pool on Ellipsis Finance (Learn More). We’ve received over 70k (!) responses — winners will be announced soon! Make sure you follow our social media channels (links at the end of this article) to stay up to date.

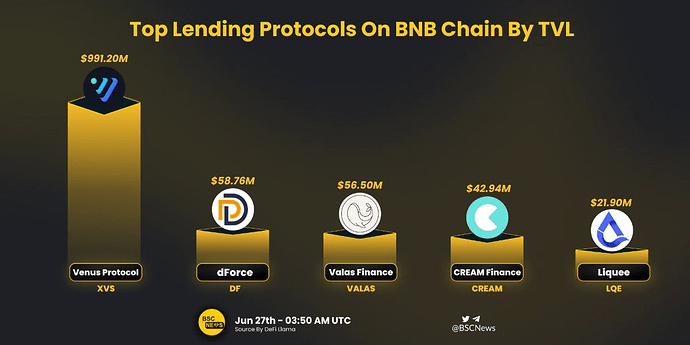

- dForce continues to hold fort as the #2 Lending protocol on BNB Chain by TVL according to BSC News

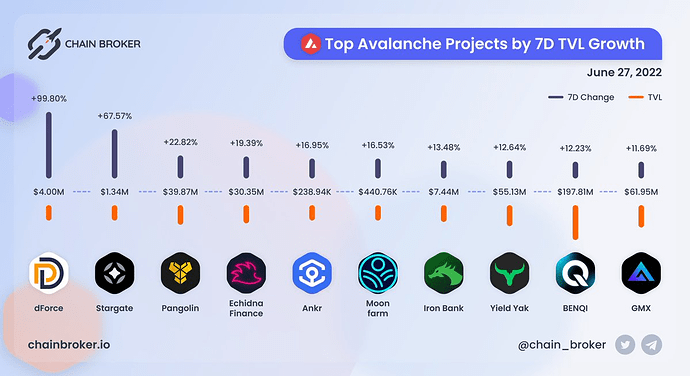

- dForce ranked #1 by 7-day TVL growth on Avalanche. This is exciting news as dForce continues to rapidly expand its presence across different chains! Learn More

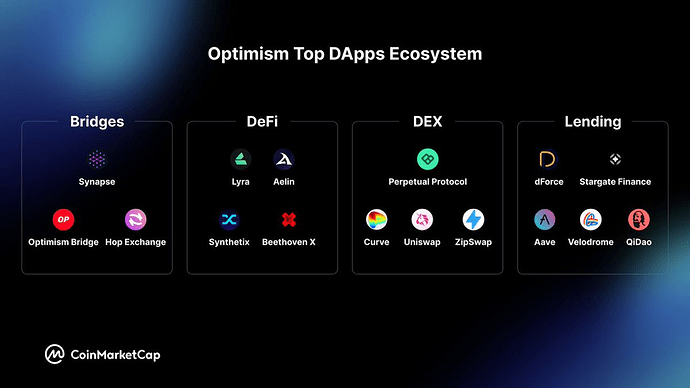

- dForce ranked #1 in the Lending protocol on Optimism according to CoinMarketCap

We welcome you to join our community to participate in related discussions.