Welcome back to dForce Ecosystem Update where we will recap our previous month and list what’s to come in the coming months.

Highlights

- dForce launched DF Staking (Free Staking & Lock-up Staking) on Ethereum for better alignments between protocol growth and $DF token holders. Current APY of Free Staking is 30%, Lock-up Staking is 154%. Learn More

- Call for dForce Governor! veDF holders (participants in Lock-up Staking) can delegate their voting rights to governors of their choice. Anyone can apply and become a governor of dForce — the process is 100% open, transparent, and permission-less.

- On 29 March, dForce had a community call held on Twitter Space and invited Aishwary from Polygon as guest speaker. We discussed around our major achievements in Q1, roadmap and outlook, new tokenomics, DF staking and delegation, multichain expansion, etc. Learn More

- dForce launched Open Staking Initiative through collaboration with our technology partners in operating nodes for a number of PoS networks, further aligning our DeFi strategies across different PoS networks by participating in the governance process and contributing to the development of PoS networks. Learn More

- dForce announced deployment of $USX and lending protocol on Polygon: Learn More

Overview

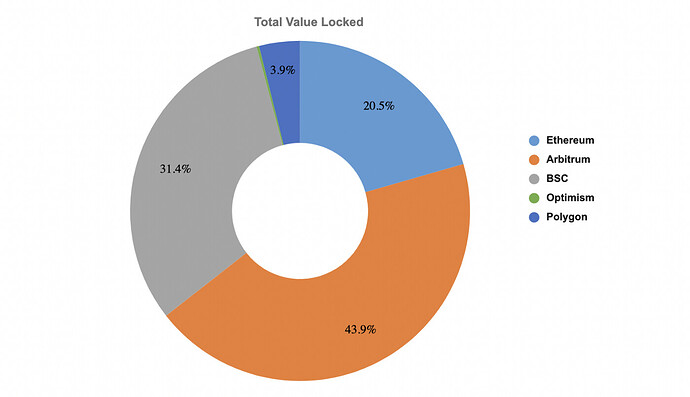

In March, dForce recorded a TVL of $271m, with 43.9% parked on Arbitrum, 31.4% on Binance Smart Chain, 20.5% on Ethereum, and 3.9% on Polygon.

USX

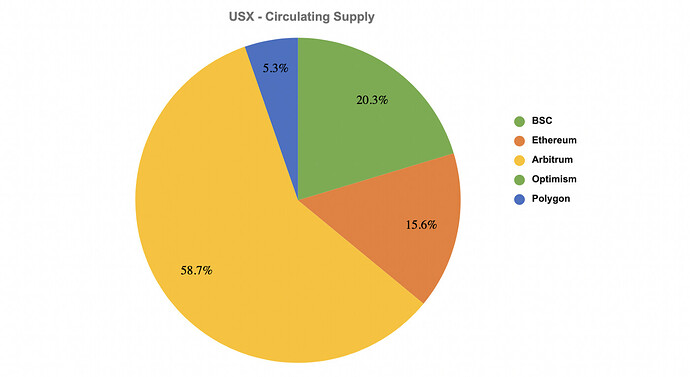

As of 31st March, 2022, total circulating supply of USX is $189m, with 58.7% of liquidity currently parked on Arbitrum, 20.3% on BSC, 15.6% on Ethereum, and 5.3% on Polygon.

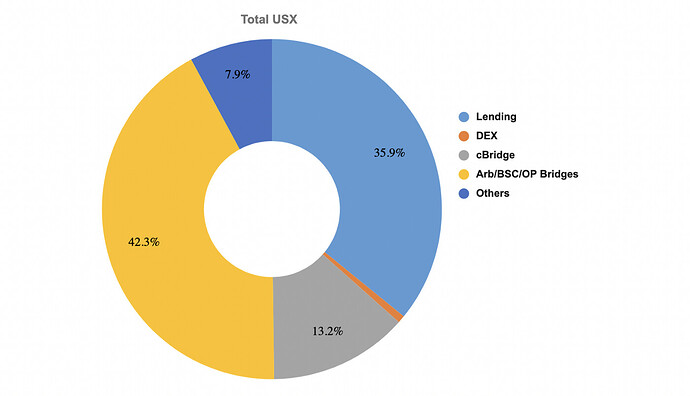

Approximately 42.3% of USX liquidity has been allocated to facilitate cross-chain expansions on Arbitrum, BSC and Optimism, 35.9% to lending, 13.2% to cBridge (cross-chain swap), 7.9% sitting in wallets with market participants, and 0.7% to DEXes.

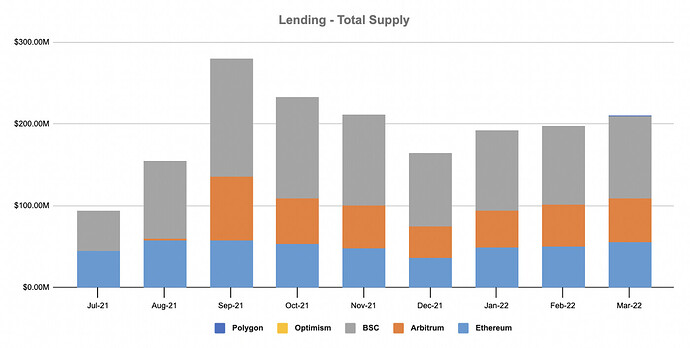

Lending

In March, dForce Lending recorded a total supply of $210m, representing a slight increase of 6.4% from February. Binance Smart Chain constituted 47.8%, Ethereum 26.6%, Arbitrum 25.1%, Optimism 0.3%, and Polygon 0.2%.

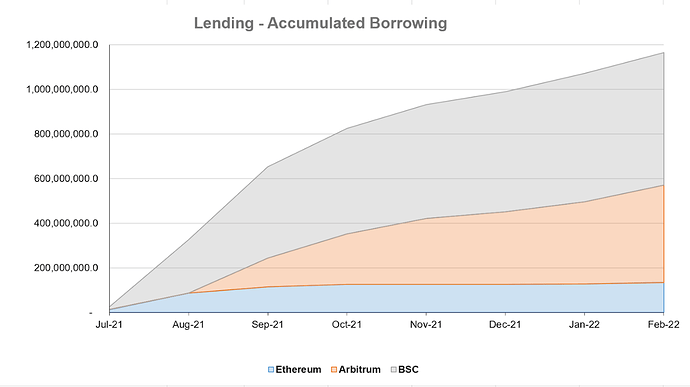

Total accumulated borrowing grew to $1.2b, representing an upward trend of a whopping 5.5% from the previous month in new loan originations.

Revenue

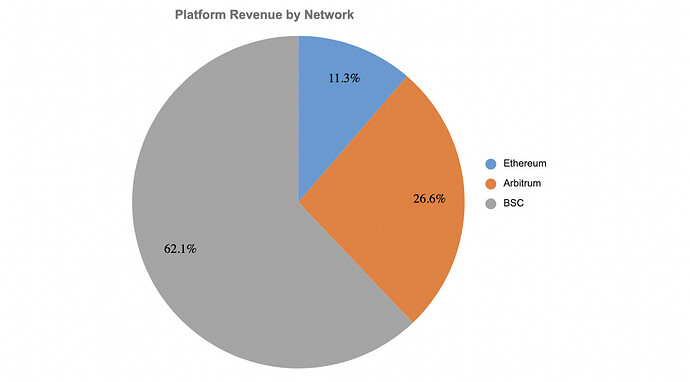

dForce recorded an Annualized Platform Revenue of $2m in March, with 62.1% generated on Binance Smart Chain, 26.6% on Arbitrum, and 11.3% on Ethereum.

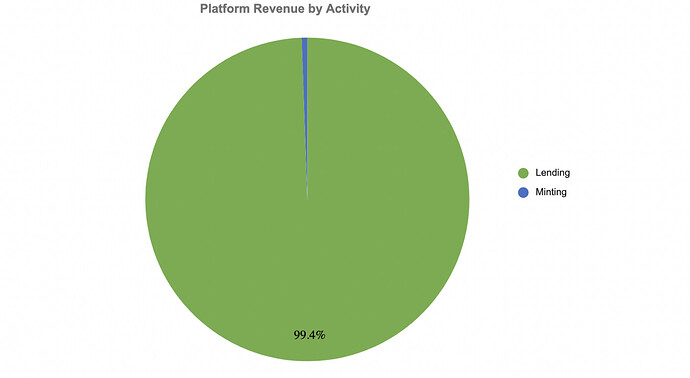

Approximately 99.4% revenue was generated from lending activities, and the remaining 0.6% from stablecoin minting.

Liquidity Mining

dForce have ongoing liquidity mining initiatives on Ethereum, Arbitrum, and Binance Smart Chain. Please visit dForce Forum to view the gauge (update on a weekly basis) and click here to see related tutorials.

Product Development

- Completed audit check with PeckShields and launched DF staking and delegation portal.

- Launched a new vault that supports USX paired LP tokens to be used as collateral to mint USX. This is beneficial to both LPs and the protocol. For LPs, it can achieve up to 20x leverage over USX stablecoin pairs which significantly improves capital efficiency. For the protocol, more liquidity will drive demand for USX in the open market and reduce liquidity subsidies.

- Deployed USX and lending protocols on Polygon and enabled the PDLP module to support liquidity operations for USX.

- Launched a new website to facilitate the dForce Open Staking Initiative.

- In the process of developing customized routes to further power the dForce Bridge.

- In the process of developing dForce Dashboard, providing a summary of dForce performance with more quantitative analysis around assets and operation efficiency. Target to launch in March.

- We are evaluating the opportunity to deploy dForce protocols to more blockchains including EVMOS and a couple of others. Join our community to learn more!

Governance

Launch of DF Staking

dForce launched DF Staking, a hybrid model featuring both Free Staking and Lock-up Staking, where DF holders can earn passive yield and participate in dForce governance. Learn More

Call for dForce Governor

veDF holders (participants in Lock-up Staking) can delegate their voting rights to governors of their choice. Anyone can apply and become a governor of dForce — the process is 100% open, transparent, and permission-less. Learn More

Snapshot Votes

DIP025 — Proposal to Implement DF Staking, Governance and New Tokenomics[Passed]

This proposal seeks approval on the following:

- Implement a hybrid free staking and lock-up staking (4-year maximum) for DF holders, with 5m DF per year distributed to participants in Free Staking, and 5m sDF per year distributed to participants in Lock-up Staking.

- Implement the new vote weighting:

- DF, iDF (lending certificate): each DF or iDF for 1 vote

- Free Staking DF: each staked DF for 1.2x votes

- veDF: each veDF for 6x votes

- Implement veDF delegation

DIP024 — New Vault for LP Tokens [Passed]

This proposal seeks approval to launch a new Vault that supports $USX paired LP tokens.

Marketing

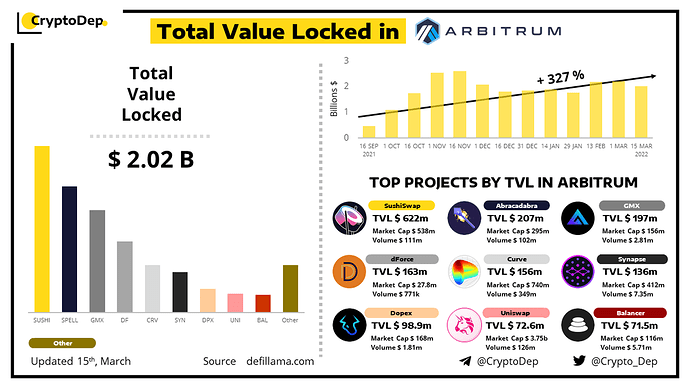

dForce ranked #4 with a TVL of $163m on Arbitrum, according to CryptoDep.

Mindao, Founder of dForce, participated in a panel hosted by Huoxin media to discuss about the risks and opportunities around the merge of Ethereum.

TheCryptoWire published an article introducing the features of dForce in details: Learn More

We welcome you to join our community to participate in related discussions.