Welcome back to dForce Ecosystem Update where we will recap our previous month and list what’s to come in the coming months.

Highlights

- dForce will soon deploy USX protocol and dForce Lending on KAVA EVM chain.

- dForce was selected as Polygon’s Liquidity Mining 2.0 incentives partner. Learn More.

- Binance added $DF to Binance convert. Learn More.

Overview

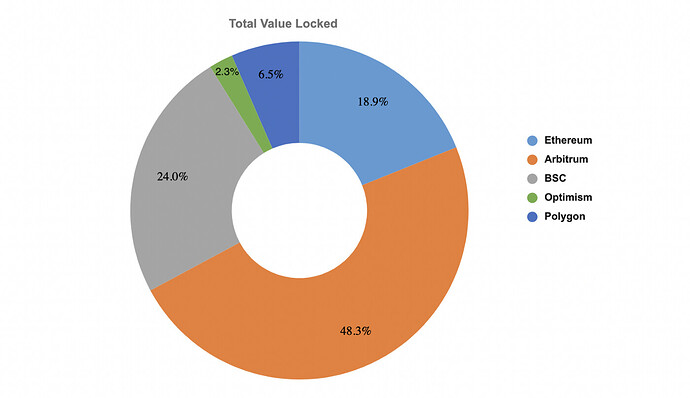

In May, dForce recorded a TVL of $234.4m, with 48.3% parked on Arbitrum, 24% on Binance Smart Chain, 18.9% on Ethereum, 6.5% on Polygon, and 2.3% on Optimism.

USX

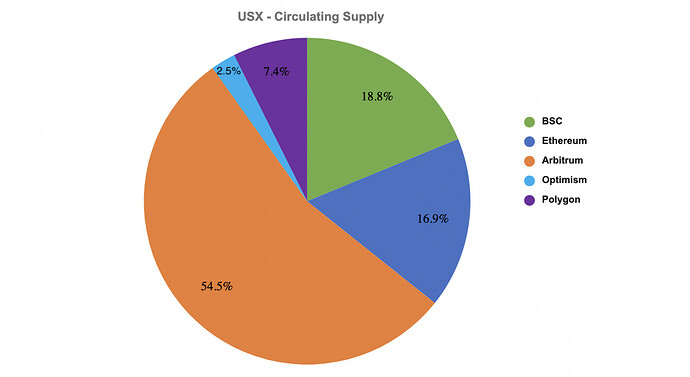

As of 31st May, 2022, total circulating supply of USX is $203.8m, with 54.5% of liquidity currently parked on Arbitrum, 18.8% on BSC, 16.9% on Ethereum, 7.4% on Polygon, and 2.5% on Optimism.

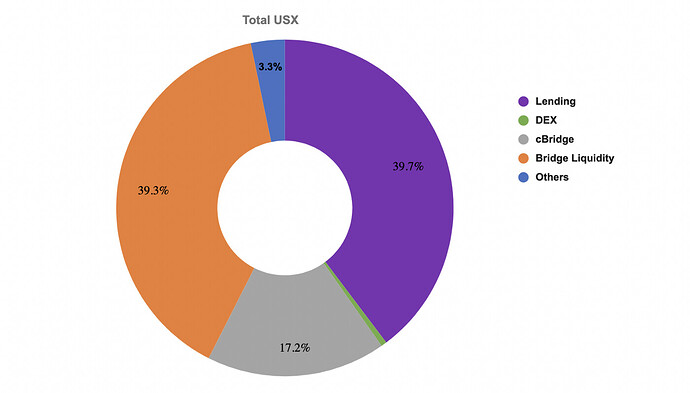

Approximately 39.3% of USX liquidity has been allocated to facilitate cross-chain expansions on Arbitrum, BSC and Optimism, 39.7% to lending, 17.2% to cBridge (cross-chain swap), 3.3% sitting in wallets with market participants, and 0.5% on DEX.

Lending

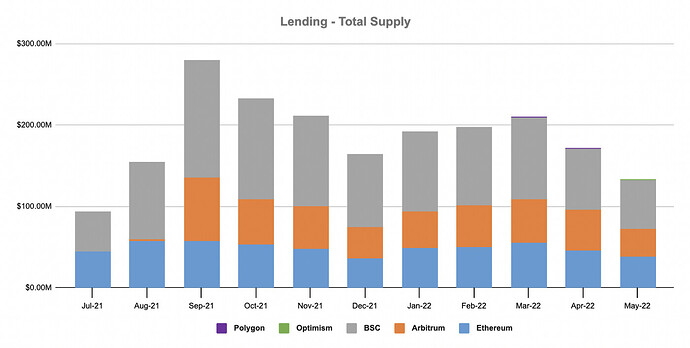

In May, dForce Lending recorded a total supply of $133.5m, representing a slight decrease of 22.3% from April. Binance Smart Chain constituted 45.2%, Ethereum 28.7%, Arbitrum 25.5%, Optimism 0.2%, and Polygon 0.2%.

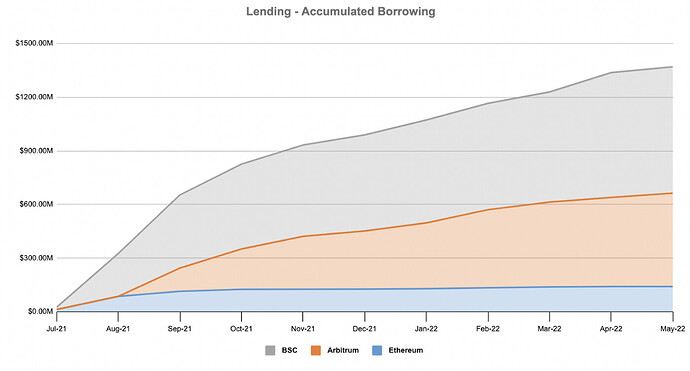

Total accumulated borrowing grew to $1.3b, representing an upward trend of a whopping 2.4% from the previous month in new loan originations.

Revenue

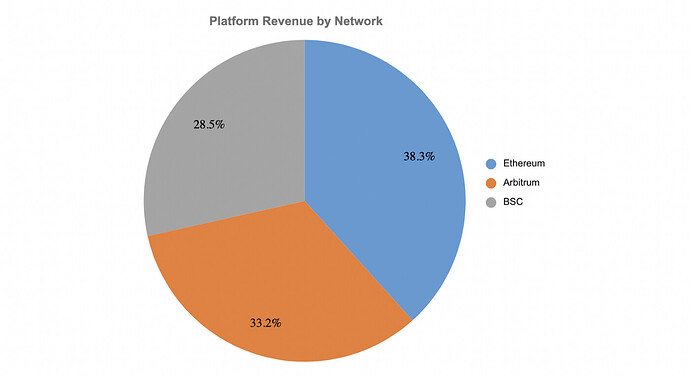

dForce recorded an Annualized Platform Revenue of $1.37m in May, with 32.2% generated on Arbitrum, 38.3% on Ethereum, and 28.5% Binance Smart Chain.

Approximately 99.9% revenue was generated from lending activities, and the remaining 0.1% from stablecoin minting.

Liquidity Mining

dForce has ongoing liquidity mining initiatives on Ethereum, Arbitrum, and Binance Smart Chain (BSC). Participants will earn a total of 627,500 DF across different chains and pairs per week!

Please visit dForce Forum to view the gauge (update on a weekly basis) and click here to see related tutorials.

Product Development

There are multiple products under development

- dForce will soon deploy USX protocol and dForce Lending on KAVA EVM chain. The deployment will come with various campaigns and marketing activities– users should stay tuned & excited!

- Dashboard will be launched soon. Through Dashboard, users will be able to see the statistical data of different dimensions within the dForce protocol, mainly including modules such as USX stablecoin, DF token, and revenues.

- APP optimization and Oracle upgrade will soon help optimize DAPP module classification and redefine the Oracle framework, add price validity checks, and be compatible with multi-chain configurations

Marketing

dForce was selected as Polygon’s Liquidity Mining 2.0 incentives partner. Learn More.

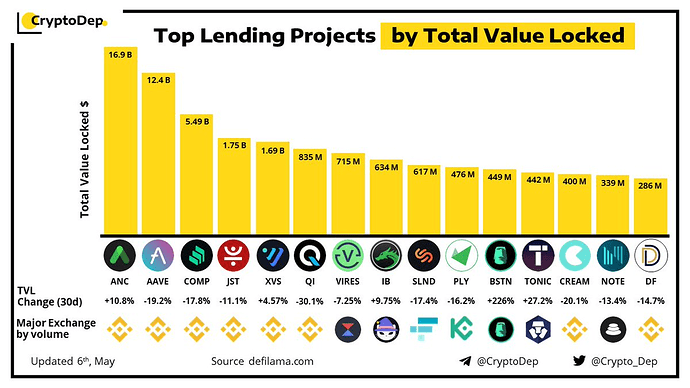

dForce is the #5 DeFi protocol by TVL on Arbitrum, according to CryptoDep.

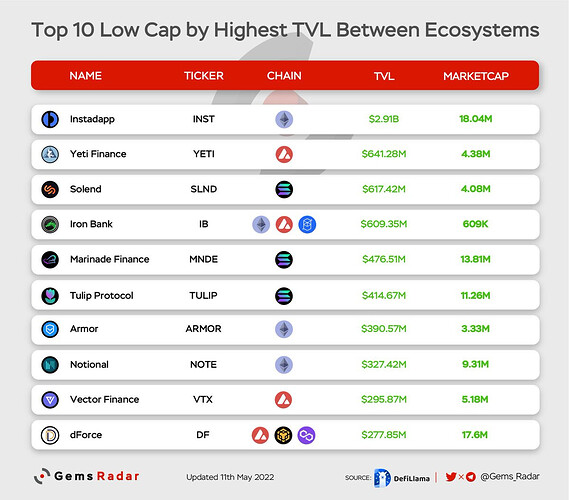

dForce mentioned as low cap gem by the highest TVL according to Gem Radar

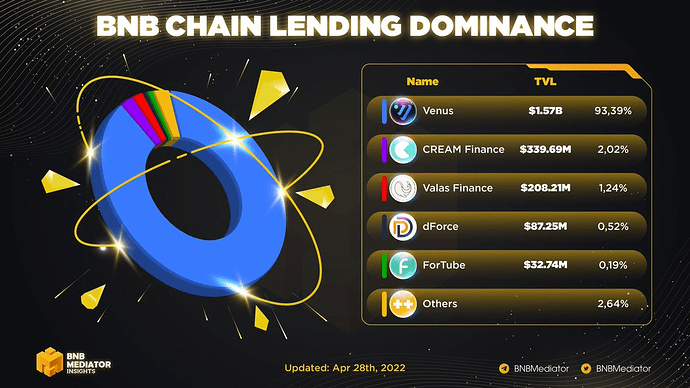

dForce is 4th top lending protocol on BSC by TVL according to BNB mediator.

We welcome you to join our community to participate in related discussions.