Welcome to the November Ecosystem Update of dForce Network. This is a one-stop-shop that consolidates what our team has been up to with dForce adventure of the month.

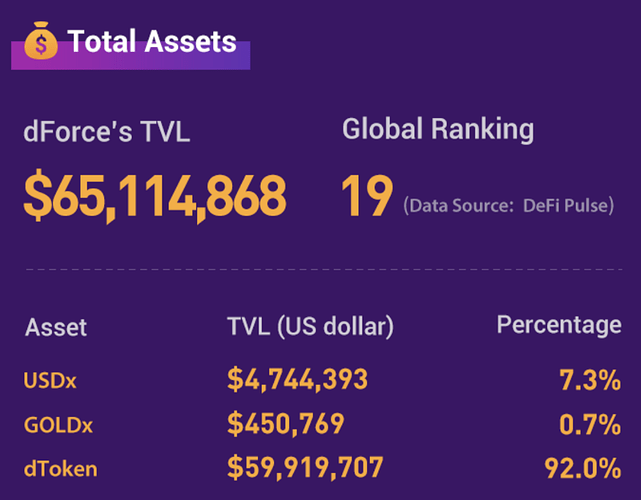

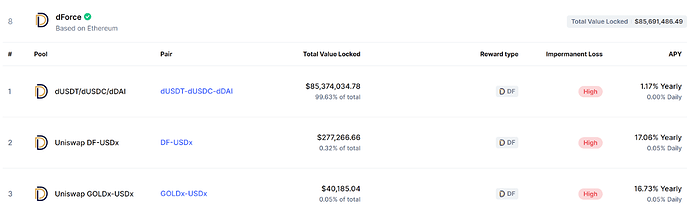

dForce now ranks #19 globally with $65.1M TVL (Total Value Locked) as of 30 November 2020, up by 13x since the launch of dForce Yield Market (dToken) in early August. dToken constitutes 92% of dForce’s TVL with $59.9M, followed by USDx with a TVL of $4.7M, accounting for 7.3% of the TVL.

(Source:https://defipulse.com/dforce)

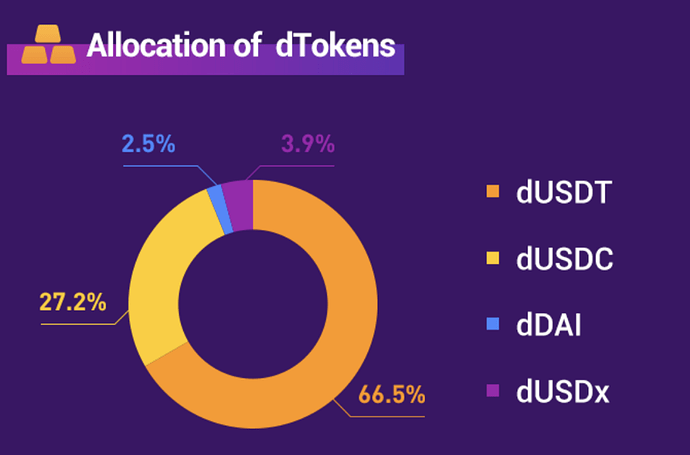

Among dToken assets, dUSDT grab the biggest slice of the pie with $39.8M TVL, accounting for 66.5% of the total, followed by dUSDC with $16.3M TVL, accounting for 27.2% of the total. dDAI recorded a TVL of $1.5M with 2.5% share of the pool.

(Source:dForce)

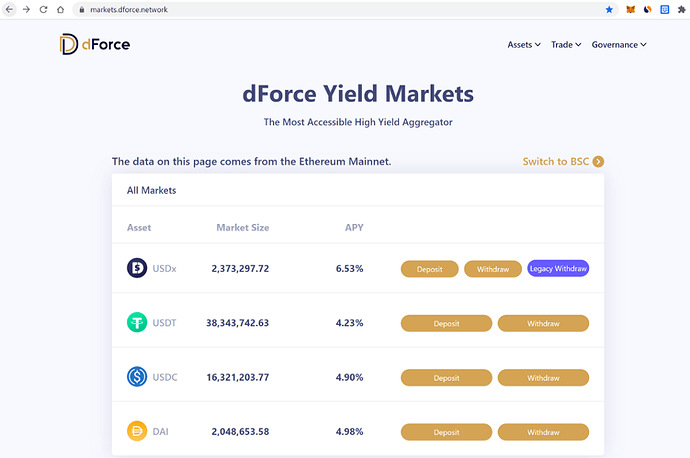

USDx is now traded on dForce Trade, Uniswap, S.Finance, Unisave, etc. USDx holders can earn passive interest (APY 6.53% at the time of writing) by simply depositing USDx into USR (aka USDx Saving Rate). Instant withdrawal is also supported.

(Source:dForce Yield Markets)

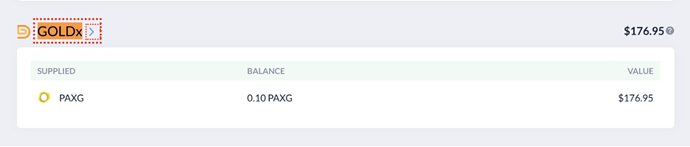

GOLDx, a digital gold token featured by zero on-chain transaction fee and denominated in gram, is currently traded on dForce Trade, Uniswap, SENBit and DigiFinex. The soon-to-be-launched dForce Lending will support GOLDx with yield.

Presently, dForce Trade has integrated with 6 mostly used DEXes including Uniswap, Balancer, Curve, etc. with >95% coverage of token swaps, scanning for the best possible price and aggregating proper liquidity across multiple platforms to facilitate large-volume trades.

(Source:dForce)

dForce is one of very few DeFi projects that offer incentivize plan over an extended time horizon, serving as a strategic compensation vehicle to promote long-term retention and community engagement. Among all yield-farming DeFi projects (Uniswap, Curve, Yearn, etc), dForce Liquidity Mining ranks #8 globally in terms of total value locked, according to CoinMarketCap, with Champagne Tower Pool accounting for the biggest slice of the pie.

(Source: https://coinmarketcap.com/yield-farming/)

Product Development

dForce Lending

dForce Lending is a fully open and permission-less lending protocol with more built-in risk parameters and diversified sources of capital supply (dToken pool and other sources). Positive synergies will be the holy grail and enhance integrations on liquidity and TVL levels across the networked matrix.

- Completed architecture review and assessment

- Coding and verification in process

- Enter into discussions with security companies for smart contract audit.

- Expected launch in 2021 Q1 (subject to audit process)

Integrations with dForce

dForce announced a strategic partnership with Unisave to jointly solidify protocol integration and community engagement. Our collaboration will start from optimizing TVL and liquidity for both platforms, with Unisave vault pool supporting dToken (dUSDT, dUSDC, dDAI) as a stepping stone, and will soon extend to dForce Trade and the to-be-launched dForce Lending in terms of TVL and liquidity integrations.

AEX announced their support to DF token by DeFi Vault Pool with 12% expected APY.

YUAN is a community-driven project and an elastic token tracking Chinese Yuan/USD rate. It was built with USDx as reserve asset on rebase (same as yUSD to YAM). By supplying liquidity to YUAN/USDx on Uniswap and staking LP token through YUAN, users can earn 9.0% APY at the time of writing.

YF Community announced their support for dForce Liquidity Mining through YF vault pool, with USDT as a start.

Further Readings:

-

dForce Partners with Unisave to Solidify Protocol Integration

Governance Proposal

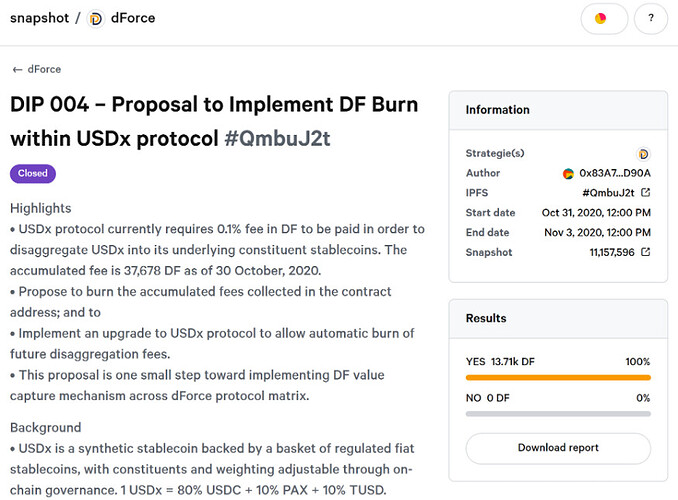

It was proposed through DIP004 to implement DF burn within USDx protocol, which was passed on 3 November, 2020 and moved forward for execution.

DF token holders can use Snapshot to propose and vote on changes to all protocols across dForce network.

Further Readings:

dForce Trade has been listed on Dapp.com and ranked as Top 30 Exchange Dapp in November.

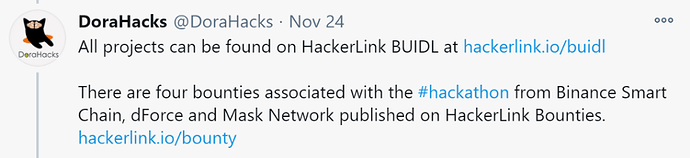

With 17 open-source projects built on Ethereum and Binance Smart Chain, we are pleased to join DoraHacks webinar in Beijing on 14~15 November, 2020 and published a bounty to support the event. We are always thrilled to connect to talented hackers around the globe!

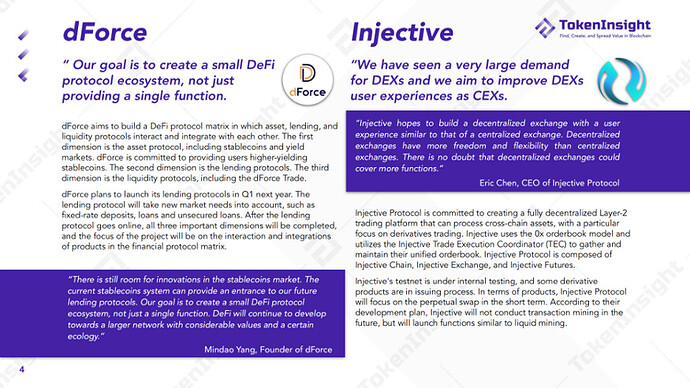

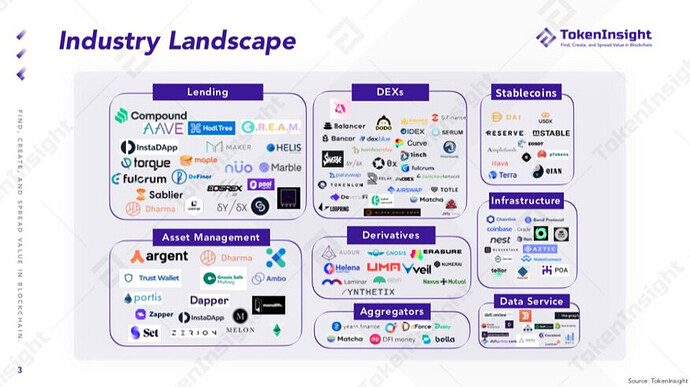

dForce has been rewarded as one of the most promising DeFi projects by TokenInsight, and shared our efforts around building a protocol matrix through an interview in November, 2020.

dForce has been included in the DeFi landscape by TokenInsight.

On 12 November, 2020, Margaret, Operation Director of dForce, was invited by YSTAR community to introduce dForce Yield Markets and how dToken differentiates from other yield tokens to provide the best risk-adjusted yield.

On 27 November, 2020, Mindao shared his viewpoints on the potential and bottlenecks for DeFi’s breakthrough, together with our friends from Loopring, DeFiner, DODO, and YFII in an video podcast organised by Mars Media.

DF Airdrop

As a salute to the community, dForce offered an airdrop of 2,000,000 DF tokens in two tranches to Lendf.Me users. The second tranche became available for claiming from 10:00am UTC+8, 28 November 2020 to 10:00am UTC+8, 31 May, 2021 (no more claiming accepted afterwards). Please make sure to log into the dForce Airdrop System with the same address that had interacted with Lendf.Me before to claim your airdrop rewards.

Further Readings:

- DF Airdrop — Tranche II

-

DF Airdrop — A Salute to Lendf.Me Users

Welcome to join our community to participate in related discussions:

dForce Official Website: https://dforce.network/

Twitter: https://twitter.com/dForcenet

Telegram: https://t.me/dforcenet

Medium: https://medium.com/dforcenet