Welcome back to another dForce Ecosystem Update where we will recap the month of November and what’s to come in the coming months.

Highlights

- Introduced dForce Vault (launching soon) as an extension to current pool-based USX lending with collaterals sitting in isolation with a completely different risk model.

- Deployed dForce Lending on Optimism.

- Integrated dForce Trade to our App (all-in-one interface).

- Announced partnership with NAOS to onboard real-world assets backed loans.

- Dual liquidity mining with DODO on Arbitrum extended to December 27 for DF/USX and USDC/USX.

- dForce is planning for a series of grand upgrade of features and revamped tokenomics that further tighten interest alignment with DF holders, and get the flywheel to spin much faster.

Overview

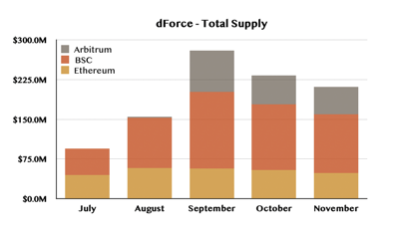

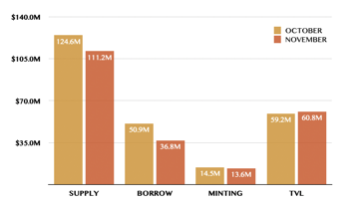

In November, dForce recorded a total supply of $211.1m, down by 10.05% compared with the previous month. Among which, Ethereum constituted 22.9%, Binance Smart Chain 52.7%, and Arbitrum 24.5%.

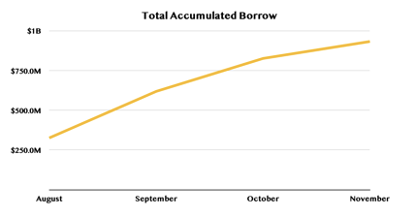

dForce recorded a total accumulated borrowing of $932.6m, representing an upward trend of $106.7m in new loan origination, or 12.9% from previous month.

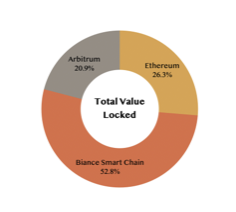

Total value locked on dForce across Ethereum, Arbitrum, and Binance Smart Chain amounted to $115.2m, 6.91% down from October. Out of which, 52.8% currently park on Binance Smart Chain, 20.9% on Arbitrum, and 26.3% on Ethereum.

Liqee, an ecosystem project of dForce, contributed $33.7m in total supply (up by 22.8%), $3.9m (down by 43.7%) in total borrowing, and $10.1m in USX minting (up by 47.2%) on Ethereum and Binance Smart Chain.

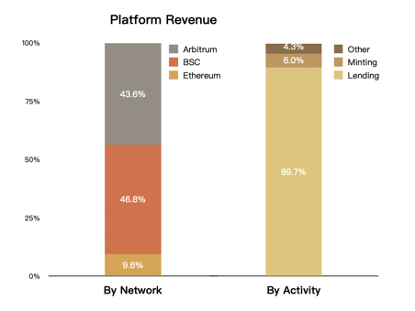

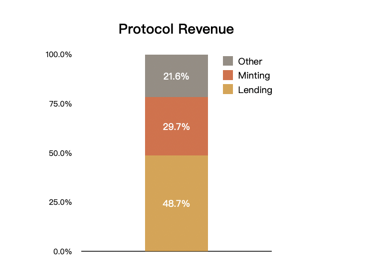

Revenue Breakdown

Glossary

- Platform Revenue: the total of interest paid by borrowers and fees generated from minting stablecoins (USX and EUX).

- Protocol Revenue: the total of reserves (interest spread between lending and borrowing) and fees generated from minting stablecoins (USX and EUX), which will be used to facilitate DF repurchase subject to future governance approval.

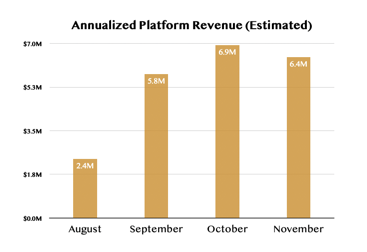

In November, dForce recorded a projected Annualized Platform Revenue of $6.4m, contributed by interest paid by borrowers (on dForce Lending), stablecoin minting fee (on dForce & Liqee), and trading fees generated from the USX pool on MCDEX.

In view of the Platform Revenue,

- By network: 9.6% from Ethereum, 46.8% from Binance Smart Chain, and 43.6% from Arbitrum.

- By activity: 89.7% from lending (interest paid by borrowers), 6.0% from stablecoin minting, and 4.3% from other sources (mainly from the USX pool on MCDEX).

In view of Protocol Revenue, approximately 48.7% were contributed by lending activities (interest spread), 29.7% from minting, and 21.6% from trading fees generated from the USX pool on MCDEX.

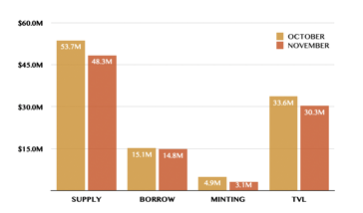

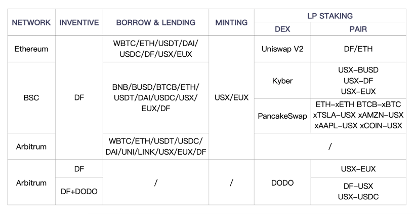

Ethereum

By end of November, dForce Lending achieved a Total Supply of $48.3m, a Total Borrowing of $14.8m, $3.1m in Total Minting and $30.3m in Total Value Locked on Ethereum.

Top 3 assets borrowed from dForce are USDT (34.4%), USDC (33.3%), and DAI (27.5%). Top 3 stable assets ranked by liquidity are USDC ($2.9m), DAI ($2.1m), and USDT ($1.0m). Top 3 assets supplied to dForce are ETH (33.8%), USDC (16.6%), and DAI (13.1%).

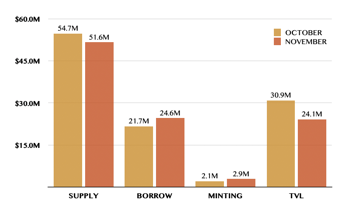

Arbitrum

On Arbitrum, dForce Lending achieved a Total Supply of $51.6m (down by 5.7%), Total Borrowing of $24.6m (up by 13.3%), Total Minting of $2.9m (up by 39.0%), with a Total Value Locked of $24.1m in November.

Top 3 assets supplied to dForce are ETH (38.9%), USDT (25.9%), and USDC (17.8%). Top borrowed are USDC (43.1%), USDT (35.0%), and DAI (16.7%).

Binance Smart Chain

On Binance Smart Chain, dForce Lending achieved a Total Supply of $111.2m, Total Borrowing of $36.8m, and Total Minting of $13.6m, with a Total Value Locked of $60.8m in November.

Top 3 assets supplied to dForce are BUSD (15.2%), ETH (12.6%), and BTCB (10.9%). Top

Liquidity Mining

dForce launched liquidity mining initiatives on Ethereum, Arbitrum, and Binance Smart Chain simultaneously, and worked with DODO to offer dual incentives to participants on Arbitrum. Please visit dForce Forum to view the gauge (update on a weekly basis). Click here to see related tutorials.

Product Development

dForce Vaults (expected launch in December)

A great extension of pool-based USX lending where all collaterals are sitting in a shared pool, allowing USX to be minted from different tokens in isolation with a completely different risk model, and further expanding USX’s collaterals to a broader category of assets. Click here to read more. Governance poll got passed on 26 November.

DF Staking (expected launch in December)

The DF staking system allows users to stake DF token in exchange for vsDF token, which can be used to propose and vote on critical protocol decisions, capture value directly from dForce protocols, and receive inflationary rewards from staking, etc. Coming soon!

Cross-Chain Bridge (expected launch in December)

A toolkit facilitating immediate swap for dForce native stablecoins across Ethereum, Arbitrum, and BSC.

Others

A number of new features and new tokenomics to be disclosed soon. Stay tuned!

Governance

DIP015 – Adjustment to Minting Fees for USX and EUX [PASS]

To bring the minting fee in line with market, this proposal suggests to adjust the Minting Fee for USX EUR in dForce Lending to 1.5% APR across Ethereum, Arbitrum, and BSC.

DIP016 – The First Batch of Assets Supported on dForce Vaults [PASS]

This proposal seeks approval from dForce Community to list iUSDT, iUSDC, and iDAI as the first batch of collateral assets supported on dForce Vaults.

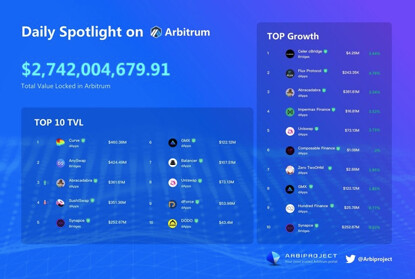

Marketing

dForce is listed on arbiproject.io as the #9 DeFi protocol or #1 lending protocol in term of TVL on Arbitrum.

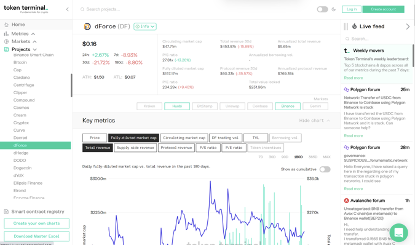

dForce is listed on Token Terminal.

Partnership

dForce and NAOS Finance Partner to Onboard Real-World Assets Backed Loans

dForce has entered into a partnership with NAOS Finance, a decentralized real-world asset (“RWA”) lending protocol, to further expand RWA backed products to DeFi. The collaboration allows NAOS to onboard dForce as a credit facility, and enables dForce to mint USX with RWA backed collaterals. Click here to view more.

dForce on Optimism!

This deployment continues dForce’s multi-chain strategy and furthers us in the journey to expand DeFi to rival TradFi. The deployment on Optimism will enable cheaper and faster trading for smaller holders, and will be a great addition to current multi-chain offerings of dForce on Ethereum, BSC, and Arbitrum. Click here to read more.

Extended Readings