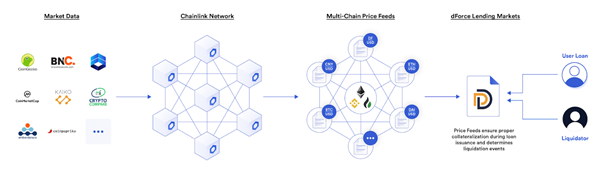

We are pleased to announce that dForce has integrated with the oracle network Chainlink on mainnet as the primary oracle solution for all of our lending and synthetic protocols. dForce decided to use Chainlink oracle in order to strengthen the security of the oracle mechanism responsible for protecting the protocol’s increasing Total Value Locked (TVL). Chainlink’s decentralized price feed oracles are used to securely calculate the value of assets used within our multi-chain lending and synthetic asset protocols, ensuring loans and synthetic assets are issued and minted at a fair market price and fully collateralized at all times.

dForce will utilize a variety of Chainlink Price Feeds for both its lending protocol as well as its upcoming multicurrency and synthetic asset protocol. This integration will support dForce’s multi-chain ecosystem, using Chainlink Price Feeds natively on Ethereum and Binance Smart Chain (BSC).

Understanding dForce and Its Need for Oracles

dForce is a multi-chain DeFi ecosystem, operating across multiple blockchains.

Our lending protocol allows users to supply crypto assets into lending pools in order to earn yield, as well as deposit collateral to borrow assets from. In V2 of the lending protocol launch, we will introduce a Synthetic Asset protocol, which combined with V1 would complete the dForce Lending & Synthetic Asset protocol. This will allow dForce to offer not only general lending, but also synthetic assets of unlimited variety, from FX currencies to commodities, stocks, indices, and more.

One of the critical components to facilitating our lending and synthetic asset markets is having real-time access to secure and reliable price feeds for the assets supported by the protocols. These price feeds are referenced every time a loan is originated or assets minted, as well as consistently referred to in the background to ensure loans and debt positions remain fully collateralized at all times.

Since crypto-assets trade across hundreds of centralized and decentralized exchanges, we require aggregated price data that is refined and weighted by volume in order to arrive at a true global market price. This information is not accessible on the blockchain itself, and thus requires an “oracle” to connect with external data sources off-chain.

Why We Use Chainlink Oracles to Secure dForce Lending Markets

Chainlink Price Feeds support various blockchains, and was suitable for dForce’s blockchain-agnostic nature.

The security of user funds is dForce’s number one priority. Chainlink Price Feed oracles provided a set of features we believed would provide maximum security and data integrity. These features included high quality data that has inherent resistance to API downtime and data manipulation, secure oracles, and wide adoption by other DeFi projects such as Aave and Synthetix.

“We are excited to use Chainlink’s trusted and scalable oracles to secure the backend smart contracts powering dForce’s Lending & Synthetic Asset protocol,” says Snow, Protocol Lead at dForce. “The quality of Chainlink data and the time-tested security of its oracle infrastructure are key to guaranteeing data integrity. We look forward to growing in our integration with Chainlink, turning dForce into a major player within the multi-chain DeFi space.”

“We’re excited to strengthen the security of dForce’s multi-chain lending markets by providing them with Chainlink’s proven and blockchain-agnostic oracle infrastructure, enabling a new range of synthetic assets powered by tamper-proof data feeds,” said Dan Kochis, Head of Chainlink Business Development. “By integrating Chainlink oracles, dForce is ensuring that price data across its lending and synthetic asset protocol reflects broad market coverage, enhancing the overall reliability of dForce as it continues to lock in more value across chains within the DeFi ecosystem.”

About dForce

dForce advocates for building an integrated and interoperable open finance protocol matrix covering assets (dToken, iToken, MSD, USDx, GOLDx), lending (dForce Lending), and liquidity (dForce Trade).

Features:

• Permissionless and open – everyone with internet access can participate.

• Non-custodial – minimal trust cost; users always have ownership over their crypto assets.

• Open-source – anyone can integrate with dForce and build their product on top of our protocols.

• Decentralized – dForce (DF) token empowers the governance voting process.

Discord | Twitter | Telegram | Medium | GitHub | Reddit | Docs

About Chainlink

Chainlink is the most widely used and secure way to power universally connected smart contracts. With Chainlink, developers can connect any blockchain with high-quality data sources from other blockchains as well as real-world data. Managed by a global, decentralized community of hundreds of thousands of people, Chainlink is introducing a fairer model for contracts. Its network currently secures billions of dollars in value for smart contracts across the decentralized finance (DeFi), insurance and gaming ecosystems, among others.

Chainlink is trusted by hundreds of organizations to deliver definitive truth via secure, reliable data feeds. To learn more, visit chain.link, subscribe to the Chainlink newsletter, and follow @chainlink on Twitter.

Docs | Discord | Reddit | YouTube | Telegram | Events | GitHub | Price Feeds | DeFi | VRF