We are pleased to annouce that dForce has entered into a strategic partnership with Unisave to jointly solidify protocol integration and community engagement. Unisave will become a valued partner in our effort to provide DeFi primitives and drive continued success as we foster our ecosystem.

Our collaboration will start from optimizing TVL and liquidity for both platforms, with Unisave vault pool supporting dToken (dUSDT, dUSDC, dDAI) as a stepping stone, allowing liquidity providers on Unisave to receive optimized yield including trading fee earned proportional to their share of the pool. We will soon extend our collaborations to support dForce Trade and the to-be-launched dForce Lending in terms of TVL and liquidity integrations.

Building on the mission to power a protocol matrix, dForce has partnered with a group of pioneering institutions/projects (YFI, Flamingo, SparkPool, imToken, Band, S.Finance, YFII, Unisave, etc) through strengthened collaborations for better yields and free and permissionless liquidity access.

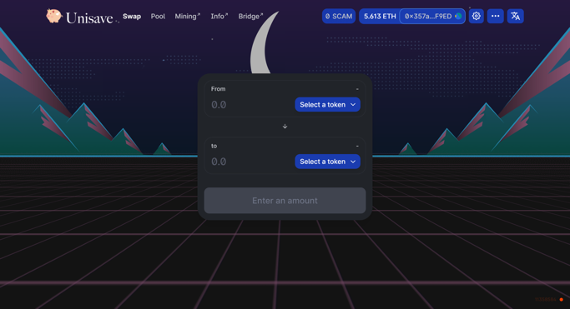

About Unisave (https://app.unisave.exchange/#/swap)

Unisave is a yield-aware decentralized exchange protocol (just like Uniswap), whereas each Unisave-pair serves as an aggregator and invests across DeFi stacks. Unisave is featured by:

- Auto Mining

- Zero Protocol Fee

- Self-adjusting Market Maker Algorithm

Click here to learn more about Unisave.

About dForce (https://dforce.network/)

dForce advocates for building an integrated and interoperable open finance and monetary protocol matrix, including asset protocols (USDx, GOLDx, dToken), liquidity protocol (dForce Trade), and lending protocol (dForce Lending).

dForce Token (DF) is the utility token that facilitates governance, risk buffers and interest alignment across the dForce Network.

Our team includes both crypto veterans and professionals from Goldman Sachs, Standard Chartered Bank, Hony Capital. dForce is backed by investors including CMBI (China Merchants Bank International), Multicoin Capital and Huobi Capital (the investment arm of Huobi Group).

About dToken (https://markets.dforce.network/)

dToken is a yield aggregator launched by dForce, aiming to harvest the most attractive risk-adjusted yield across DeFi stacks.

Depositing supported tokens into dForce Yield Markets (https://markets.dforce.network/), users will receive corresponding dToken on a pro rata basis (i.e. depositing USDT to receive dUSDT). Each dToken represents a pro rata claim of the underlying token plus yields generated and can be redeemed at any time.

Presently, pooled capital of dTokens are supplied to Compound and Aave to earn yield and will soon add support to more yielding protocols. All governance token farmed (i.e. COMP) will be automatically converted into underlying stablecoin and added into the underlying yield.