It’s summer again, it feels like ages ago since we started our first liquidity mining initiative last summer, the market has gone through epic run, and we feel the need to sunset most of our old liquidity initiatives.

We are thrilled about the launch of dForce Lending and Synthetic Asset protocol, which marks the completion of dForce protocol matrix. Now, it is time to roll out DF liquidity mining initiative in a larger and more impacting scale.

The Summer Vibes initiative will include rewards on lending and borrowing activities, minting synthetic stablecoins, as well as providing liquidity for dForce synthetic assets. The revamped DF liquidity mining will be carried out on both Ethereum and BSC, however, for Ethereum, liquidity mining will only be activated for lending activities and minting synthetic stablecoins.

DF liquidity mining will be carried out in three forms, namely:

- For lending: DF rewards will be distributed evenly between lending (50%) and borrowing activities (50%), with a fixed amount for respective asset.

- For minting: minting synthetic stablecoins (USX, EUX) will get rewarded. Please note that minting USX and EUX, require to pay interest rate accrued on an annual basis (aka an over-collateralized loan, borrowers need to pay the protocol for the opportunity to mint synthetic stablecoins).

- For liquidity providing (only on BSC): Pancake LPs will receive DF rewards by providing liquidity for supported pairs on Pancake.

DF liquidity mining will be carried out on per block basis, meaning that you can claim DF, anytime, at your convenience.

The first phase of Summer Vibes liquidity mining initiative will start on 4th June and end on 18th June. We may adjust the plan based on further assessments in order to continuously improve it.

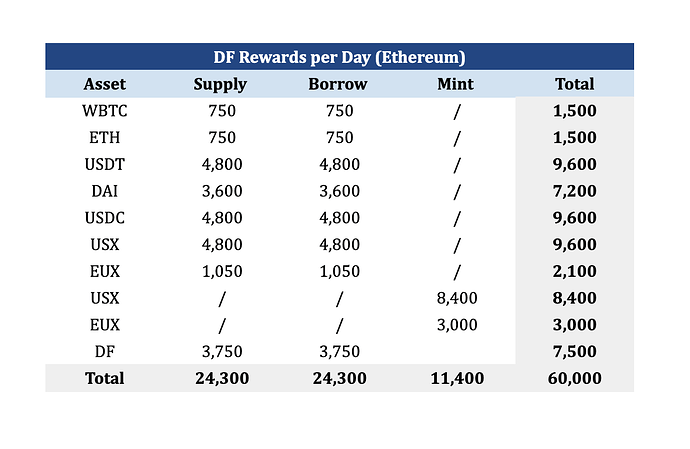

On Ethereum

A total of 60,000 DF / day will be given away as rewards for the dForce Lending and Synthetic Asset protocol users.

- Lending activities: 48,600 DF / day rewards will be distributed evenly between supplying (24,300 DF / day) and borrowing (24,300 DF / day) .

- Minting synthetic stablecoins: 11,400 DF / day will go to mining rewards for minting USX and EUX.

Below is a detailed schedule of DF allocation across lending, borrowing and minting:

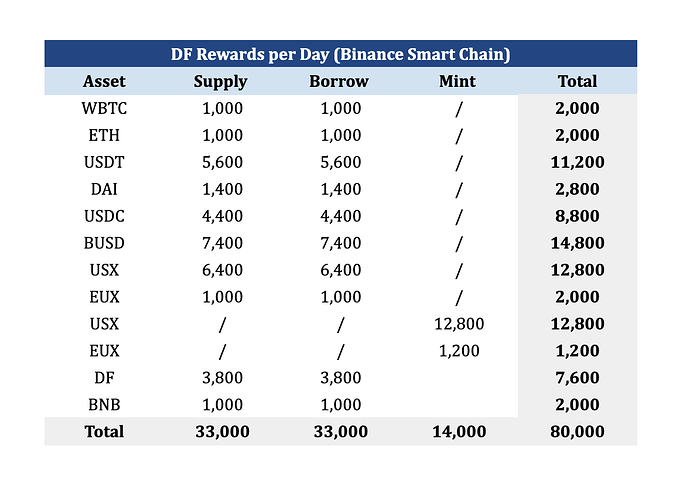

On BSC

A total of 80,000 DF / day will be allocated as rewards for the dForce Lending and Synthetic Asset protocol users.

- Lending activities: 66,000 DF / day rewards will be distributed evenly between supplying (33,000 DF / day) and borrowing (33,000 DF / day).

- Mintage of synthetic stablecoins: 14,000 DF / day will go to mining rewards for minting USX and EUX.

Below is a detailed schedule of DF allocation across lending, borrowing and minting:

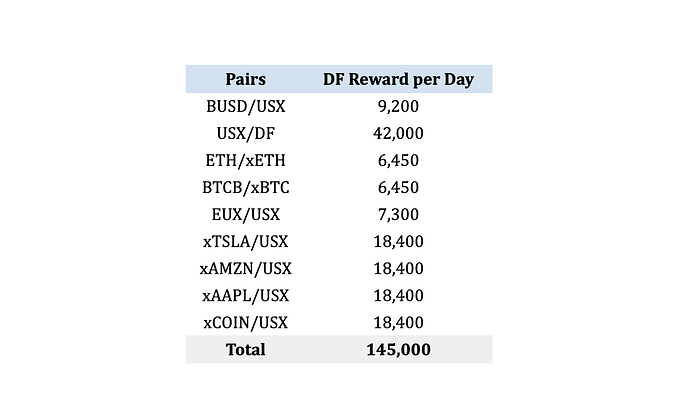

On top of this, there is a whopping 145,000 DF / day allocated for rewards for LP pairs on Pancake for the following pairs:

ATTENTION: please be aware of the following risks while participating in DF liquidity mining:

- Minting USX and EUX will be subject to a mintage interest rate of 3% per annum, this is similar to borrowing interest rate.

- While providing liquidity on AMM (i.e., Pancake) with minted synthetic stocks (xTSLA, xAAPL, xAMZN, xCOIN), please be aware of the impermanent loss risks given synthetic stock tokens are tracking the market price of respective stocks.

- During stock market close, you cannot mint, redeem or withdraw from the stock pool. Click here to learn more.

We welcome you to join our community to participate in related discussions