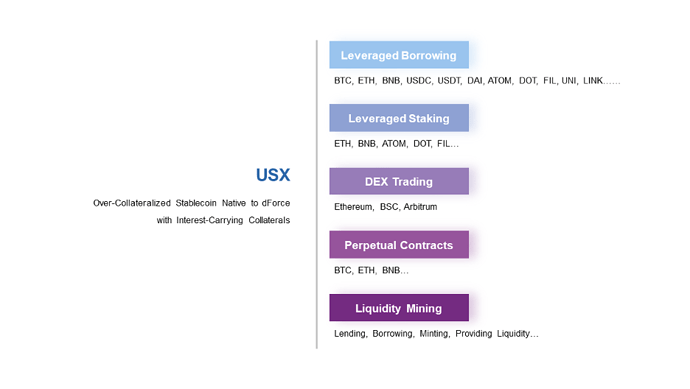

We are pleased to announce the launch of Vaults, a great extension of pool-based USX lending where all collaterals are sitting in a shared pool, allowing USX to be minted from different tokens in isolation with a completely different risk model, and further expanding USX’s collaterals to a broader category of assets. We will formulate a governance proposal with regard to the first batch of proposed collateral assets across Ethereum, Arbitrum and BSC for DF token holders to jointly make a decision on this exciting deployment.

Currently, users can mint USX through dForce Lending (under the Synthetic General Pool) and Liqee Lending (an ecosystem project of dForce), where all supported assets can be used as collaterals to mint USX. However, this pool-based lending model restricts onboarding of yield tokens and long-tail assets as collaterals. This is due to the lack of flexibility in setting restrictions on debt ceiling and other risk parameter for each collateral.

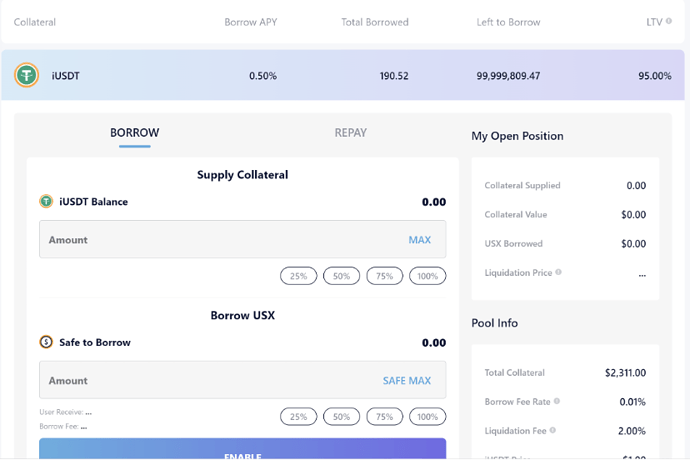

The Vaults will be implemented with several risk parameters, including Interest (borrowing APY), Total Borrowed (total outstanding USX borrowed under this vault), Left to Borrow (available USX limit of this vault); LTV (loan to collateral ratio), Liquidation Price (the price to trigger liquidation of your collaterals), Borrow Fee (upfront fee for each borrowing).

The Vaults exist independently from dForce’s General Lending Pool, meaning that your collaterals deposited into the General Lending Pool cannot be used as collaterals to support borrowings from Vaults. There will be Borrow Fees charged upfront upon each loan origination.

A governance proposal with the first batch of supported collaterals and proposed risk parameters will be formulated for voting.

The Vaults open up opportunities to vastly expand USX’s utility. We are happy to collaborate with other DeFi projects by supporting their tokens through different vaults. Please contact us at [email protected].