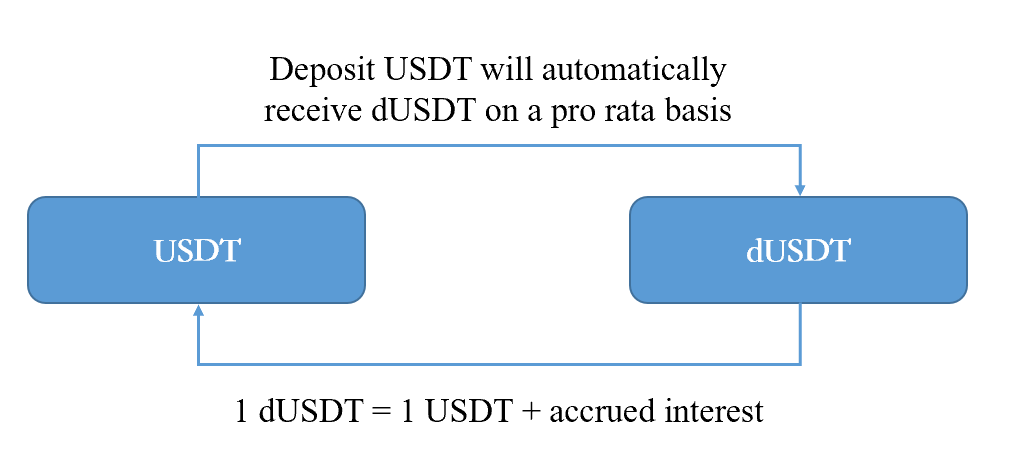

Today, we are pleased to introduce the Yield Markets as the second core asset protocol across dForce Network following USDx. The Yield Markets aim to become the most accessible yield aggregator to farm the most attractive risk-adjusted yield across DeFi protocols. It now supports USDx, GOLDx, USDT, USDC, and DAI. Depositing supported tokens into the Yield Markets, you will receive corresponding dToken on a pro rata basis (i.e. depositing USDT to receive dUSDT). Each dToken represents a pro rata claim of the underlying token plus yields generated.

Pooled capital under Yield Protocol will be allocated to different DeFi markets, including lending protocols, hybrid pools, high-yield asset pools, etc., to farm the most attractive risk-adjusted yield. Initially, Yield Protocol will be integrated with Compound and Aave. dToken will simplify the governance token harvesting, by converting the COMP token (or other tokens) received from Compound into underlying stablecoin and redistributed back to the pool for added yields.

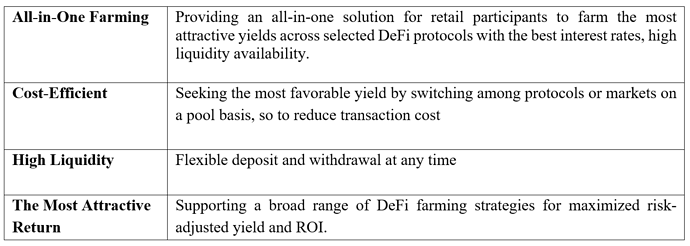

DeFi yield farming is becoming more and more complicated. Seeking the most attractive yield by rotating among protocols requires a solid and comprehensive understanding of smart contract security, farming rules, and expected yields as well as gas fees, these are huge barriers for retail participants. The Yield Markets aims to provide an optimized solution for everyone to farm the best yield across protocols at ease.

Highlights of the Yield Markets:

Join us for online discussions! We’d love to hear your voice!

Twitter: https://twitter.com/dForcenet

Telegram: https://t.me/dforcenet

Medium: https://medium.com/dforcenet