Summary:

We performed risk assessments in accordance with dForce Risk Framework for a number of widely adopted cryptoassets, and hereby propose to list WBTC, ETH, USDT, USDC, DAI as the first batch of assets to be supported by dForce Lending upon soft launch.

Background:

dForce Lending is a pool-based lending protocol operating in a permissionless and transparent manner through smart contracts, with interest rates dynamically driven by market supply and demand and accounted for in every block.

Similar to other protocols across dForce’s protocol matrix, dForce Lending is governed by dForce (DF) token holders, who can vote to collectively decide on proposed protocol changes, including onboarding of new assets, supporting of new collateral, and deciding the supply/borrow cap of each asset, etc.

Proposal:

We propose to list WBTC, ETH, USDT, USDC, and DAI as the first batch of assets supported with dForce Lending based on analysis and assessments of the following risk factors.

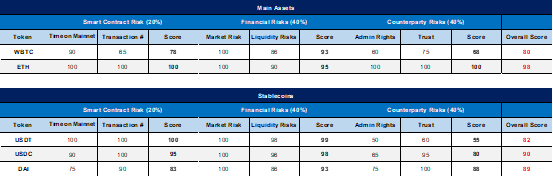

Smart contract risks: maturity, code security, code openness

Financial risks : market and liquidity risks

Counterparty risks : centralization and intermediary risks

The Risk Score represents the robustness of each asset’s risk factors. The higher the score, the less risks associated.

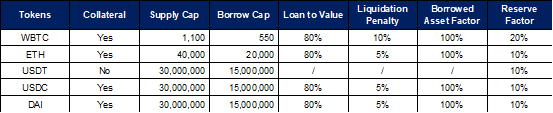

All assets except USDT can be used as a collateral to borrow other assets, with full coverage of risk parameters for each asset including supply cap, borrow cap, loan to value %, liquidity penalty, borrowed asset factor, and reserve factor.

Further reading: dForce’s Risk Assessment Guideline

Risk Analysis per Asset:

WBTC [Overall Score: 80]

WBTC is the first ERC20 token backed 1:1 with Bitcoin, which was jointly initiated by Kyber, Ren, and BitGo. WBTC has been audited by multiple third-party audit firms including Solidified Technologies, ChainSecurity and Coinspect.

WBTC Smart Contract Risk: 78

WBTC became available on Ethereum since November 2018 and has recorded over 1.2 million verifiable transactions since deployment.

WBTC Financial Risk: 93

WBTC is the dominant BTC-pegged ERC20 tokens on Ethereum in terms of market capitalization ($5.7 billion) and 24h trading volume (approx. $338 million).

WBTC Counterparty Risk: 68

WBTC is a centralized Bitcoin with Bitgo playing the role of sole custodian with WBTC, hence we apply a relatively lower score

ETH [Overall Score: 98]

ETH is the native cryptocurrency of Ethereum. Users need to pay gas fee denominated in ETH while interacting with smart contracts. A majority number of decentralized applications are currently built on Ethereum, with ETH accounting for the biggest slice of pie of the total funds staked in DeFi projects.

ETH Smart Contract Risk: 100

Ethereum network went live on 30 July 2015. Ether (ETH) is widely adopted by almost all decentralized platforms.

ETH Financial Risk: 95

ETH is the second largest crypto asset following BTC, and has gained a considerable market cap of US$200 billion with around US$46.8 billion trading volume in 24h.

ETH Counterparty Risk: 100

Ethereum is open-source and transparent, it is one of the strongest blockchain communities with tens of thousands of developers, technologists, users, HODLers, and enthusiasts all over the world.

USDT [Overall Score: 82]

Formerly known as RealCoin, Tether (USDT) was established in 2014. It is the oldest fiat-backed stablecoin and dominates the current stablecoin landscape. Tether Limited is responsible for custody of fiat reserves.

USDT Smart Contract Risk: 100

USDT was the first mainstream stablecoin in the market. It has been deployed on Ethereum since November 2017 with 89 million verifiable transactions up to date.

USDT Financial Risk: 99

USDT is the most widely used stablecoin and the third largest cryptoassets following Bitcoin and Ethereum in terms of market capitalization (approx. US$30 billion). USDT has the highest trading volume, at US$157 billion within 24h according to Coin Market Cap.

USDT Counterparty Risk: 55

USDT is centrally managed by Tether Limited, with crypto exchange Bitfinex sharing the same management and corporate structure (iFinex as the parent company), which exposed USDT to great single point of failure risk. Today, there are still multiple ongoing lawsuits against Tether and Bitfinex, including opaqueness with its dollar reserve and market manipulation. Tether’s vulnerability to counterparty risk is significant and therefore is subject to a lower score according to our risk factors.

USDC [Overall Score: 90]

USDC is a dollar-backed stablecoin powered by CENTRE, an open-source initiative established by Circle and backed by Coinbase. USDC is operating within the regulatory framework of U.S. and foreign money transmission laws and working with established banks and auditors.

USDC Smart Contract Risk: 95

USDC has been issued since September 2018. It is the oldest regulated stablecoin and second largest fiat stablecoin with approximately 12 million of on-chain transactions by far.

USDC Financial Risk: 98

USDC has grown its presence in DeFi rapidly with a market capitalization of $6.6 billion and 24h trading volume of $2.3 billion.

USDC Counterparty Risk: 80

USDC is still heavily reliant on its centralized issuer (CENTRE); though it is more regulated than USDT, it is still subject to potential regulatory recapture.

DAI [Overall Score: 89]

DAI is the first decentralized and on-chain collateralized stablecoin, backed by a number of cryptoassets of supreme quality. ‘Maker’ is the entity that powers the generation of DAI.

DAI Smart Contract Risk: 83

DAI is the first decentralized stablecoin with much longer history than many other decentralized stablecoin projects. However, with the support of multi-collateral to mint DAI, smart contract risks associated increases and may require market validation over a longer period.

DAI Financial Risk: 93

DAI is widely adopted in decentralized environment on Ethereum with a market capitalization of $1.9 billion and 24h trading volume of $395 million (mostly through DEX).

DAI Counterparty Risk: 88

DAI is fully operating in a decentralized manner. Though it introduced other regulated assets as collateral, its decentralized governance and a variety composition of assets expose itself to less counterparty risk than regulated stablecoin.

Join our discussion and voice your opinion through

FOR: Yes, I support the listing as proposed.

AGAINST: No, please do not list as proposed.

https://snapshot.page/#/dforce/proposal/QmXpVfZr1kPQrW7ZsFZDnXdmJaKot9HTr3iiKEW1jDEjfd