Summary:

dForce lending protocol has been operating smoothly since its deployment in March 2021, and it is necessary to re-assess risk parameters for supported assets. All proposed adjustments will be applicable to dForce lending protocols deployed on Ethereum, BSC, and the soon-to-be-launched Arbitrum.

Background:

After 6 months of steady operation, dForce Lending now boast over $120m supplied assets, and it is necessary to perform another assessment for supported assets in order to further understand each specific instance of risk and manage them more effectively.

Proposal:

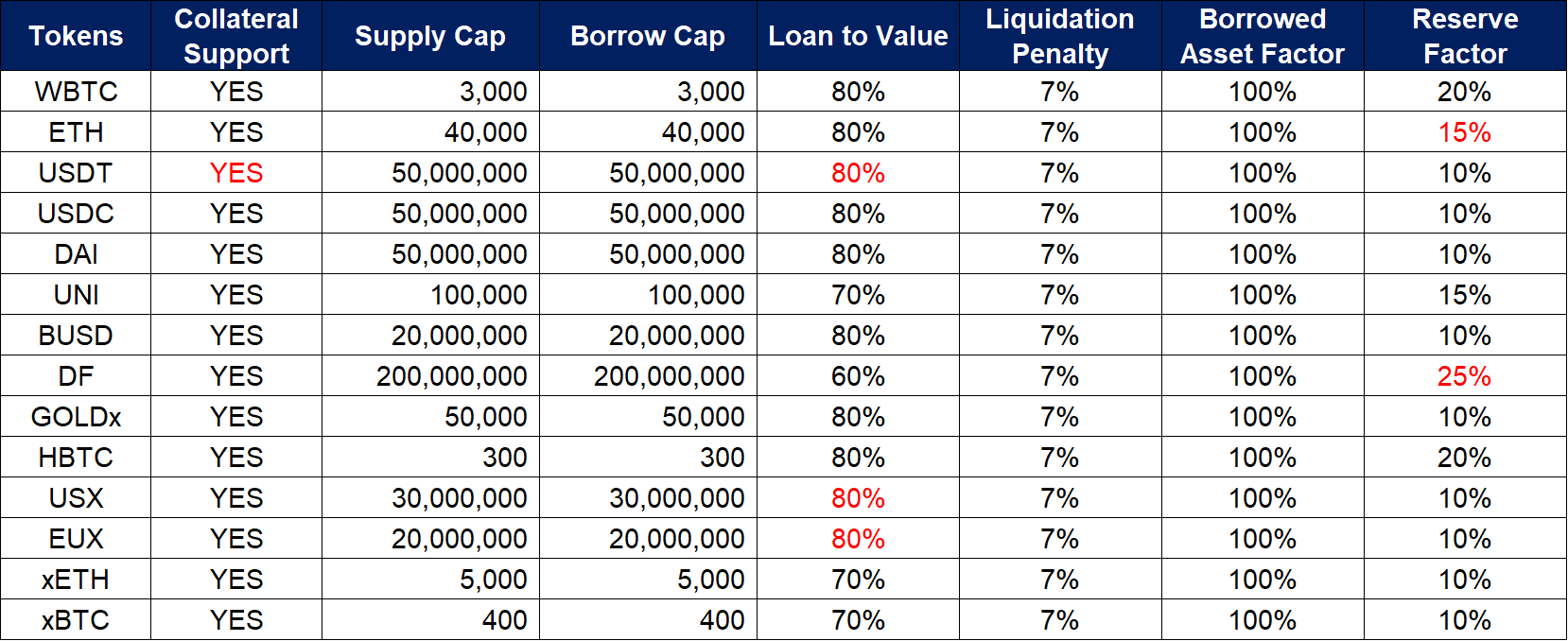

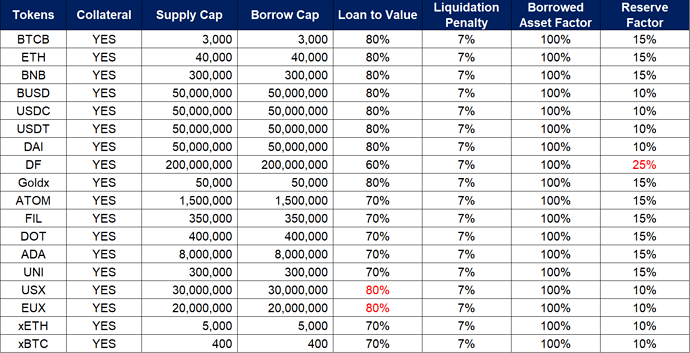

Please refer to the table below for risk parameters of supported assets on dForce Lending, with proposed changes highlighted in RED:

On Ethereum:

On BSC:

Key takeaways from the revision:

-

Add collateral support to USDT on Ethereum. We propose to extend collateral support to USDT on Ethereum in compliance with BSC (USDT-backed loans have been activated on BSC already). USDT has been significantly de-risked over the past 6 months, with increased transparency on the breakdown of its reserves (examined by Moor Cayman) and the release of Consolidated Reserve Report.

-

Increase the LTV of USX and EUX from 70% to 80%. We propose to increase the LTV of USX and EUX to 80% after months of market-validated operation, which is quite a common parameter with stablecoins, allowing the interest rate of USX and EUX to stay in line with the broader market with improved capital efficiency.

-

We also propose to adjust the Reserve Factor for some of the supported assets, achieving unified standards across Ethereum and BSC.