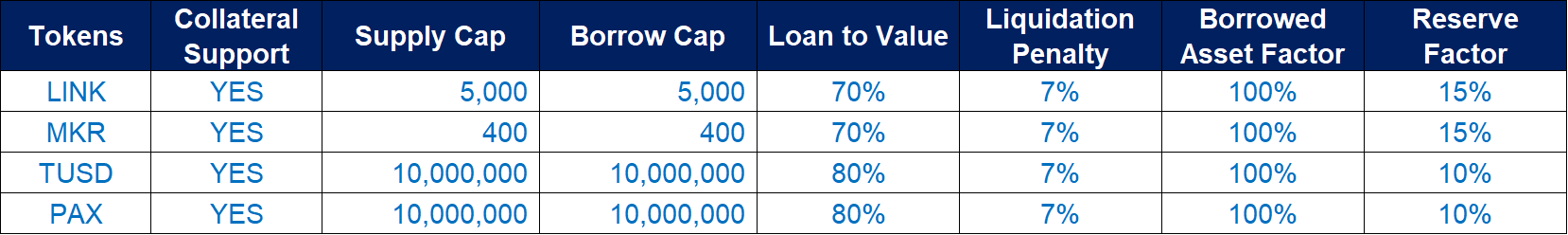

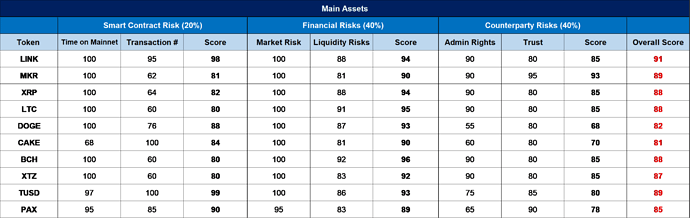

LINK (Overall score: 91)

LINK is issued by Chainlink, a framework for building Decentralized Oracle Networks (DONs) that bring real-world data onto blockchain networks, securing billions in value for leading DeFi applications in the market.

Smart Contract Risk: LINK went live on Ethereum since Sep 16, 2017 with over 9.6 million transactions by far.

Financial Risk: LINK is among the most popular cryptocurrencies in the market with a market capitalization of around $11.6 billion and trading volume of around 1.5 billion within 24 hours.

Counterparty Risk: Chainlink holds decentralization at its core by using a large collection of node operators to collectively offer price feeds for a wide range of decentralized applications. It’s open sourced and presents low centralization risk.

MKR (Overall score: 89)

Maker (MKR) is the governance token of the MakerDAO and Maker Protocol based on Ethereum that allows users to issue and manage the DAI stablecoin. The Maker ecosystem is one of the earliest projects on the decentralized finance (DeFi) scene.

Smart Contract Risk: Initially conceived in 2015 and fully launched in December 2017, Maker ecosystem is one of the earliest projects on the decentralized finance (DeFi) scene with over 1.5 million of verifiable transactions.

Financial Risk: MKR has a market capitalization of around $3.6 billion with a 24-hour trading volume of around $141 million.

Counterparty Risk: The MKR token is decentralized and non-custodial, allowing holders to directly participate in the process of governing MakerDAO. It boasts over 80K holders with manageable centralization risks.

TUSD (Overall score: 89)

TrueUSD (TUSD) is a stablecoin pegged to USD at 1:1 launched by TrustToken, a platform for tokenizing real-world assets. TrueUSD’s equivalent redeemability for USD is maintained via partnerships with banks and fiduciary entities.

Smart Contract Risk: First launched to a limited investor base in January 2018, TUSD went on live on Jan 4, 2017 with a total of 1.4 million verifiable transactions.

Financial Risk: TrueUSD has a market cap of around $1.4 billion and a 24-hour trading volume of $74 million.

Counterparty Risk: TrustToken is a platform that creates the tokens backed by assets that can easily be purchased and sold all around the world, and the first asset token of TrustToken is TrueUSD. The USD funds are regularly verified in scheduled attestations by a very much trusted auditing firm and kept safely in a third-party account.

PAX (Overall score: 85)

Created by Paxos, a financial technology company, Paxos Standard (PAX) is a flat-collateralized stablecoin and collateralized 1:1 through the USD held in Paxos-owned US bank accounts. Paxos Standard (PAX). The Paxos Standard (PAX) is the first digital asset to be issued by a financial institution and to be fully secured by the U.S. dollar.

Smart Contract Risk: Founded in September of 2018, PAX has recorded a total 0.7 million on-chain transactions by now.

Financial Risk: PAX has become the most widely adopted cryptocurrency in the fastest time frame, with support from over 20 exchanges and OTC desks in the first five weeks of its existence. PAX has gained a market cap of $949 million with a 24-hour trading volume of $75 million.

Counterparty Risk: PAX is the first digital asset to be issued by a financial institution and to be fully secured by the U.S. dollar. When there is a security threat, Paxos can pause transfers and approvals of the PAX Token, which introduced some level of counterparty risks.

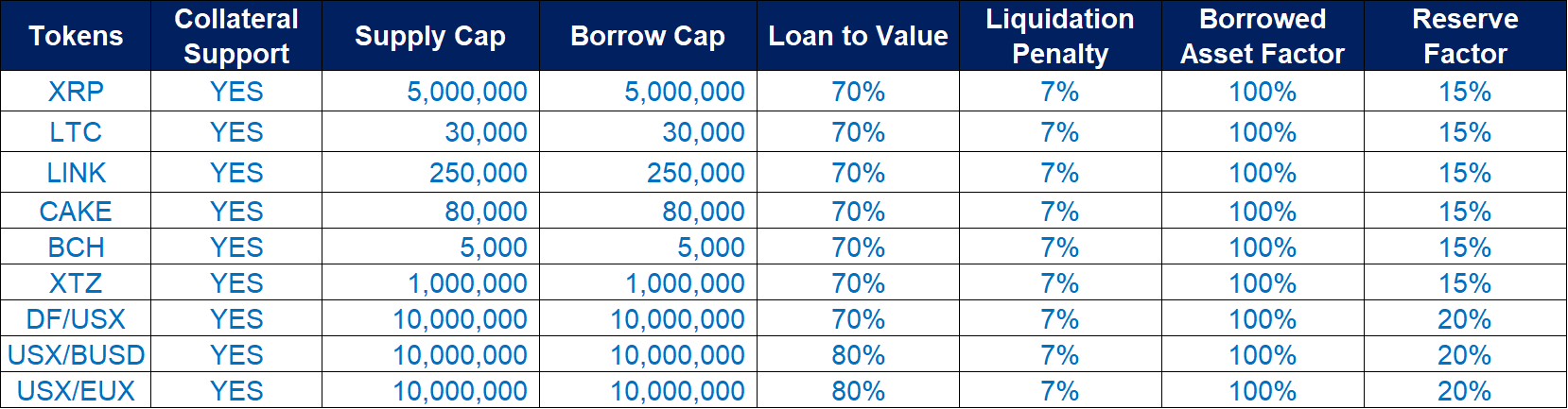

XRP (Overall score: 88)

Ripple is a technology that is mainly known for its digital payment network and protocol. Ripple describes itself as a global payments network and counts major banks and financial services amongst its customers. XRP is used in its products to facilitate quick conversion between different currencies.

Smart Contract Risk: XRP has come into existence since Apr 18, 2011, earlier than ETH, with 1.4 million on-chain transactions recorded.

Financial Risk: As of Aug 26, XRP market cap ranks #6 among the cryptocurrency market at around $53 billion, with a 24-hour trading volume of $5.9 billion.

Counterparty Risk: The Ripple network, although decentralized, is owned and operated by a private company with the same name.

LTC (Overall score: 88)

Litecoin (LTC) is a decentralized cryptocurrency which utilizes similar protocols as Bitcoin except for a few parameter tweaks. It was designed to provide fast, secure and low-cost payments confirmation schedule over Bitcoin.

Smart Contract Risk: Litecoin was launched on Oct. 7, 2011 by former Google and Coinbase engineer Charlie Lee, with 810K transactions recorded on-chain.

Financial Risk: Litecoin (LTC) is one of the top-10 cryptocurrencies with a market cap of $11.6 billion and a 24-hour trading volume of $1.9 billion.

Counterparty Risk: Litecoin (LTC) is decentralized money, free from censorship and open to all. Litecoin also relies on proof-of-work for consensus and operates on a permissionless peer-to-peer network without the need to rely on any central authority.

DOGE (Overall score: 82)

Dogecoin (DOGE) was forked from Litecoin in December 2013 based on the popular “doge” Internet meme and features a Shiba Inu on its logo. It was used primarily as a tipping system on Reddit and Twitter to reward the creation or sharing of quality content.

Smart Contract Risk: Dogecoin was forked from Litecoin introduced as a “joke currency” on 6 December 2013, with 78 million on-chain transactions by now.

Financial Risk: DOGE has a market cap of $37 billion with a 24-hour trading volume of $3.1 billion.

Counterparty Risk: Dogecoin is an open-sourced peer-to-peer digital currency, with no middleman and low centralization risk.

CAKE (Overall score: 81)

CAKE is the governance token for PancakeSwap, a Binance Smart Chain-based decentralized exchange (DEX) that was launched by anonymous developers. It is the biggest Automated Market Maker (AMM) based exchange on BSC, allowing users to exchange tokens, providing liquidity via farming and earning fees in return.

Smart Contract Risk: PancakeSwap launched in September 2020 with 998 million verifiable on-chain transactions since its deployment.

Financial Risk : CAKE has a market cap of $5.4 billion with a 24-hour trading volume of $668 million.

Counterparty Risk : Similar to Uniswap, PancakeSwap is an automated market maker (AMM) that features liquidity pools where users can earn fees from staking, lending, and yield farming in a decentralized manner with no custody support.

BCH (Overall score: 88)

Bitcoin Cash (BCH) is a peer-to-peer electronic cash system. It is a fork of Bitcoin as a result of a chain split when a certain group of Bitcoin developers became dissatisfied with Bitcoin’s overall scalability direction.

Smart Contract Risk: Bitcoin cash is a cryptocurrency created in August 2017, from a fork of Bitcoin, with 68,279 on-chain transactions and more than 17 million holders.

Financial Risk: BCH has a market cap of $12 billion with a 24-hour trading volume of $3 billion.

Counterparty Risk: As a permissionless, decentralized cryptocurrency, Bitcoin Cash requires no trusted third parties and no central bank. Unlike traditional fiat money, Bitcoin Cash does not depend on monetary middlemen such as banks and payment processors.

XTZ (Overall score: 87)

Tezos is a decentralized, open-source Proof of Stake blockchain network that can execute peer-to-peer transactions and serve as a platform for deploying smart contracts. The native cryptocurrency for the Tezos blockchain is XTZ.

Smart Contract Risk: Tezos was first proposed in a whitepaper published in 2014.[3] Its testnet was launched in June 2018, and its mainnet went live in September 2018, with a total 68 million on-chain transactions recorded.

Financial Risk: XTZ has a market cap of $3.8 billion with a 24-hour trading volume of $608 million.

Counterparty Risk: Tezos is a decentralized, open-source Proof of Stake blockchain network that can execute peer-to-peer transactions and serve as a platform for deploying smart contracts.