Summary

It is proposed to introduce a LSR (Liquid Stability Reserve) module as an addition to the existing minting model (pool-based & vault-based) for USX.

Abstract

This DIP seeks to introduce a LSR module that allows users to use supported stablecoins including USDC, BUSD, USDT, DAI, USDP as collaterals to mint USX (or redeem USX for supported stablecoins) at 1:1 rate - USX’s full collateralization will remain intact.

This is an improved version of Maker’s PSM (Peg Stability Module), with all stablecoins collected from LSR being deposited into dForce Lending to earn yield, unlocking a new revenue stream for dForce Treasury.

Click here to read more.

Motivation

The proposed LSR module is primarily created to defend the peg for USX in a more efficient manner:

-

Peg Stability: the arrival of LSR with zero slippage and zero fees will unlock a significant source of price stability driven by market arbitrage.

-

Efficient Router: with zero fees, the LSR module will serve as the most cost-efficient and major router for all USX-paired trades via supported stablecoins (i.e., USX>USDC/BUSD/USDT/DAI/USDP>ETH/BTC…).

-

Treasury Income: USX’s stablecoin reserves will be supplied to lending protocols to earn yield, delivering a new revenue stream for dForce Treasury.

-

POO (Protocol-Owned-Liquidity): the supply of stablecoin reserves into dForce Lending will help boost liquidity in dForce Lending, reduce protocol reliance on subsidized liquidity and offset DF inflation, and bootstrap liquidity for USX paired trades on DEXes via POO strategy.

-

Minimal Technical Risk: the implementation of LSR module can use the audited and battle-tested codes of dToken (audited by Trail of Bits), USR (audited by Quantstamp, PeckShield, and SlowMist) and Vaults (audited by Trail of Bits, ConsenSys Diligence, CertiK, and Certora), which does not require extra engineering efforts.

Specification

USX is featuring a dual-minting model at present:

-

Pool-based: Users can mint USX against multiple types of collateral assets supported on lending protocols integrated with USX. Borrowing rate will be automatically adjusted based on market demand for USX.

-

Vault-based: further expand the collateral type of USX to a broader range of assets including LP tokens, yield tokens, etc. Each collateral asset will be housed in an isolated pool with a completely different risk model, customized parameters, and a fixed interest rate.

The to-be-introduced LSR (Liquid Stability Reserve) module, as an addition to the current minting mechanism, is designed to help USX maintain its dollar peg in a more efficient manner:

-

Users can mint USX against (or redeem USX for) supported stablecoins (USDC, BUSD, USDT, DAI, USDP) at 1:1 rate.

-

Given most stablecoin reserves will be supplied to lending protocols to earn yield, the smart contract will automatically execute fund withdrawal from lending protocols to facilitate the swap upon user’s request, but there is a slim chance that users have to wait when 1) the LSR pool doesn’t have sufficient balance to support the swap; 2) liquidity for the desired stablecoin is drained from supported lending protocols. In the event of a liquidity shortage, users can trade USX on supported DEXes alternatively.

-

Zero fee charges (but users still need to pay gas fee to facilitate the ‘swap’).

-

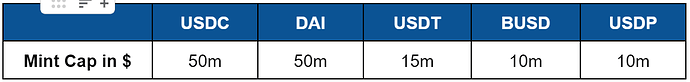

Each collateral stablecoin carries a ‘Minting Cap’ to back the issuance of USX, translating to the total amount of USX that can be minted against each collateral stablecoin. Please find the proposed cap for each collateral stablecoin supported as below:

- All stablecoin reserves collected from the LSR module will be automatically deposited into lending protocols (i.e., dForce Lending, Aave, etc) to earn yields, unlocking a new revenue stream for dForce Treasury.

Vote through Snapshot.