Summary

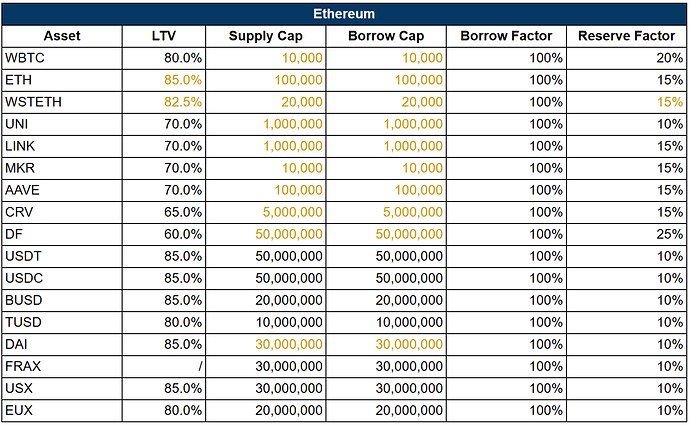

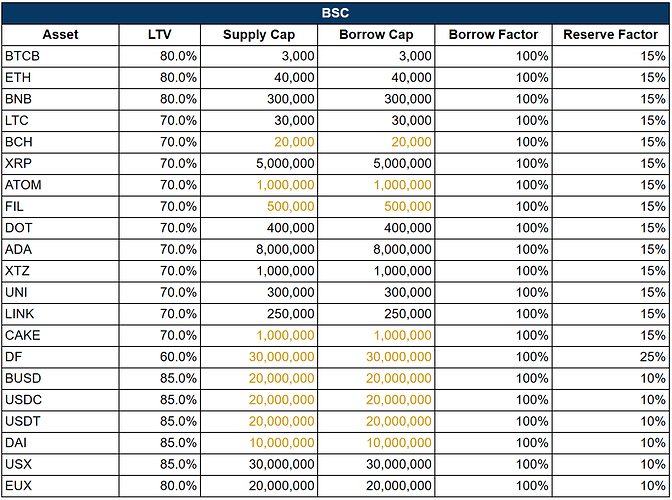

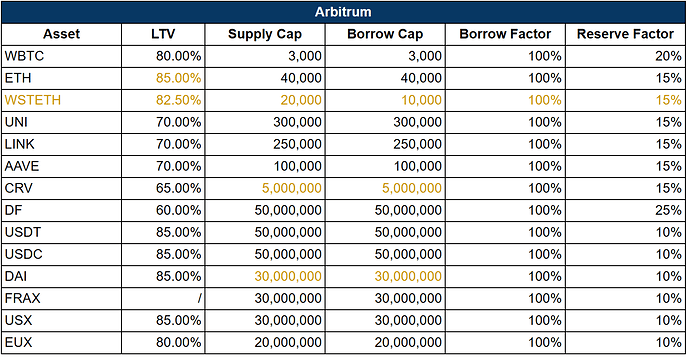

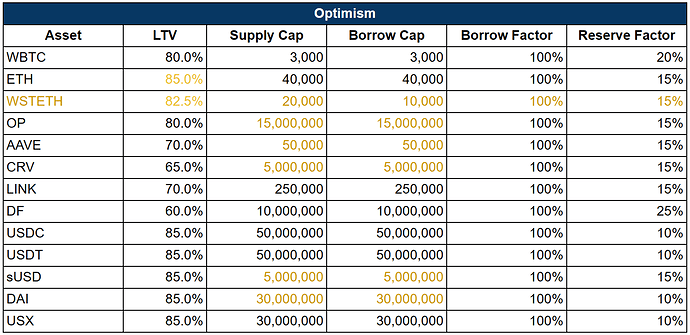

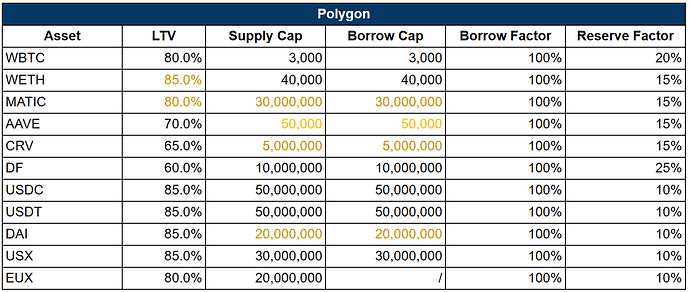

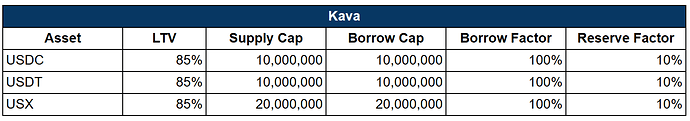

It is proposed to adjust risk parameters for assets supported on dForce Lending across different networks.

Motivation

This set of parameter updates aligns with the dForce Risk Framework developed based on existing market’s best practices including the DeFi Score developed by Codefi team.

We continuously perform regular assessments and adjust risk parameters to maintain protocol risk at safe levels while optimizing capital efficiency.

Specification

Vote through Snapshot