Summary

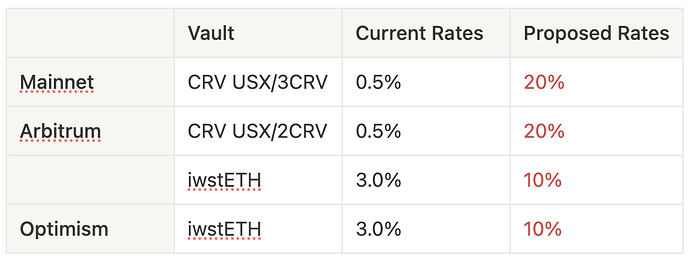

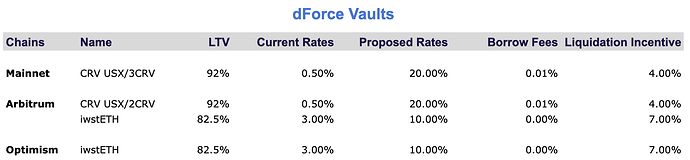

This DIP aims to enhance the price peg of USX at $1 and safeguard our protocol against extreme market volatility. It seeks support from the dForce DAO to adjust the parameters for dForce Vaults, as outlined below:

Background

The increasing bullish sentiment has fueled the demand for stablecoins, with the total market capitalization of stablecoins soaring from $131 billion to $145 billion - an 11% increase since the beginning of 2024. Investors often sell stablecoins to acquire other assets and capitalize on this growth. Conversely, they purchase more stablecoins as a strategy to mitigate losses when bearish trends dominate the market.

In response to the recent market volatility conditions, Maker has approved an Executive Vote to prepare the Maker Protocol for a potential excessive DAI demand shock caused by further bullish sentiment, including the increase of Stability Fee up to 17.25%, and SparkLend DAI borrow APY up to 16%, etc)

As a fully decentralized stablecoin, USX consistently ensures an over-collateralized backing through lending protocols (Unitus), Vaults, and LSR mechanisms (offering 1:1 swaps with USDC, USDT, and DAI). Excessive buying or selling of USX carries the risk of destabilizing its peg, leading to deviations from its US dollar peg.

To more effectively mitigate the risks of liquidity and deviation from the peg caused by swiftly fluctuating market volatility, it is proposed that the parameters for USX be adjusted.

Motivation

This proposal is motivated by the following considerations:

- Stay aligned with market practice; Maker has approved an Executive Vote to adjust parameters for DAI, including the increase of Stability Fee up to 17.25%, and SparkLend DAI borrow APY up to 16%, etc)

- Safeguard USX’s price peg against potential volatility due to excessive demand or supply amidst increasing bull sentiment.