After 6 months of hard work and development, the launch of dForce’s Multicurrency Asset and Lending Protocol is just around the corner.

This is a novel lending protocol with built-in over-collateralized multicurrency stable debt protocol, which could extend to fund the fractional reserve of an algorithmic stablecoin.

In layman’s terms, the protocol is: General Lending + Multicurrency Collateralized Stable Debt + Fractional Reserve Algorithmic Stablecoin.

The guided launch will be phased out in several stages, with the first stage featuring a general lending protocol, followed by a multicurrency stable debt protocol built on top of the lending protocol and with its interest spread to fund the fractional reserve of an algorithmic stablecoin.

dForce Lending is at the final stage of the audit process. Upon satisfactory completion of the security audit, dForce Lending will be released via a soft launch — most likely sometime February or March.

The first phase will feature a general lending protocol. I’d like to give a high-level introduction about dForce Lending and will dedicate a separate post for a deep dive into our Multicurrency Stable Debt Protocol and its associated algorithmic design.

dForce Lending is a pool-based lending protocol, with its interest rate dynamically driven by market supply and demand. There are several innovative features that set dForce Lending apart from other lending protocols.

Key highlights of dForce Lending’s Offerings

Enhanced Risk Model

· LTV Factor for Borrowed Assets

Loan-to-Value ratio (or the inverse Collateral Ratio) is one of the most critical risk parameters in all lending protocols. There is one issue however, that all existing lending protocols only take the collateral risk into consideration, and the risk associated with borrowed assets is often overlooked. For example, a borrower who pledges ETH as collateral is typically able to borrow either USDC or WBTC, both at an LTV of 85%. But we believe the latter transaction (borrowing WBTC) is riskier, as both ETH and BTC market risk will impact the loan position. Hence, we believe these two loans should have different LTV discount, so the risk of both collateral and borrowed assets are accounted for into the risk factor. Borrowers who borrow non-stablecoin will likely be subject to a discount on LTV.

· Borrow/Supply Cap

One of the greatest risks a lending protocol possess is the possibility of infinite minting of the underlying asset. For example, if a bug causes infinite minting of DAI (Maker’s stablecoin), this could be detrimental to all lending protocols that accepted DAI as collateral. Maker itself has a debt ceiling on its collateral assets, but most lending protocols lack such mechanism.

dForce introduces both borrow and supply cap in our core lending protocol, and each asset is regulated by its respective cap. Considering the diversity of assets we are going to support, we believe this feature will act as an additional layer of safety margins on our protocol

· Off-chain Risk Monitoring

Lending protocols are exposed to many layers of attack vectors, some of which don’t fall under the scope of security reviews. An example is risk on the assets level. Let’s consider any protocol that accepts Cover token as collateral for example. In the recent Cover protocol hack, the hacker used a bug in the staking contract to mint an infinite number of Cover tokens. In such circumstances, the consequences can be devastating, as the tokens could flood the lending protocol and drain all users’ funds from the protocols that accept Cover token as collateral. Our off-chain monitoring system was designed to monitor anomalies including detecting token minting events of the supported collaterals, price anomalies, and many others. Once an anomaly is detected, it will send transaction to pause certain function (or all functions) of the lending protocol to contain the situation.

Multicurrency Stable Debt Protocol

This is an innovative feature that allows users to mint stablecoin debt using the same collateral they provided to dForce Lending.

This was built as a separate multicurrency collateralized stablecoin protocol to run on top of our core lending protocol. The native multicurrency stablecoins will be standard ERC 20 tokens, fully compatible with existing DeFi infrastructure.

This function supports virtually any foreign exchange rate denominated debt. Several multicurrency tokens including xUSD, xEUR and xCNY have been added to the wish-list by our community, and decision will be subject to final on-chain governance.

Users will be able to mint stable debt tokens such as xUSD, xEUR, or xCNY, and treat them as DAI denominated in USD, EUR, and CNY to be used as over-collateralized stablecoin in different currency. The stable debt in different currencies will also help bridge crypto liquidity to foreign exchange exposures other than US Dollar and help building a truly global and multicurrency money market and lending protocol. More information about the Multi-currency Stable Debt Protocol will be provided in a separate post.

Public-Private Pool

The downside of pool-based lending protocols is that all assets are pooled into one single pool, and inherently assumes all assets are created equal (but they are not). Though we could use borrow/lending cap to limit the risk exposure of certain assets within a pool, it is difficult to apply such restrictions towards illiquid or alternative assets such as real-world assets like account receivables, residential rental property etc.

The vast majority of real-world assets have very distinguished risk and liquidity profiles compared to crypto assets. One can’t simply mingle all these assets into one single pool. Public-Private Pool is a customized pool catering to different classes of assets, and different type of users; i.e. a stand-alone pool for CeFi trading/lending desk, where the counterparties are mainly KYC’ed CeFi operators. In order to accommodate such demand, our lending protocol is able to supply customized pools with different liquidity and risk configuration.

Initial Public-Private Pool will likely include staking assets such as DOT, XTZ, ATOMs, etc, and may also feature a dedicated unsecured lending pool.

Flashloan Support

Flashloan is standard feature for lending protocol now and it will be enabled and we offer very attractive terms!

EIP 2612

We will implement EIP2612. This EIP saves the processes needed to approve authorizations, and it helps optimize gas fees.

On the upper layer feature level, we will support:

Fixed Rate and Fixed Term Borrowing (will be launched in later phase, community dev efforts)

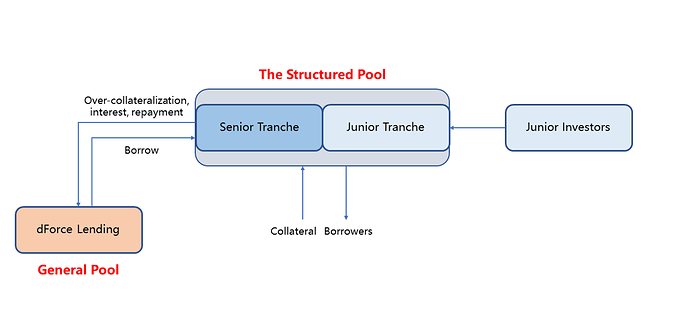

Fixed rate/term borrowing, will be built on top of the core dForce Lending protocol, so the two protocols are decoupled and risks ringfenced. With a senior and junior tranche structure, loan maturity and debt seniority will be managed on the upper protocol level, not at the core lending level. The underlying lending pool (the General Pool) will supply senior capital along with junior tranche (provided by junior tranche investors) to form a Structured Pool on the upper level to capitalize risks from fixed/floating rates and loan maturity. The Structured Pool comprises of senior tranche funded by the General Pool and junior tranche funded by junior investors participating in the Structured Pool.

We are engaging community developers to implement the feature and if you are interested, please kindly approach us and join. A more detailed post about this feature will be released soon — below is a high-level flow of the mechanism.

Credit Line Sharing

This feature allows you to share your credit line with any account, so they could borrow money with your credit lines. If we expand the use case, it could empower anyone with large collaterals and high borrowing limits to expand their offerings to other borrowers.

Unsecured Lending

Unsecured Lending feature leverages our core lending protocol by using a combination of structured financing and centralized P2P platforms. The General Pool provides senior tranche capital (low funding cost, high seniority), where junior investors risk buffer for absorbing risks associated with lending protocol. We have several solutions for tapping unsecured lending market, partnerships will be announced along the way. In a series of future posts, I will explain our plans for implementing unsecured lending.

I think the above pretty much covers our key offerings of our lending protocol, in the future posts, I will elaborate on the Multicurrency Stable Debt Protocol (to be integrated shortly after lending launch) and will also talk about the very experimental fractional reserve algorithmic stablecoin protocol to build on top of the stable debt protocol (however, this may, or may NOT come to final implementation).

In 2021, there is so much to be expected and to be excited about in the pipeline. If you’d like to get involved and support the development of dForce, please join our social platforms.