With S.Finance integrating dToken via Stable Pools, anyone now can supply stablecoin liquidity on the platform and jointly share trading fees, trade stablecoins (USDx, USDT, USDC, DAI) with minimized slippage, and mine DF and SFG simultaneously to improve the APY.

About dToken ( https://markets.dforce.network/)

dToken is a yield aggregator launched by dForce, aiming to harvest the most attractive risk-adjusted

Depositing supported tokens into dForce Yield Markets (https://markets.dforce.network/), users will receive corresponding dToken on a pro rata basis (i.e. depositing USDT to receive dUSDT). Each dToken represents a pro rata claim of the underlying token plus yields generated and can be redeemed at any time.

Presently, pooled capital of dTokens are supplied to different lending protocols to earn yield and will soon add support to more yielding protocols. All governance token farmed (i.e. COMP) will be automatically converted into underlying stablecoin and added into the underlying yield.

dToken has internal buffer pool to batch transactions, including rebalancing strategy that is anticipated to save at least 60% of gas consumption associated (compared with direct interactions with underlying lending protocol for asset supply and sale of governance token mined).

About S.Finance ( https://s.finance/)

S.Finance is a DeFi project, which start as offering stable currency exchange service. Compared with Uniswap, S.Finance adopts StableSwap market maker algorithm, similar to Curve, which is smoother than Uniswap algorithm and can achieve low slippage. In other words, S.Finance can offer a more stable price and lower service fee in terms of stable currency exchange.

S.Finance forked from Curve, offering a more friendly interface to users in Chinese community.

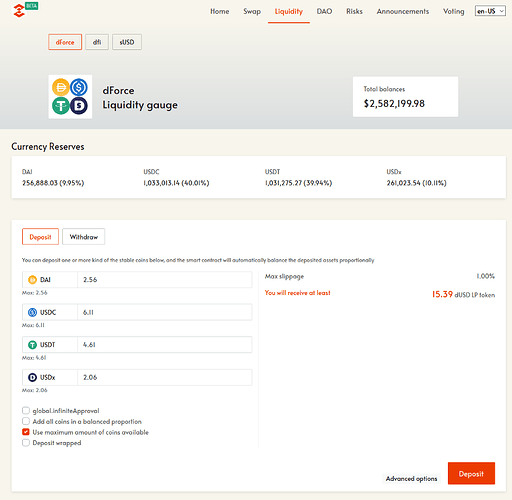

dForce Pool

dForce Pool will include all yielding stablecoins supported by dForce, including dUSDx, dUSDT, dUSDC, dDAI. By providing stablecoin liquidity to dForce Pool on S.Finance, users will have access to:

-

underlying interest of dToken (it automatically mines governance token and converts into stablecoin yields, on top of saving interest);

-

jointly share trading fee;

-

S.Finance governance token (SFG) rewards;

-

dForce governance token (DF) rewards.

How to Participate? -

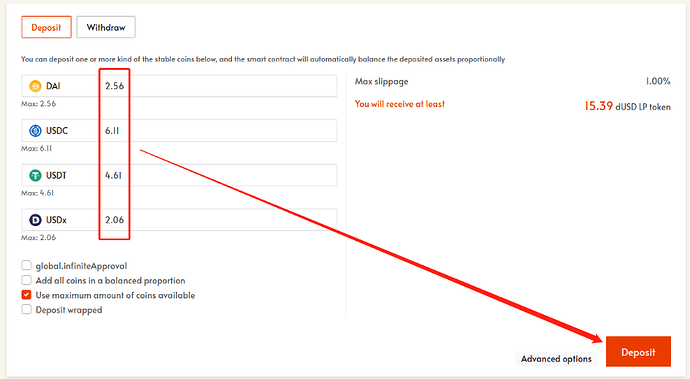

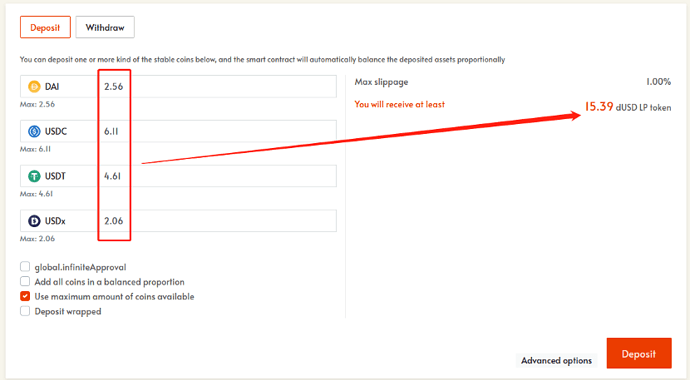

Find the dForce Pool from S.Finance and click on ‘deposit’.

-

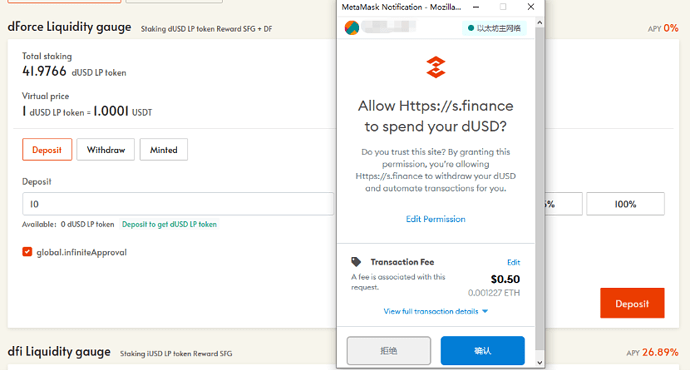

Choose one or more stable asset to supply liquidity, authorize and approve the transaction from your Ethereum wallet (i.e. MetaMask).

-

Your successful transaction will send you dUSD (Liquidity Provider Token) on a pro rata basis automatically

-

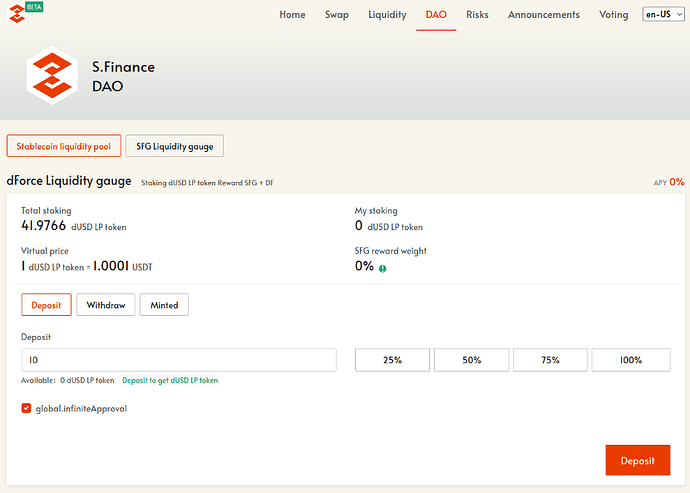

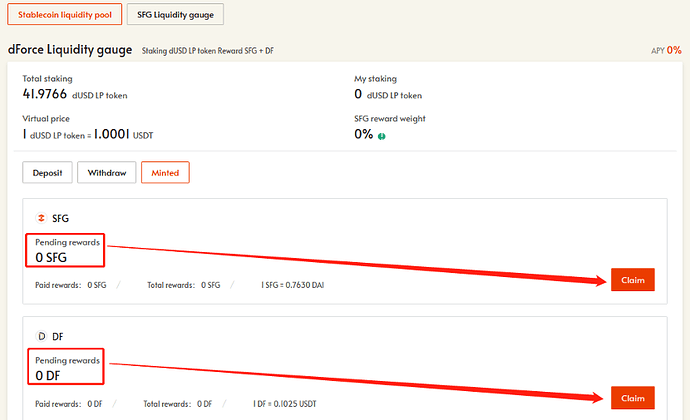

Go to the DAO page and switch to dForce Pool, enter the amount of dUSD you wish to stake and click on ‘deposit’.

-

Approve the transaction from your Ethereum wallet.

-

Once you have staked your LP tokens, you can then claim your DF and SFG rewards at any time you wish by clicking on “Minted”.

Welcome to join our community and forum for mining and governance discussion:

Twitter: https://twitter.com/dForcenet

Telegram: https://t.me/dforcenet

Medium: https://medium.com/dforcenet

Forum: https://forum.dforce.network/