Proposal: List BEL as A Collateral Asset on dForce Lending

Summary

dForce is an integrated and interoperable open finance and monetary protocol matrix covering asset, trading and lending. dForce builds a protocol matrix that maxes out composability and fungibility over a variety of protocols, the decentralized lending platform of which minimizes consumer effort and maximizes risk management for users. To expand the use cases for BEL tokens in the ecosystem, Bella Protocol would be delighted to collaborate with dForce.

Overview of Bella Protocol

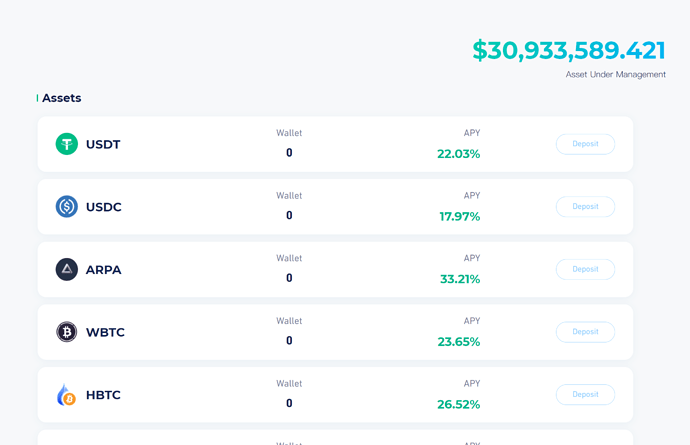

Bella is a suite of open finance products, including automated yield farming tools, BEL Locker, and Flex Savings. We believe everyone deserves equal access to premium financial products and services with elegant design and a smooth user experience. Incubated by the ARPA (arpachain.io) team, Bella Protocol aims to simplify the user experience of existing DeFi protocols and allow users to deploy their assets and earn risk-adjusted yield with ease. Bella has run a smart yield aggregator since September 2020 with $30 million TVL.

Token Name (from contract): Bella

Token Address: 0xa91ac63d040deb1b7a5e4d4134ad23eb0ba07e14

Explorer: https://etherscan.io/token/0xa91ac63d040deb1b7a5e4d4134ad23eb0ba07e14

Token Decimals (from contract): 18

LogoURI: https://drive.google.com/file/d/1l8RnGJ8cGYPtFa3bZ6Z_S5bBy-ivM7Yp/view?usp=sharing

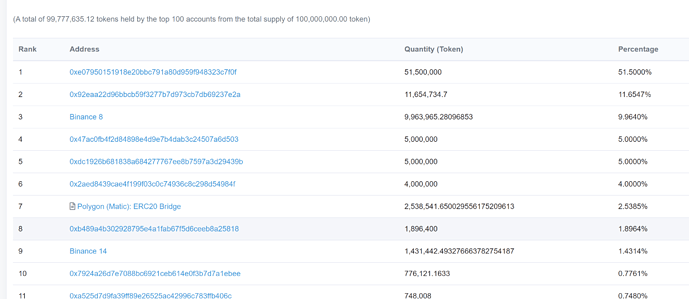

Bella Protocol Supply:

Circulating Supply: 48,000,000 BEL

Total Supply: 100,000,000 BEL

Max Supply: 100,000,000 BEL

Website: https://bella.fi/

CMC: https://coinmarketcap.com/currencies/bella-protocol/

CoinGecko: https://www.coingecko.com/en/coins/bella-protocol

Bella Flex Savings (Yield aggregator based on Ethereum layer 1 with $30mil TVL): fs.bella.fi

Github: https://github.com/orgs/Bella-DeFinTech/

What Makes Bella Protocol Unique?

Bella’s team consists of experienced smart contract developers, finance professionals, and crypto veterans. We share a vision of a more transparent, distributed, equal, permissionless, seamless, and frictionless financial infrastructure. At the inception of the Bella project in early 2020, the Bella team held the firm belief to bring mass adoption to DeFi and crypto by lowering the barrier to entry and creating a product suite designed with lower cost, seamless user experience, and innovative use cases.

Product Suite and Bella 2021 Roadmap

a) Bella Liquidity Mining - Users stake liquidity provider (LP) tokens to earn rewards

b) Bella Flex-Savings - A smart pool that routes funds to DeFi protocols with the most competitive return

c) BEL Locker - The official BEL staking product with fixed APY

In 2021, the Bella ecosystem will be more open, inclusive, vibrant, with even more collaborations and integrations with other DeFi legos. We hold the belief that the boom of NFT will add value to the current DeFi world and bring life to numerous novel and significant creations. Besides our existing success, we will continue to explore the possibilities of different use cases of NFT, from blind-boxes to card games and farming.

Q2 2021: Bella ecosystem fund & more integrations for btokens

Q3 2021: NFT use cases and launch of Bella DAO governance

Q4 2021: Bella Launcher & incubation program

How to Get BEL Tokens?

- Obtain BEL tokens by purchasing from cryptocurrency exchanges such as Binance or DEX such as Uniswap, Quickswap (Polygon), or Pancakeswap (BSC).

- Bella Protocol’s own liquidity mining program lets users farm BEL by staking Uniswap liquidity provider tokens. Users may choose to provide liquidity for the BEL/USDT, BEL/ETH or ARPA/USDT liquidity pool on Uniswap.

- Through our flex-savings program, users can deposit stablecoins and supported tokens to earn attractive yields automatically. The smart contract then automatically routes the fund to different mining pools under ever-updating investment strategies.

- BEL Locker, the official BEL staking product with fixed APY. Anyone can stake any amount of $BEL and earn juicy rewards automatically from anywhere, anytime. Besides that, the APY is fixed so there’s no need to worry about market fluctuations

BEL Token Use Cases:

- Fee Collection: Management fees collected are ultimately used to reward BEL holders

- Discounts: Custodians fees are lower when paid in BEL

- Voting and Governance: Users can stake BEL to vote for changes to the network.

How Is Bella Protocol Secured?

Bella Protocol has been working diligently and prudently to raise the bar of robustness and security in the DeFi world, by implementing more rigorous style checks, code static analysis, code review, automated unit and behavior testing to uphold the standard of a multi-million-dollar-handling DeFi product. Bella Protocol partnered with the best security firms to ensure smart contract robustness and asset safety. PeckShield audit report is available on http://bella.fi and http://liquidity.bella.fi.

Bella’s team built a “Time Machine”, so we can go back and forth freely on block-time in a simulated Ethereum universe. This made Bella’s testing and debugging much easier since the team could always rewind to any previous state of the blockchain to figure out at which state a problem might have occurred. We have also built utilities around the “Time Machine”. These are the reusable tools tailored to Bella protocol that allows us to quickly implement as many test cases as possible in parallel. In addition, Bella Protocol built a Curve.fi Emulator, which is the infrastructural protocol that Flex Saving depends on. Bella’s engineering team has added approximately 20,000 lines of testing scenarios code, fixed numerous bugs that would have stayed otherwise elusive and undetectable by the audits, refined pricing strategy from understanding implementation details of Curve to maximize users’ returns, as well as integrating to new pools with higher yields.

Additional Information

TVL stats: DeFi Pulse, DeFi Llama

Investors: Bella Protocol is backed by Binance Labs and Arrington Capital as lead investors. Other investors include Alphabit, AlphaCoin Fund, Koi Ventures, Ledger Capital, Tensor, N7 labs, Quest Capital, HBTC Labs, and more.

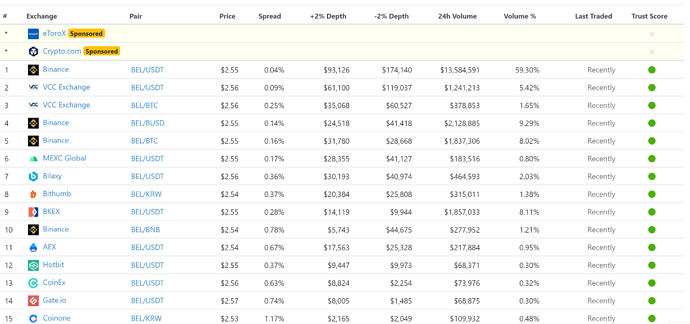

Exchanges: Binance, Bithumb Korea, Uniswap, Gate.io, Pancake Swap (8mil+ USD liquidity), Dinoswap (17mil+ USD liquidity), CoinEx, 1inch Exchange, Pionex, VCC Exchange, MEXC, BKEX, AEX, Bilaxy, Hotbit, Coinone, Sushiswap, QuickSwap, ZT, BHEX, and more.

Trading volume: On average 50mil USD across all exchanges.

DeFi is permissionless, borderless, and decentralized, which spurs endless innovation and opportunities for partnerships. What we could achieve as one single team is limited by resources, time, and space. Besides the in-house tech and product development, collaboration across different protocols brings about synergies for all parties. When projects with diverse backgrounds and individual focus start teaming up, creativity and innovation will flourish. Bella Protocol believes the collaboration with dForce can help increase TVL of the underlying assets on dForce and bring more users, community and liquidity to the dForce ecosystem. We look forward to building out our ecosystem and amplifying the broader DeFi space with dForce soon! Cheers!

For more information about Bella, please contact us at: [email protected]

Learn about Bella’s recent official news:

Medium: https://medium.com/@Bellaofficial

Twitter: @BellaProtocol

Telegram: https://t.me/bellaprotocol

Discord: https://discord.gg/JamMH5P