Summary

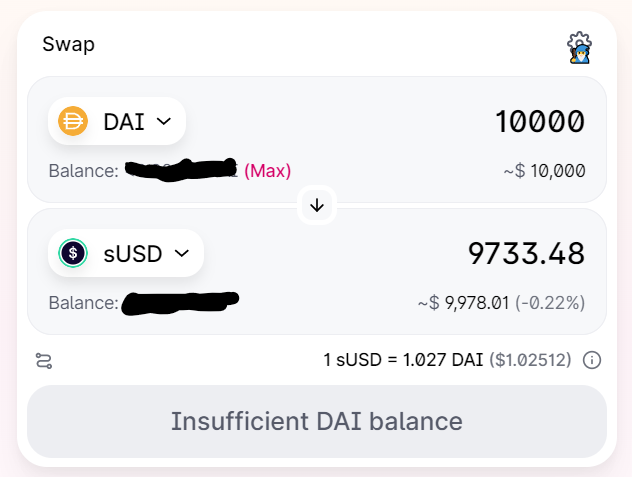

This proposal is to list Synthetix’s Synth USD, allowing users to lend and borrow sUSD.

Background

As dForce has landed on Optimism. This is a good opportunity for Synthetix to expands its user case by allowing people to borrow and lend sUSD. Lending and borrowing is the fundamental use case of money. Especially for Synth USD, as it can be the gateway to access synth trading on Kwenta, Hedging and trading options on Lyra Finance and upcoming Thales Binary Option and dHedge decentralized fund.

Proposal

List sUSD with the following parameter:

| Ur Kink | Base | Slope 1 | Slope 2 |

|---|---|---|---|

| 90% | 0 | 5% | 60% |

Remark

- Currently L1 sUSD and L2 sUSD isn’t connected to each other.

- What is L2 synth collateral?

- SNX with minimum 500% C-Ratiowith Liquidation enabled (<200% for 3 days) per latest update. The Menkalinan Release (synthetix.io)

- ETH with ETH Wrapper

- Current maximum ETH in Wrapper:

2_200ETH

- Current maximum ETH in Wrapper:

- LUSD with LUSD Wrappr (https://contracts.synthetix.io/ovm/LUSDWrapper)

- Current maximum LUSD in Wrapper:

50_000_000LUSD

- Current maximum LUSD in Wrapper:

- Current risk in L2 sUSD

- Collateral Risk from SNX price movement, ETH and LUSD.

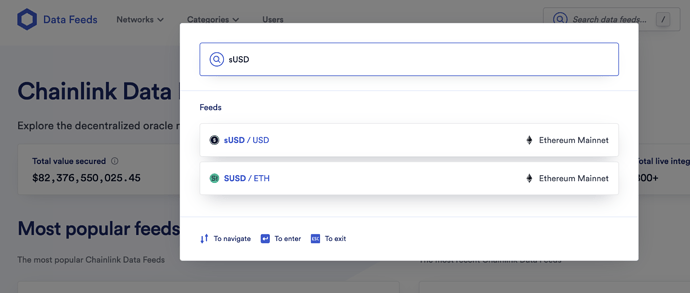

- Oracle Risk from Chainlink for SNX and LUSD.

- Upgradable Proxy Risk from Synthetix itself.