Title: [Temperature Check] Gauging Community Interest on Creating Separate Interest Parameter Slopes for Each Asset on dForce Lending

Author(s): Anthias.xyz Team

Submission Date: 9 July 2023

Abstract

The Anthias team has been monitoring dForce markets and would like to gauge community sentiment around creating individual interest rate slopes for each asset as opposed to the current category-based slopes, which may not be adequate for certain assets.

Current Interest Parameters

Currently, interest parameters for lending on dForce are broken down into the following five categories:

- Stable Primary

- BNBLike

- Main Primary

- Main Secondary

- CakeLike

In this forum post, our focus is primarily on the Stable Primary category as we are most concerned with the state of the USDT market on dForce. The Stable Primary category encompasses collateral assets like USDC, USDT, and USX.

State of the USDT Market

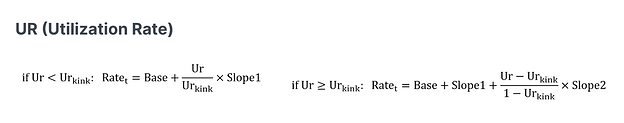

dForce’s current interest rate formula is the same as that of Aave. However, this formula does not seem to be working as efficiently as it could for some markets on dForce, especially the USDT market, which is nearing a 92% utilization rate (above the 90% kink). The USDT market on dForce has nearly $1.85M supplied and nearly $1.7M borrowed. It is this lack of borrowing liquidity that is a potential cause for concern–the protocol’s potential revenue appears handicapped. To fix this, the protocol could incentivize greater supply and an avoidance of surpassing the kink rate.

Current dForce Rate Formula (Same as that of Aave)

Updated Individual Slope Concept

The Anthias team would like the dForce community to consider possibly creating new Slope 1’s on a per-asset basis. The current Stable Primary Slope 1 appears to be functioning well for USDC, but not as well for USDT. For example, we would propose a current Slope 1 of 7.5% for USDT, which would more quickly raise rates in order to avoid surpassing UR Kink as often. However, this is only one example and could be extended to all assets on dForce in order to more efficiently maximize protocol revenue while minimizing risk. USDC.e, for example, could maintain a Slope 1 of 5%.

About Anthias

Anthias is a tool suite for easily monitoring liquidation risk for DeFi borrowing/lending markets. The Anthias team is composed of three members of the Dartmouth Blockchain club. Our philosophy is to continually provide value to the blockchain ecosystem through shipping useful products and research. The Anthias team consists of three individuals with extensive experience in DeFi, having contributed at Yeti Finance, Primitive Finance, Temple DAO, and more. We have shipped multiple grants for Euler, Aave Grants, and Compound Grants.

Conclusion

The Anthias team would like to gauge sentiment and hear thoughts from the dForce community with regards to creating individual asset interest rate slopes as opposed to grouping assets by category. Please share thoughts/questions in the comments of this forum post, and feel free to reach out to 0xBroze (@0xBroze on Discord or @OxBroze on Telegram) with any questions.