There is no perfect interest rate model that fits all scenarios and we need to adapt our interest rate models to accommodate different market conditions. Interest rate models are always about liquidity depth, optimized utilization and average and max yields in the market. So, the best interest rate model will always adapt to various factors, ideally, it could be driven to the optimal utilization rate at which the max interest rate (hence higher ROI) and available liquidity (not to dry up the pool at all times).

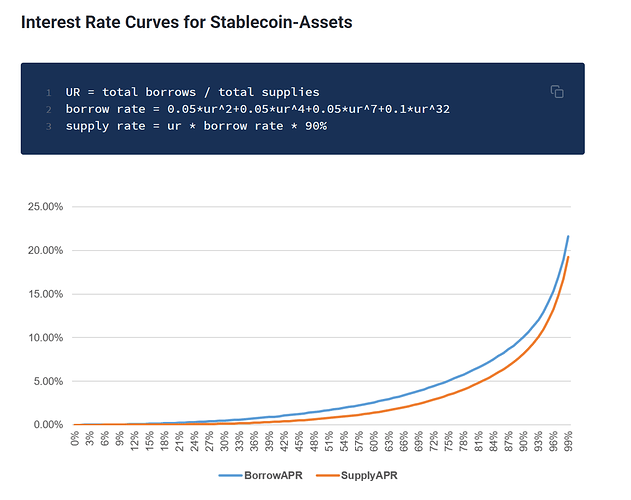

We have long been using interest rate models that have the narrowest spread between saving rates and borrowing rates, hence it delivers the best yields to both lenders and borrowers, this is the interest rate model we used for our assets, this works most of the time, particularly good for largest liquidity pools:

However, now there are some problems with the above models, particularly for some of the assets which are highly demanded for yield farming, i.e., for Cake on BSC, it has been mostly borrowed out to supply into much higher yield farm. Given the curve of our current interest rate model which cap the supply rate at about 19%, the borrower has a greater incentive to borrow all the liquidity and deposit into Pancake for i.e., 60% APY yield farming.

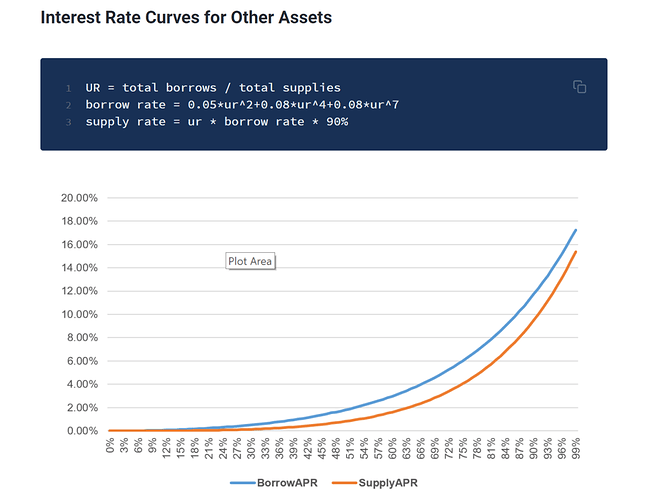

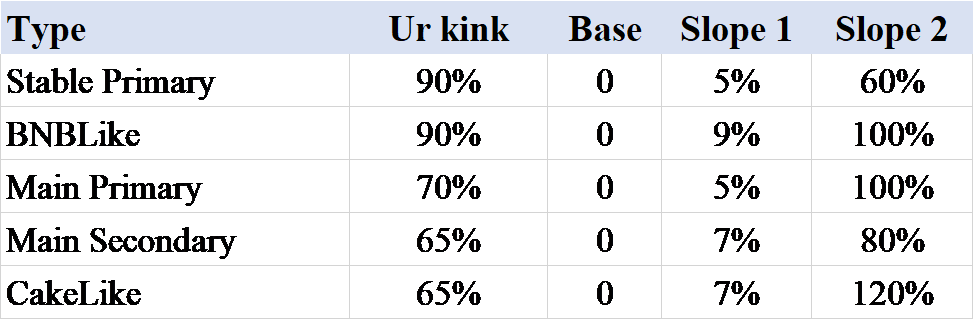

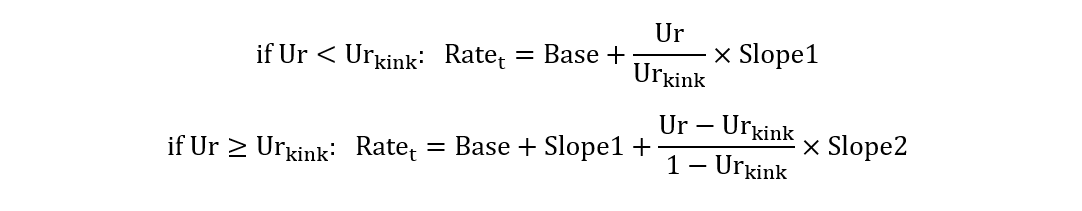

In order to tackle this, we are revisiting the interest rate curves and proposed updating our interest rate model, with the following parameters:

Ur stands for current Utilization Rate:

Below are some of the examples of different classification of assets:

On Ethereum:

- Stable Primary: USDC, USDT, DAI, BUSD, USX, EUX, TUSD

- Main Primary: WBTC, xBTC, ETH, xETH, HBTC

- Main Secondary: GOLDx, UNI, LINK, MKR, DF

On BSC:

- Stable Primary: USDT, USDC, BUSD, DAI, USX, EUX

- BNBLike: BNB, ATOM, DOT, FIL

- Main Primary: BTC, xBTC, ETH, xETH

- Main Secondary: GOLDx, UNI, LINK, ADA, XRP, LTC, BCH, XTZ, DF

- CakeLike: Cake

On Arbitrum:

- Stable Primary: USDT, USDC, USX, EUX

- Main Primary: WBTC, ETH

- Main Secondary: UNI, LINK, DF

We are going to rollout our interest rates cross all assets across Ethereum, BSC and Arbitrum, but we will start gradually to minimize the impact.

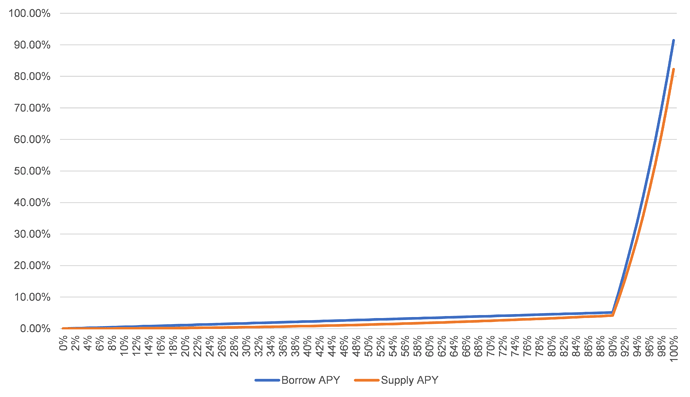

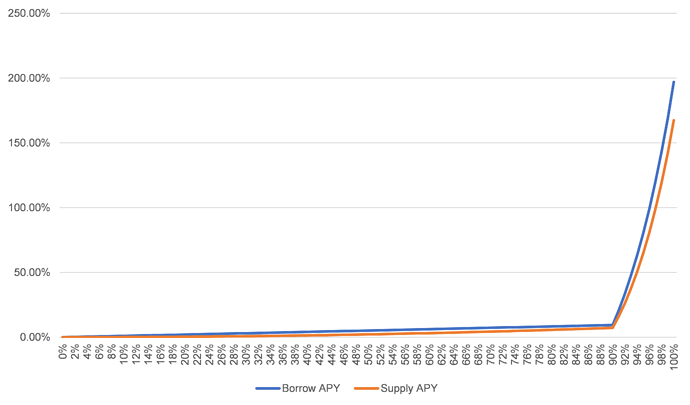

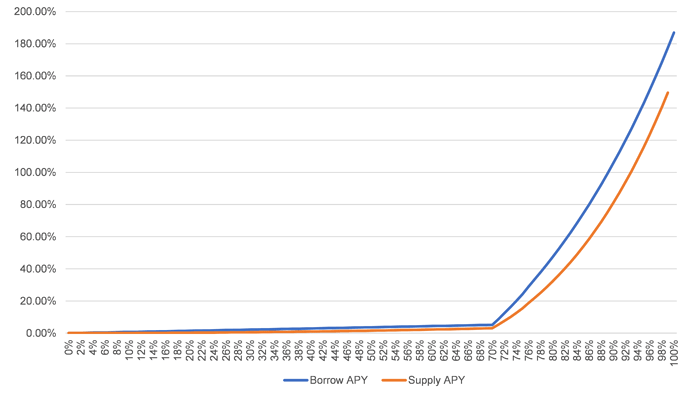

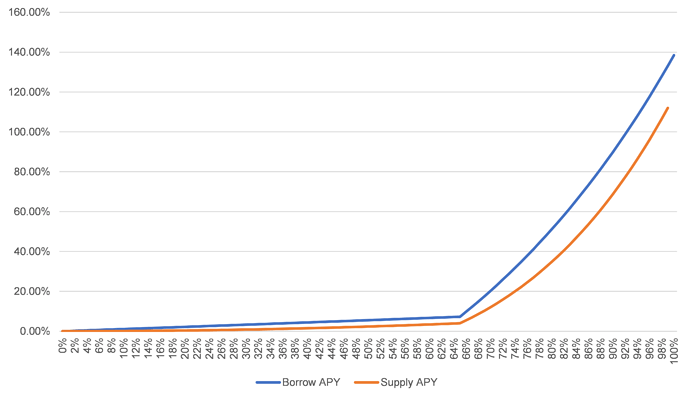

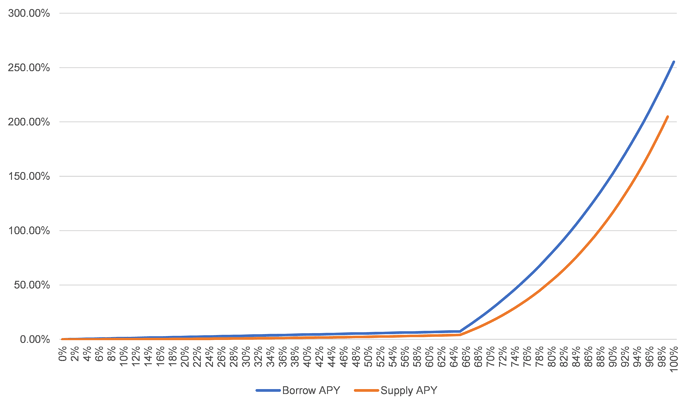

So, here is the graph of different interest rate curves:

Stable Primary:

BNBLike:

Main Primary:

Main Secondary:

CakeLike:

Execotion time is Sept 29, 2021