dForce*BSC AMA Transcript

dForce is an integrated and interoperable open finance and monetary protocol matrix.

All questions answered by Mindao

Hans Y (AMA Host): Could you give a brief introduction about your project, the background, and your own crypto journey?

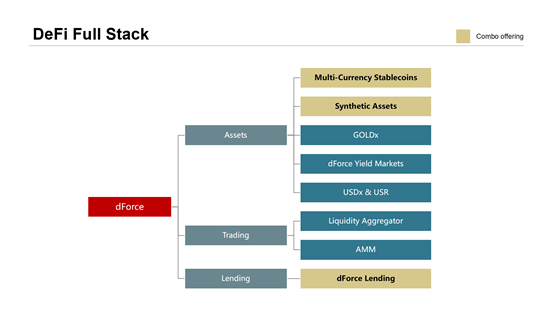

Mindao : Hi guys, Mindao from dForce here, I’ve been engaged in crypto since 2013. dForce was founded in 2019 and developed into a DeFi protocol matrix covering lending, assets (synthetic assets, stablecoin, yield token, etc) and trading protocol (aggregator and AMM). dForce is backed by CMBI (China’s 5th largest commercial bank), Multicoin Capital and Huobi Capital.

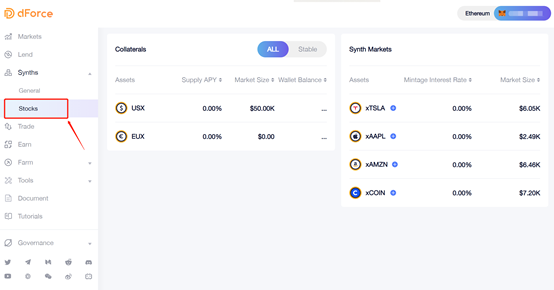

The recent launch of dForce Lending & Synthetic Asset Protocol marks the completion of protocol matrix on BSC, including lending (a pool-based lending protocol, with instant lending and borrowing of major assets from the pool managed by smart contracts in a decentralized manner), synthetic stablecoins (USX, EUX) and synthetic stocks (xTSLA, xAAPL, xAMZN and xCOIN), with new assets can be added or adjusted through governance jointly decided by DF token holders.

Hans Y (AMA Host): With hack every day, security is now at heart of every user, could you elaborate on how dForce strengthen your security measures, risk policy etc to safeguard your protocols?

Mindao: The security of the dForce protocol is our highest priority. We have engaged multiple global top audit firms to perform smart contract audits for all our protocols, including Trail of Bits, ConsenSys, CertiK and Certora (formal verification) for the recently launched dForce Lending & Synthetic Asset protocol.

A vast majority of attacks are in association with the onboarding of new collateral assets, we have very stringent process in respect of asset onboard, including: 1) perform multi-dimensional risk assessments for respective asset, including liquidity test to determine the loan-to-value ratio. It is worth noting that dForce is the only lending protocol implementing supply cap and borrow cap on collaterals. 2) on-chain voting by DF holders before onboarding a new asset / collateral; 3) implement a 24/7 on-chain monitor that keeps watch on irregularities, with several contingency plans in place; 4) we launched a Bug Bounty program to encourage security researchers, white hats, community’s participation in identifying potential vulnerabilities in dForce protocols and receive bounty rewards.

Hans Y (AMA Host): dForce advocates for DeFi protocol matrix, what really makes it special versus other protocols?

Mindao: dForce is different from a number of vertical protocols by creating a matrix with multiple key protocols and strong synergies across the network. Our major protocol is lending, integrated with native stablecoins denominated in different currencies (USX for dollar, EUX for Euro dollar), meaning that you can mint USX and EUX against assets deposited to dForce lending to earn saving yield (like what you do with other lending protocols).

dForce is the only lending protocol introducing synthetic assets capability, that is to say, you could deposit USX, EUX and mint synthetic stocks (i.e., xTSLA, xAAPL, xAMZN, xCOIN). We will expand support to more synthetic stocks, commodities, ETFs in the near future, subject to governance proposal.

As a combo that brings the best out of general lending, stablecoin and synthetic assets, it will greatly increase the value capture capability of DF token and further strengthen the liquidity moat for dForce.

Hans Y (AMA Host): For DF token holders, what are the benefits of holding DF tokens?

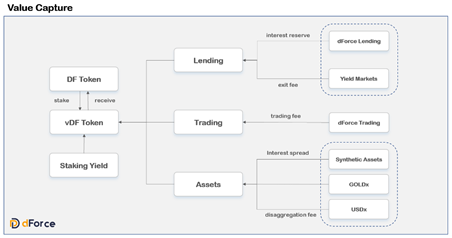

Mindao: DF token is the governance token across dForce network. We recently published a revamped DF Tokenomics 2.0, here is the link Proposal for dForce Tokenomics 2.0

We will create a vDF token, which is a staking token contract, where users can stake DF into the contract (in exchange for vDF) and earn yields generated across a variety of protocols.

Now in our Summer Vibe liquidity mining initiative, DF holders can deposit DF into our lending protocol to earn mining rewards on top of saving yield, You can also use DF as collateral to mint USX, EUX or synthetic stocks to earn more DF rewards.

Hans Y (AMA Host): dForce is also launching your Summer Vibe liquidity mining initiative, it is highly anticipated, what are in store for the Summer Vibe liquidity mining initiative? How can average user participate?

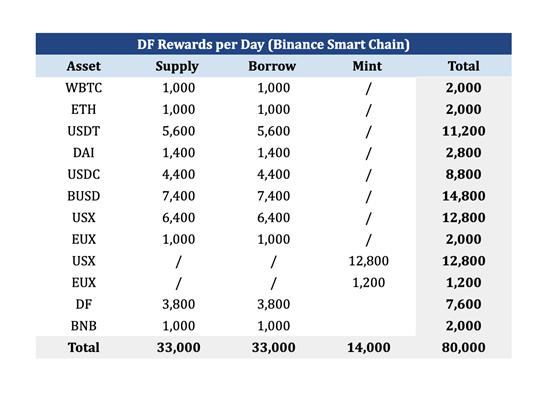

Mindao: dForce launched liquidity mining last summer, but it dialed own a bit to give us more time to develop our protocol. Now, it’s summer again and we are about to kick off the Summer Vibe liquidity mining, to incentivize lending, borrowing, stablecoin minting (USX, EUX), providing liquidity for dForce synthetic assets on Pancake.

Below is a detailed schedule of DF allocation across lending, borrowing and minting stablecoins:

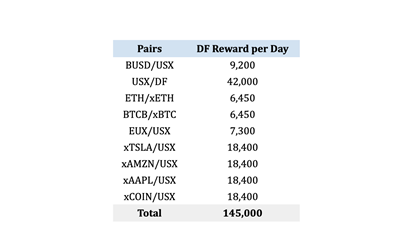

On top of this, there is a whopping 145,000 DF / day allocated for rewards for LP pairs on Pancake for the following pairs:

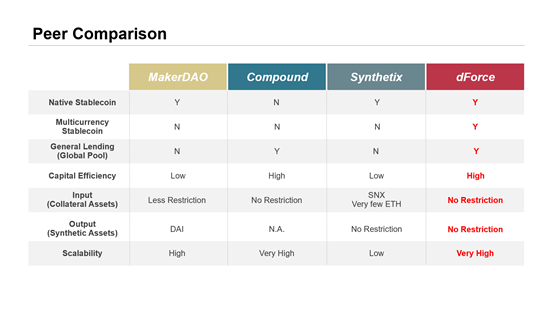

Hans Y (AMA Host): There is an analogy that dForce is trying to build a unified Compound+Maker+Synthetix, could you elaborate on how your combo offering differs from other similar protocols?

Mindao: Lending, stablecoin and synthetic protocols are fundamental money Legos in DeFi, and so far, different team are building different siloed protocol, we are indeed the only protocol that combine lending, native stablecoin and synthetic assets together, in a way that greatly increased capital efficiencies.

Hans Y (AMA Host): dForce new protocol comes with two native stablecoin, USX (which is a USD denominated over collateralized stablecoin and EUX, which is a Euro denominated stablecoin, could you tell us your design consideration for multiple stablecoins?

Mindao: Stablecoin are centric to DeFi’s ecosystem. Our native stablecoin is over-collateralized, meaning that you need to over-collateralize your supplied assets to mint USX and EUX. Though the majority of stablecoins are denominated in USD, we continue to see a rise of demands in other currencies, for instance, EUR stablecoins.

In our offering, we support both USX (USD denominated stablecoin) and EUX (Euro denominated stablecoin), along with liquidity pairs (i.e., EUX/USX), so people can trade their USD stablecoin for EUX.

As USD continues its money printing, we expect to see more people jump into other foreign currency denominated stablecoins, so we, dForce, should expand our stablecoin support to other foreign currencies.

Hans Y (AMA Host): There will be synthetic stock offering with dForce’s new protocol launch, could you elaborate on how TSLA, AAPL, etc are synthetized at dForce and what is the different from trading these synthetic stocks v.s real stocks?

Mindao: At dForce (https://app.dforce.network/), you can see a Stock Pool.

Currently, we accept USX or EUX as collateral to synthetize stock. Please note that dForce integrate with Chainlink to bring the price of real-world stocks on-chain for minting and burning of synthetic stocks, which means, you can only mint supported synthetic stocks when the traditional stock market is open, the max Loan-to-Value ratio for minting synthetic stocks is 80%, meaning that, you can mint $80 equivalent synthetic stocks against $100 (100 USX) collaterals. As a gentle reminder, don’t max out the LTV when minting stocks as stock prices are quite volatile. You should ensure your Adequacy Ratio stays above 1 to avoid a default loan and liquidation of your collateral assets.

Synthetic stock is not backed by underlying stock, it, however, tracks the price of the underlying stock, so there is a chance that the price of synthetic stock deviates from the real-world trading price of the stock, but arbitrageurs can help to facilitate the price peg.

We propose to incentivize providing liquidity for our synthetic assets on Pancake, so synthetic stocks are tradable 24/7 on these AMMs even during stock market trading halt.

Hans Y (AMA Host): dForce’s lending protocol is also aiming for real world asset financing, could you tell us your plans and how is the real-world asset financing look like?

Mindao: Most of the DeFi protocols are now focusing on crypto assets, including lending and borrowing. But in order to break the growth ceiling, it is important to bring real world assets to DeFi.

We already saw MakerDao funding several real-world asset financing deals.

We are exploring opportunities with a number of teams facilitating real world asset financing, with deal proposals most likely be finalized over the next couple of months.

There are several ways to facilitate real world assets financing, including onboarding certain assets into our protocol as collateral, where the borrower can mint USX against it to finance their deal; another example is to directly expand USX loan to real world entities.

We expect to close several real-world financing deals over the next two months.