Overview

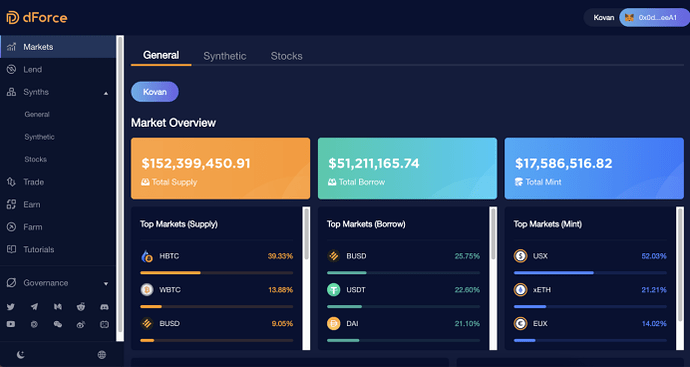

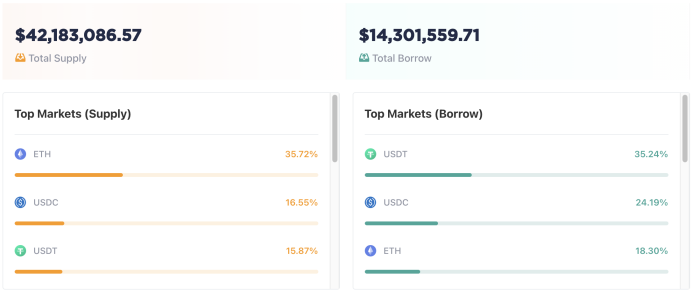

dForce Lending is a decentralized lending protocol featured by global liquidity pool, over-collateralized loan and dynamic interest rates. It has achieved a total supply of $42m and borrow of $14m in less than a month since the launch in April, 2021.

(Source: https://app.dforce.network/#/lending/Markets/mainnet)

Combo Offering

Late this month, we released A Tale of Three Protocols: Unifying Lending, Stablecoin & Synthetic Protocols. Following the deployment of dForce Lending (previously called V1), dForce Lending & Synthetic Asset Protocol features native over-collateralized stablecoins such as USX and EUX, beyond which we will expand our synthetic protocol to other type of assets such as essential cryptos such as xBTC and xETH as well as synthetic assets tracking the price of stocks such as xTSLA and xAAPL. As always, support assets will be subject to DF governance votes when the combo goes live on the mainnet (expected launch in mid-May).

This is the first attempt in DeFi that brings the best out of general lending, native stablecoin and synthetic assets. All the collaterals supported in the General pool are deposited into dForce Lending to earn interest. With yield-on collaterals and DF farming rewards, users can mint stablecoins denominated in multiple currencies and other synthetic assets at minimal cost. We will also create liquidity pools for our stablecoins and synthetic assets on a number of widely adopted DEXes for traders to profit from price arbitrage, which will help to stabilize the price of our synthetic assets.

Beta Testnet

dForce Lending & Synthetic Asset Protocol is open to everyone on Kovan testnet. We welcome everyone to participate and test the new features and create more possibilities, and we would like to hear your suggestions on how we can further improve it before the formal launch on mainnet. To encourage more participation, we have started Beta Testnet Launch event from April 28 to May 11, 2021 and will give DF and dForce Genesis NFT rewards to selected users. Please see dForce Lending V2 Beta Test Event for more details.

All-in-One User Interface

The new UI/UE provides consolidated entrance for users to access lend, mint, trade, earn and farm activities. Dark mode has been introduced as well.

Click here to learn how to use dForce protocol and get some faucet coins through Discord.

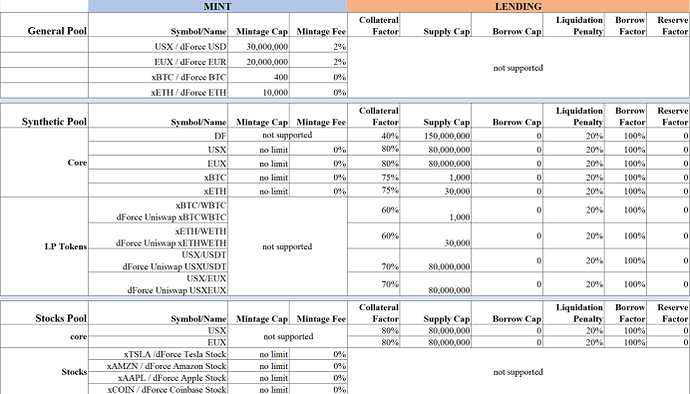

Proposed Asset Parameters/Pools

Hereunder please find the proposed pools upon formal launch and risk parameters for respective asset/pool. Again, this is subject to governance decision jointly made by DF holders. Click here to read through details and let us have your views and suggestions.

dForce Liquidity Mining

We will kick off revamped DF mining after the launch of dForce Lending & Synthetic Assets Protocol to bootstrap our stablecoins and synthetic assets. The initial plan is to sunset existing liquidity mining and yield farming, and to prioritize on incentivizing liquidity parking and trading of synthetic assets on a number of DEXes (self-built AMM, Uniswap V3, Kyber DMM, etc), as well as lending activities. A detailed liquidity mining proposal will be submitted for community discussion soon!

Product Development

Lending & Synthetic Asset Protocol

- Completed smart contract audit and formal verification by Trail of Bits, Consensys Diligence, Certora, and CertiK.

- Testnet launched on Kovan as the final test phase before formal launch.

- Integrated Chainlink oracle to provide price feeds for supported assets.

- Price-feed solutions for stock synthetic assets when markets are closed.

dForce Trade

- Completed development of AMM.

- Will integrate our AMM with dForce Trade (DEX aggregator) as one of the underlying protocols to facilitate the best available price and liquidity.

- UI/UE improvement is underway.

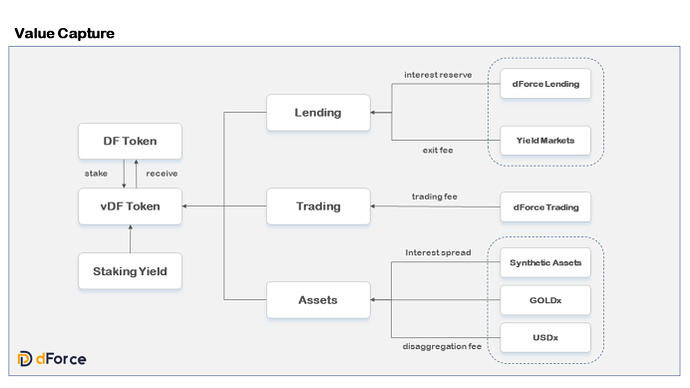

dForce Tokenomics 2.0

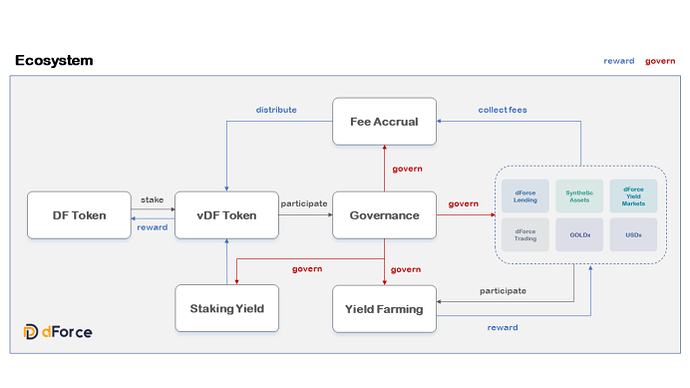

DF used to act as governance token for dictating decision making as well as fee token when interacting with our USDx stablecoin protocol.

We will be creating a vDF token, a receipt token for staking DF, where holders of DF token are able to deposit into staking contract to mint vDF. vDF can be used as general voting vehicle and staking assets and it is also a major vehicle for receiving ecosystem wide incentives. Once DF staked into vDF, vDF is engineered such that fees from dForce Lending, dForce Trade and Synthetic Asset protocol will be periodically used to be purchase DF in the market and distribute to vDF holders.

Key highlights of dForce token’s tokenomics including:

For lending protocol and yield markets

a.Participate in governance for listing new asset and determine key risk parameter

b.to receive fees from interest reserve of lending protocol as well as exit fee from yield market.

For synthetic protocol

a.To provide the system with collateral to generate synthetic assets

b.To participate in the providing liquidity for the synthetic assets

For trading protocol

a.Participate in governance for setting fee policies of the trading protocol as well as key risk parameters

b.to receive fee from trading

Please join us for related discussions through Proposal for dForce Tokenomics 2.0.

dForce Community Call

dForce Community held a global community call on April 26, offering an opportunity for existing and prospective dForce community members to come together for updates, governance discussions, and Q&A.

Mindao, Founder of dForce, discussed about the upcoming launch of dForce’s Lending & Synthetic Assets Protocol, key features, testnet, risk parameters for each asset/pool, as well as revamped tokenomics, together with guest speakers Pan Chao from Maker Foundation and Mable Jiang from Multicoin Capital. You can also watch the community call again on YouTube.

Extended Readings: dForce Community Call — April 26, 10 am (UTC+8)

Marketing

On April 1, Mindao Yang, founder of dForce, participated in a podcast & AMA with Chainlink Community. The discussion was centered on decentralized oracles meeting the needs of DeFi, and our recent integration of Chainlink to provide price feeds for dForce Lending & Synthetic Assets Protocol.

On April 15, Mindao was invited to a panel discussion hosted by Start Consulting and shared his views on the prospective of CeFi and DeFi.

dForce Governance Token (DF)

Currently, over 30 exchanges support trading of DF, including:

Binance (https://www.binance.com/en/trade/DF_ETH)

Huobi (https://www.huobi.com/zh-cn/exchange/df_usdt/)

Gate.io (https://www.gate.io/trade/DF_USDT)

MXC Exchange (https://www.mxc.com/trade/easy#DF_USDT)

HBTC Exchange (https://www.hbtc.com/exchange/DF/USDT)

Hotbit (https://www.hotbit.io/exchange?symbol=DF_USDT)

Friendly reminder: The dForce Ecosystem Update aims to help our community get up-to-date on the latest progress and product developments of dForce. Information provided does not constitute, and should not be construed as, investment advice or a recommendation to buy and sell cryptocurrency. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.