Welcome to dForce’s Ecosystem Report! August has been another action-packed month for dForce and this report will walk you through what happened.

Overview

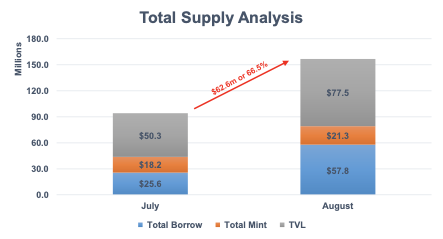

Total supply across dForce ecosystem achieved $156.6m in August, representing a MoM increase of $62.6m or 66.5% from July.

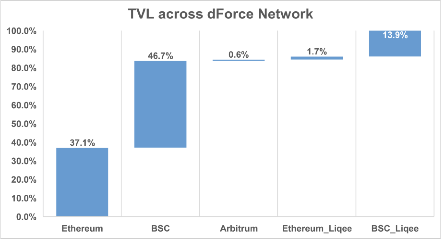

• Out of which, total value locked across dForce ecosystem amounted to $77.5m in August, representing $27.2m or 54.2% MoM increase from July. Out of which, about 38.8% of the total liquidity are currently parked on Ethereum (including Liqee), 60.6% on Binance Smart Chain (including Liqee).

• Accumulated borrowing reached $325.8m by 31 August, with $57.8m loan originated in August, representing a MoM increase of $32.2m or 125.6% from July. dForce is now the #2 largest lending protocol on Binance Smart Chain in terms of total outstanding borrowing volume, according to DeBank.

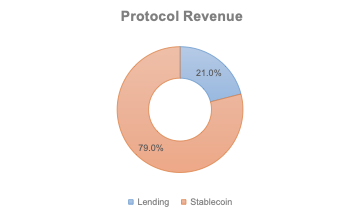

Revenue Breakdown

Glossary:

*• Platform Revenue: the total of interest paid by borrowers and fees generated from minting stablecoins (USX and EUX). *

• Protocol Revenue: the total of reserves (interest spread between lending and borrowing) and fees generated from minting stablecoins (USX and EUX), which will be used to facilitate DF repurchase subject to future governance approval.

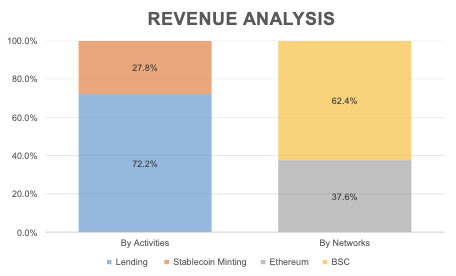

dForce recorded an annualized Platform Revenue of $1.9m in August, representing an increase of 120% from July.

• Out of which, revenue generated from lending activities (interest paid by borrowers) accounts for 72.2%, while the rest 27.8% is contributed by stablecoin minting fees.

• 62.4% of the Platform Revenue were generated on Binance Smart Chain, while the rest 37.6% from Ethereum.

About 79.0% of the Protocol Revenue was contributed by stablecoins (USX and EUX) and 21.0% by lending.

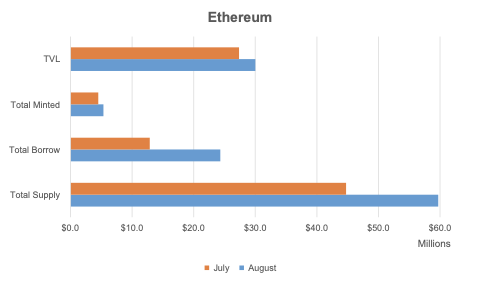

Ethereum

In August, dForce achieve a solid growth on Ethereum with 89.1% increase in total borrow to $24.3m, 33.4% in total supply to $60.0m, 18.5% in total stablecoins minted to $5.3m, and 9.7% in TVL to $30m.

Top three assets supplied to dForce were ETH (40%), USDT (12%), and USDC (11%); top three borrowed were ETH (38%), USDC (25%), and USDT (21%).

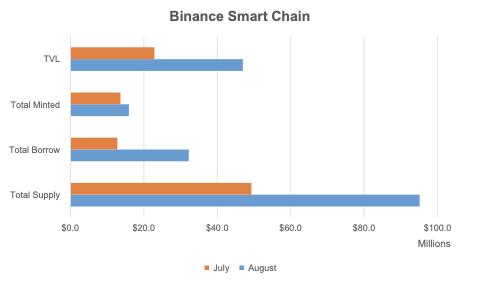

Binance Smart Chain

dForce is now the number #2 largest lending protocol on Binance Smart Chain in terms of total outstanding borrowing volume.

In August, dForce witnessed a robust growth on Binance Smart Chain with 152.3% increase in total borrow to $32.2m, 105.2% in TVL to $47.0m, 93.0% in total supply to $95.1m, and 16.8% in total stablecoins minted to $15.9m.

Top assets supplied were ATOM (28%), BUSD/USX/USDT (11%), and ETH (9%); top borrowed were BUSD (19%), USDC (17%), and USDT (13%).

dForce Liquidity Mining

dForce liquidity mining initiatives include rewards on lending and borrowing activities, minting synthetic stablecoins, as well as providing liquidity for dForce synthetic assets. Please click here to view the latest gauge.

Three-in-one liquidity mining with Liqee and StaFi

dForce announced its plan with Liqee and StaFi to introduce liquid staking assets to DeFi lending and kicked off 3-in-1 liquidity mining on both Ethereum and Binance Smart Chain, starting from 27 August. Users can mint or borrow USX on Liqee against liquid staking assets (minting fee are exempted till 10 Sep), and mine DF, LQE, FIS based on users’ contribution. Click here to view the gauge breakdown.

Product Development

• Add collateral support to a number of assets: TUSD, MKR, and LINK on Ethereum, and CAKE, LINK, XTZ, XRP, LTC, and BCH on Binance Smart Chain (BSC).

• Upgrade of user interface to include dForce Trade and Yield Markets (development in process).

• Upgrade of dashboard with more in-depth data analysis (development in process).

• New portal to support on-chain governance voting (development in process).

• Staking contract of DF token (development in process).

Network

dForce’s core protocol - dForce Lending & Synthetic Asset Protocol has been deployed on Arbitrum mainnet as one of early adopters of this vibrant ecosystem while dForce users would benefit from the faster transaction speeds and lower gas fees.

Initially, dForce Lending & Synthetic Asset Protocol on Arbitrum supports five assets: USDC, ETH, WBTC, as well as dForce’s native overcollateralized stablecoin - USX and EUX, with which you can lend to earn, borrow at attractive rate, and mint stablecoin. More assets and features, as well as liquidity mining are coming soon!

• Tutorial for dForce on Arbitrum: What You Need before Using dForce on Arbitrum

Protocol Integrations

dForce announced its partnership with Liqee to introduce liquid staking assets to DeFi lending.

Liqee utilizes dForce’s smart contract to power its lending market and integrate with USX stablecoin natively, so it could further leverage dForce’s existing lending pools and liquidity, hence the TVL of both projects are integrated. The partnership with Liqee demonstrates dForce’s new attempt to further scale out/up and tap into new markets.

Liqee is the first liquid staking token lending market powered by dForce’s lending protocol, it also provides tokenization for PoS and mining facilities and provides PoS staking services across a number of networks. We strive to become the largest lending protocol for liquid staking tokens and a unified portal for liquid staking markets.

The upsides for dForce token holders from such a partnership include: more USX protocol fees will be generated; 15% of Liqee (LQE) tokens to be allocated to DF token stakers.

Liqee, StaFi and dForce are also a generous amount of token rewards to incentivize participants of Liqee’s lending market.

Extended Readings:

• Liqee Joins dForce as An Ecosystem Partner to Launch Liquid Staking Lending Markets

• Liqee Genesis Liquidity Mining

Marketing Campaigns

On Aug 6, Mindao Yang, Founder of dForce, gave a presentation during the ‘Smart Contract Summit’ powered by Chainlink, and shared his exclusive insights and views, as the founder from one of Asia’s largest DeFi networks, on how to build a multi-facet DeFi protocol and how DeFi is expected to drive convergence with CeFi to further grow the market size.

On Aug 17, Mindao joined AladdinDAO’s first community call as one of early contributors and Boule candidates. Click to watch REPLAY.

On Aug 27, dForce and Liqee were invited by StaFi to introduce the significance of DeFi lending to liquid staking assets and how rToken holders can earn lending yield on top of staking rewards or participate in leveraged staking through Liqee.

Governance

DIP011 – Proposal to Extend USX Secured Credit Line to Liqee [PASSED]

dForce community proposed to extend $3m of secured credit line for USX on Liqee (both Ethereum and BSC), the world’s first lending market for liquid staking tokens (powered by dForce’s lending protocol), allowing users to mint USX against supported collaterals on Liqee.

DIP012 - Proposal for Risk Parameter Adjustment [PASSED]

dForce Lending has been operating smoothly for months since its deployment, and it is necessary to re-assess risk parameters for supported assets.

Key take-aways from the revision include adding collateral support to USDT on Ethereum; increasing the LTV of USX and EUX from 70% to 80%; adjusting Reserve Factor for part supported assets for a unified standard across Ethereum and BSC.

DIP013 - Proposal for New Collateral Onboarding [PASSED]

Our community expressed a strong interest in extending collateral support to more assets on dForce Lending, which have been compiled for risk assessments in accordance with dForce Risk Framework by the dForce team, including a number of large cap DeFi protocols and infrastructure protocols, as well as a couple more stablecoins, and three pairs of dForce’s LP tokens (for liquidity parked on Pancake).

Collateral support to LINK, MKR, TUSD has been implemented on Ethereum, while CAKE, LINK, XTZ, XRP, LTC, BCH on BSC.

dForce Token (DF)

Currently, over 30 exchanges support trading of DF, including:

• Binance (https://www.binance.com/en/trade/DF_ETH)

• Huobi (https://www.huobi.com/zh-cn/exchange/df_usdt/)

• MXC Exchange (https://www.mxc.com/trade/easy#DF_USDT)

• BHEX Exchange (https://www.hbtc.com/exchange/DF/USDT)

• Hotbit (https://www.hotbit.io/exchange?symbol=DF_USDT)

Friendly reminder: The dForce Ecosystem Update aims to help our community get up-to-date on the latest progress and product developments of dForce. Information provided does not constitute, and should not be construed as, investment advice or a recommendation to buy and sell cryptocurrency. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.