Welcome back to dForce Ecosystem Update where we will recap the past month and list what’s to come in the coming months. For the month of January 2022:

Highlights

- dForce boasts a TVL of $261.5m as of 31 January, largely powered by the recent V3.0 upgrade and PDLP implementation.

- dForce added lending support to $FRAX and $FEI on Ethereum and Arbitrum.

- dForce partners with Celer’s cBridge for cross-chain bridging of $DF and $USX.

- 2021 Annual Report is out! Read about the evolution of dForce from DeFi 1.0 to Multichain Infrastructure in Web3

- Dual liquidity mining with DODO on Arbitrum extended to February 26, 2022 for USDC/USX pair.

- Snapshot voting system upgraded, now total balance of DF sitting in your wallets across ETH, Arbitrum, and BSC can be accumulated to calculate your weighted voting

Overview

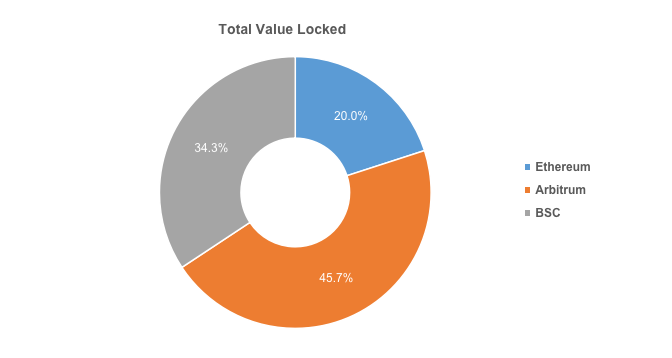

In January, dForce recorded a Total Value Locked of $261.5m. This includes TVL of both lending and USX. Out of this, 45.7% is currently parked on Arbitrum, 34.3% on Binance Smart Chain, and 20% on Ethereum.

Recent spike in TVL is directly connected to the implementation of PDLP and POO through governance proposal DIP019, as part of dForce protocol V3 grand upgrade.

USX

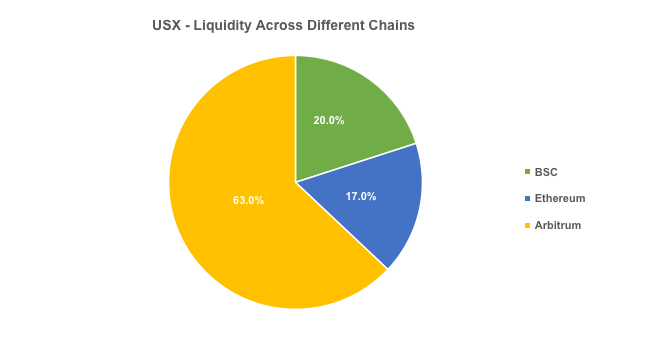

As of 31 January, 2022, total circulating supply of USX is $176.3m. Out of which, 63% is parked on Arbitrum, 20% is parked on BSC, 17% on Ethereum.

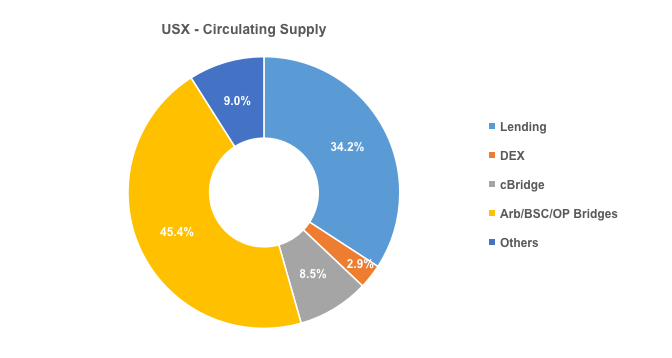

Approximately 45.4% of USX liquidity is currently parked on cross-chain bridges of Arbitrum, BSC and Optimism, 34.2% on lending, 9% sitting idle with market participants, 8.5% on cBridge, and 2% on DEXes.

Lending

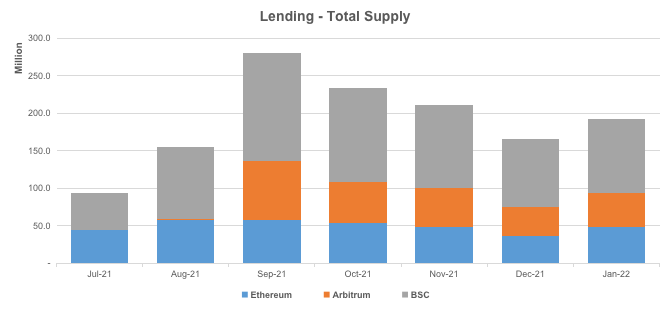

In January, dForce Lending recorded a total supply of $192.7m. Ethereum constituted 25.18%, Binance Smart Chain 51.45%, and Arbitrum 23.37%.

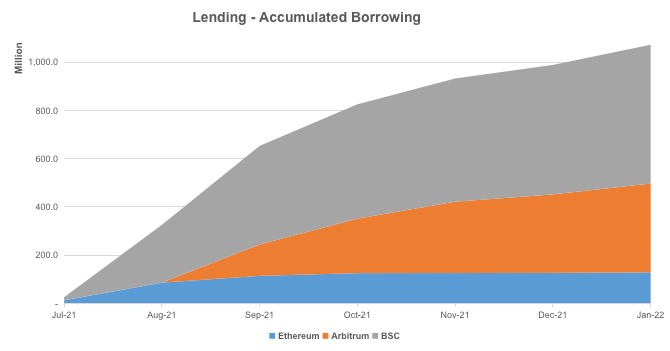

Total accumulated borrowing grew to $1.72B, representing an upward trend of a whopping 8.5% from the previous month in new loan originations.

Revenue

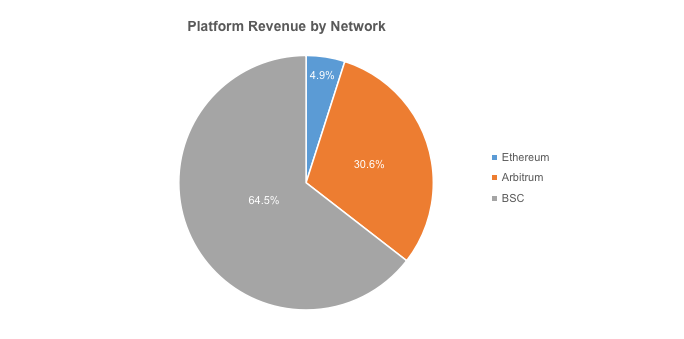

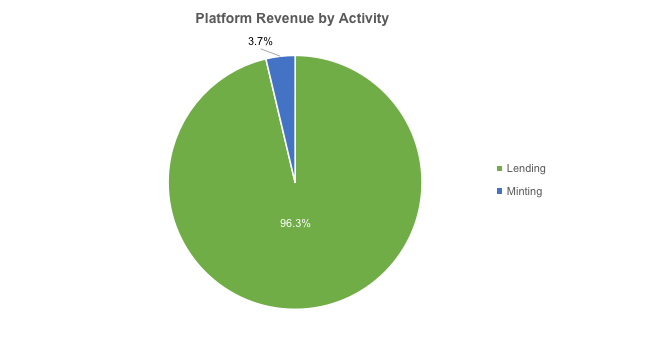

dForce recorded an Annualized Platform Revenue of $1.6m Starting from January 2022. Out of which, approximately 64.5% was generated on Binance Smart Chain, 30.6% on Arbitrum, and 4.9% on Ethereum. Or 96.3% from lending and 3.7% from stablecoin minting.

Liquidity Mining

dForce has ongoing liquidity mining initiatives on Ethereum, Arbitrum, and Binance Smart Chain simultaneously, and worked with DODO to offer dual incentives to participants on Arbitrum. Please visit dForce Forum to view the gauge (update on a weekly basis). Click here to see related tutorials.

Product Development

- dForce Lending (new asset supported)

dForce added lending support to $FRAX and $FEI on Ethereum and Arbitrum.

- DF Staking (coming soon)

The DF staking system allows users to stake DF token in exchange for sDF or veDF token, which can be used to capture value directly from dForce protocols, receive inflationary rewards, airdrop from ecosystem projects, vote on critical protocol decisions, etc. Coming soon!

- dForce Vault (coming soon)

Accept a wider variety of assets as collateral with a new risk model and independent pool to mint USX. The first batch of supported collateral assets are iUSDT, iUSDC, and iDAI.

- dForce Bridge (integrated with cBridge)

Facilitate low-cost and high-speed bridging of DF and USX across Ethereum, Arbitrum, Optimism, and Binance Smart Chain. First integration with cBridge backed by Celer Network was launched in January 2022.

- PDLP (launched)

Similar to the D3M model MakerDAO deployed with Aave, PDLP (Protocol-Direct-Liquidity-Provision) is an alternative approach to supplement USX and EUX liquidity in secondary venues. Simply put, it can effectively combat liquidity shortage for whitelisted protocols integrated with USX and EUX.

- POO (launched)

POO (Protocol-Owned Operator) is the improved version of PCV (Protocol-Controlled-Value), where dForce leverages PCV and acts as its own counterparty and super user to ensure supply and demand are in equilibrium with optimized efficiency.

- Dashboard (coming soon)

The Dashboard will give users an easy-to-read form of key information relating to the protocol performance, including TVL, revenue, analysis around USX, PDLP allocation, POO efficiency, etc.

Governance

DIP019 — Proposal for the Implementation of PDLP and POO [Passed]

It was proposed to implement PDLP (Protocol-Direct-Liquidity-Provision) and introduce protocol-owned liquidity to lending protocols integrated with USX and EUX. It is also proposed to implement POO (Protocol-Owned Operator) and leverage treasury liquidity to further boost supply and demand.

DIP020 — Proposal For New Assets Onboarding [Passed]

This proposal seeks to add lending support to $FRAX and $FEI on dForce lending.

DIP021 — Proposal for PDLP Schedule and Stablecoin Minting Upgrade [Passed]

This proposal seeks approval to disable native minting of $USX and $EUX on dForce lending and Liqee lending. PDLP limits: 300m $USX on Ethereum (including Arbitrum and Optimism), 200m $USX on BSC.

Marketing

- dForce published the 2021 Annual Report with coverage on key achievements in 2021 as well as V3 new features and tokenomics, which aligns DF token value accrual more closely with protocol adoption and TVL growth.

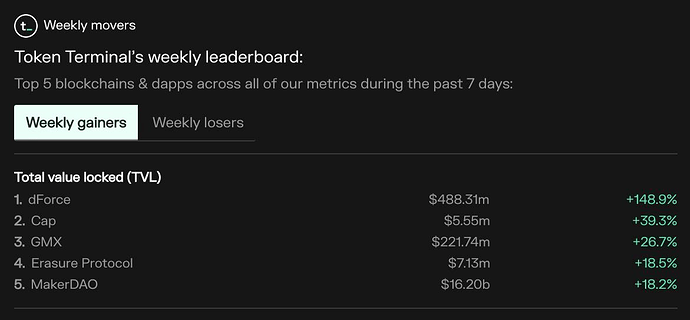

- dForce ranked #1 on Token Terminal’s weekly leaderboard in terms of TVL Growth.

Partnerships

dForce partners with Celer’s cBridge for cross chain bridging of $DF and $USX. Through cBridge, $DF and $USX tokens can be bridged across Ethereum, BSC (Binance Smart Chain), Arbitrum, and Optimism in a liquidity-pool-based model with lower fees and faster transaction speeds.

Extended Readings

- dForce partners with Celer’s cBridge for cross chain bridging of $DF and $USX

- How to transfer $DF and $USX across multiple chains

We welcome you to join our community to participate in related discussions.