Summary

It is proposed to add lending support to FRAX and FEI on dForce Lending.

Background

While centralized stablecoins still dominate the market, a great number of decentralized stablecoins, especially algorithmic stablecoins, have been moving in and accrued billions of dollars in locked value this past year.

Decentralized stablecoins have a wide array of mechanisms to retain their peg, ranging from over-collateralization to partial collateralization to collateral-free. In essence, they are code tokens using smart contract to replace the intermediary role with self-executing lines of codes, inherently value-aligned with dForce’s vision to offer real DeFi product that are completely independent from anything centralized.

Though still in the early days, decentralized stablecoins might eventually serve as a blueprint for, and stepping stone to, a multi-trillion-dollar market.

dForce is devoted to supporting and contributing to the rapid growth of DeFi, as well as the breadth of offered service and asset types. To this end, we’d like to propose to add lending support to a couple of decentralized stablecoins that passed risk assessments based on dForce Risk Framework, adding diversity to asset types and further boost decentralization of dForce.

Proposal

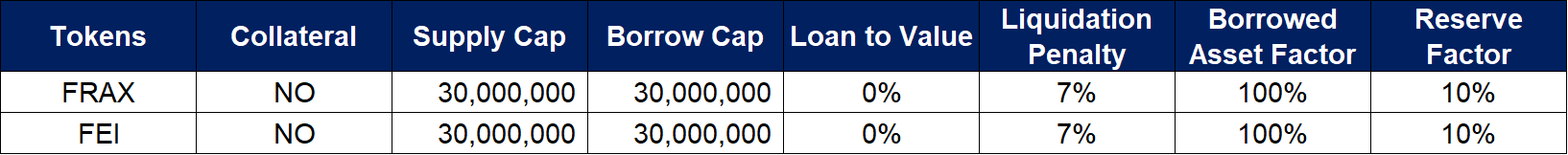

It is proposed to add lending support to FRAX and FEI with proposed parameters as below:

However, both cannot be used as collateral to borrow other assets at present.

Support or objection to this proposal shall apply to dForce lending protocols across Ethereum, BSC, Arbitrum, Optimism, as well as future deployment of dForce Lending on other blockchains and layers.

Click here to view the risk assessments for proposed assets.

Informal Poll

- Support

- Against

0 voters