Welcome back to dForce Ecosystem Update where we will recap the month of September and what’s to come in the fourth quarter!

Overview

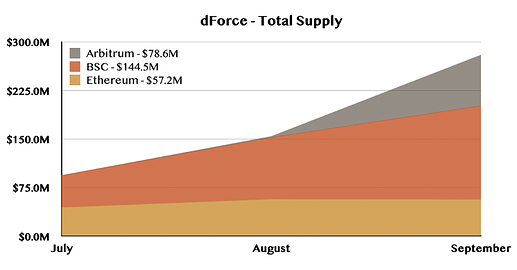

In September, dForce recorded a total supply of $208.4M, seeing a jump of 125.9M (or 81.5%) from August – most of which comes from Arbitrum, followed by Binance Smart Chain (BSC).

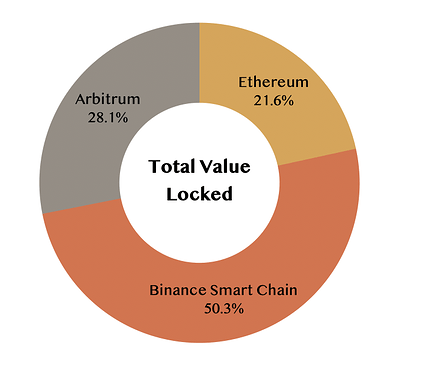

As of 30 September, Total Value Locked (TVL) across dForce network (including Liqee) on Ethereum, Arbitrum, and Binance Smart Chain amounted to $139.9m, up by $60.0M (or 75.0%) from August. Out of which, about 50.4% of total liquidity are currently parked on Binance Smart Chain, 28.1% on Arbitrum, and 21.5% on Ethereum.

Total Accumulated Borrowing on dForce reached $618.6m by 30 September, with $113.2m loans originated in September – up by 89.8% from last month.

As an ecosystem project of dForce, Liqee contributed around $34m (or 12.2%) in total supply and $11.4m (or 10.1%) in total borrowing.

Revenue Breakdown

Glossary

+ Platform Revenue: the total of interest paid by borrowers and fees generated from minting stablecoins (USX and EUX).

+ Protocol Revenue: the total of reserves (interest spread between lending and borrowing) and fees generated from minting stablecoins (USX and EUX), which will be used to facilitate DF repurchase subject to future governance approval.

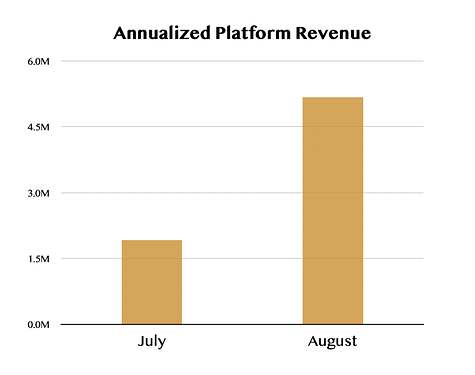

In September, dForce achieved an annualized Platform Revenue of $5.17m, representing a MoM increase of 170% from the previous month.

Among the Platform Revenue:

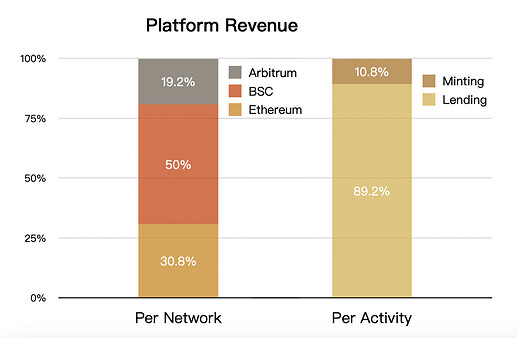

- Revenue generated from lending activities (interest paid by borrowers) accounted for 89.2% of the Platform Revenue, while the remaining 10.8% by stablecoin minting fee.

- In terms of networks, around 50.0% were generated on Binance Smart Chain, 30.8% on Ethereum, and the remaining 19.2% on Arbitrum.

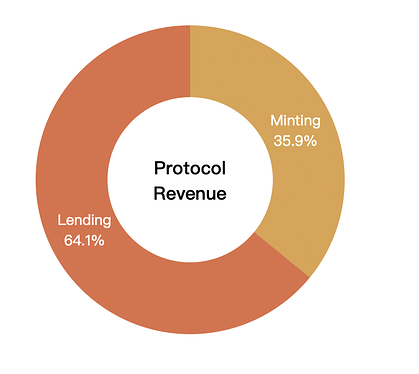

In view of the Protocol Revenue:

Approximately 35.9% of the Protocol Revenue were contributed by stablecoins (USX and EUX) and 64.1% by lending.

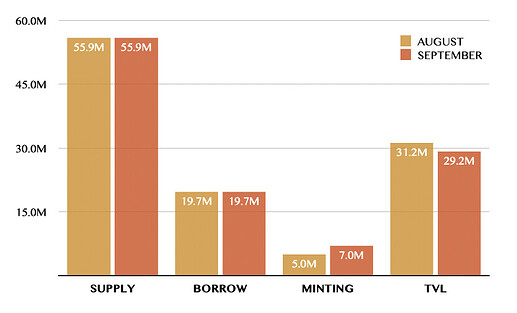

Ethereum

In September, Total Supply and Total Borrowing of dForce on Ethereum remains flat from previous month, with a slight decrease of 6% in Total Value Locked, which stays in line with the overall market performance (10.1% shrink from $87.5 billion to $78.7b across DeFi protocols on Ethereum, according to DeFi Pulse).

Top three assets supplied to dForce were ETH (31.0%), DF (14.58%), and USDT (11.1%); top three borrowed were ETH (39.83%), USDT (21.73%), and USDC (16.70%).

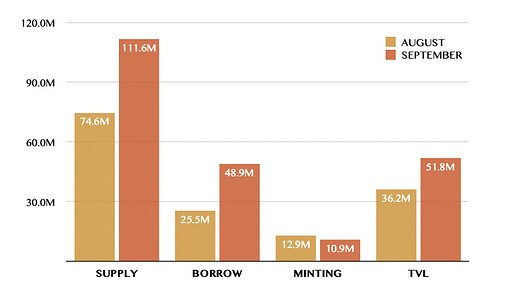

Binance Smart Chain

dForce is now the #2 largest lending protocol on Binance Smart Chain in terms of Total Borrowing, according to DeBank.

In September, dForce achieved a substantial growth on Binance Smart Chain with 152.3% increase in Total Supply to $111.6M, 43.2% increase in Total Value Locked to $51.8M, and 91.5% increase in Total Borrowing to $48.9$.

Top assets supplied were ATOM (29.6%), BUSD (12.6%), and USDT (9.3%). Top borrowed were BUSD (19.7%), USDC (14.8%), and USDT (14.2%).

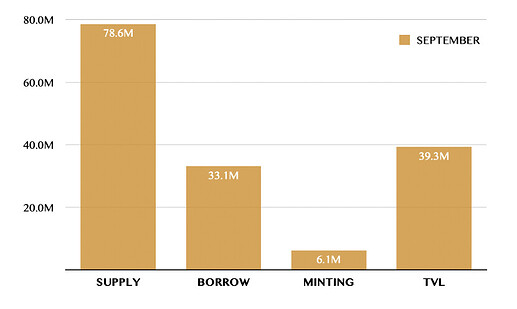

Arbitrum

Within less than a month since dForce Lending’s launch on Arbitrum One, dForce is now the #1 lending protocol and #6 DeFi protocol in terms of TVL (Source: DeFi Llama)!

On Arbitrum, dForce has gained a Total Supply of $78.6M, Total Borrowing of $33.1M, and Total Minting of stablecoins of $6.1M.

Liquidity Mining

[Ethereum & Binance Smart Chain] - “Summer Vibes” Liquidity Mining

dForce liquidity mining initiatives include rewards on lending and borrowing activities, minting synthetic stablecoins, as well as providing liquidity for dForce synthetic assets. You can go to our forum to view the latest gauge.

[Ethereum & Binance Smart Chain] - Three-in-One Liquidity Mining with Liqee and StaFi

dForce announced its plan with Liqee and StaFi to introduce liquid staking assets to DeFi lending and kicked off 3-in-1 liquidity mining on both Ethereum and Binance Smart Chain. Users can mint or borrow USX on Liqee against liquid staking assets, and mine DF, LQE, FIS based on users’ contribution. Go to Liqee forum to k view the gauge breakdown.

[Arbitrum] - “I-Still-Feel-Summer” Liquidity Mining

“I-Still-Feel-Summer” liquidity mining program kicked off with DF, dForce’s native token, as liquidity mining incentives for its lending protocol. At later stages, the offering will be extended to dForce’s native stablecoins (USX, EUX) and synthetic pairs in DEX. You can go to our forum to view the latest gauge.

Learn More

- dForce Launches $50m Liquidity Mining Program on Arbitrum

- “I-Still-Feel-Summer” dForce Genesis Liquidity Mining on Arbitrum

[Arbitrum] - Dual Liquidity Mining with DODO

With a target to boost liquidity across Arbitrum ecosystem, we would like to extend the dForce liquidity mining initiative to incentivize liquidity provision for dForce-backed assets, with DODO becoming the first trading venue. 3 pools will be set up on DODO through this initiative with dual rewards:

- DF/USX pool

- USX/USDC pool

- USX/EUX pool

Learn More

Product Development

dForce Trade

- Landed on Arbitrum

- Further optimizations on Ethereum mainnet and Binance Smart Chain

- Off-chain routing development

- All-in-one interface integration

Governance

- vDF and new governance portal development

Others

- Uniswap V3 staking interface development

- Customized bridge to Arbitrum under development and validation

- Back-end service upgrade to sub graph for optimized monitoring system

Marketing Campaigns

On Sep 4, Mindao Yang (founder of dForce) shared his insights on ‘How blockchain will make data more valuable’ in a panel discussion during the BeWater DevCon 2021.

On Sep 9, dForce global community hosted an AMA together with Liqee and StaFi in telegram. As a strategic supporter, dForce is willing to foster a strong interest alignment between the two communities with a solid win-win. We are continuing pushing out new integrations to further grow the dForce ecosystem.

On Sep 15, Mindao joined AladdinDAO’s community call as one of early contributors and a AlladinDAO Boule candidate. To learn more, you can watch replay on Youtube.