Summary

The time has come that we launch our stablecoin and synthetic protocols after months of intense development, audit and public testnet. The new protocol features are discussed here:

-

We already passed security audits by Trail of Bits, ConsenSys Diligence, CertiK and Certora.

-

The features will further advance dForce into a full suite protocol matrix centering around lending, native stablecoin and synthetic assets.

-

This proposal aims to introduce core features and associated risk parameters for DF token holders to vote on, including proposed markets and assets to be listed on both Ethereum and Binance Smart Chain (BSC) and their respective risk parameters.

Background

The proposed upgrade will introduce native stablecoin and synthetic assets features into dForce lending, so users can deposit assets as collateral and mint a variety of supported synthetic assets. This proposal applied to both Ethereum and BSC deployment.

Proposal

We would like to advance the following proposals:

- propose to add native stablecoin feature as well as synthetic asset feature into dForce on both Ethereum and BSC chains.

- to add USX, EUX, xETH, xBTC into core synthetic asset list.

- to enable USX, EUX, xETH, xBTC as collaterals on dForce Lending.

- to add TLSA, AAPL, AMZN, COIN as supported synthetic stocks.

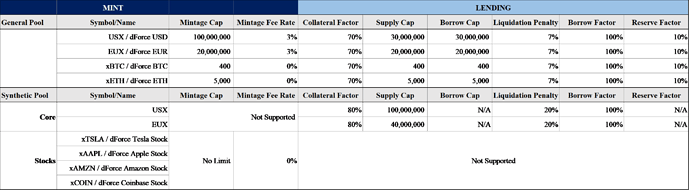

- proposed risk parameters associated with the above proposals are shown as below.

Risk Parameters

The above risk parameters will apply to both Ethereum and BSC, subject to DF governance voting.