Overview

dForce Lending & Synthetic Asset Protocol is officially live on both Ethereum mainnet and Binance Smart Chain (BSC). As a combo offering that brings the best out of general lending, native stablecoins and synthetic protocols, it is:

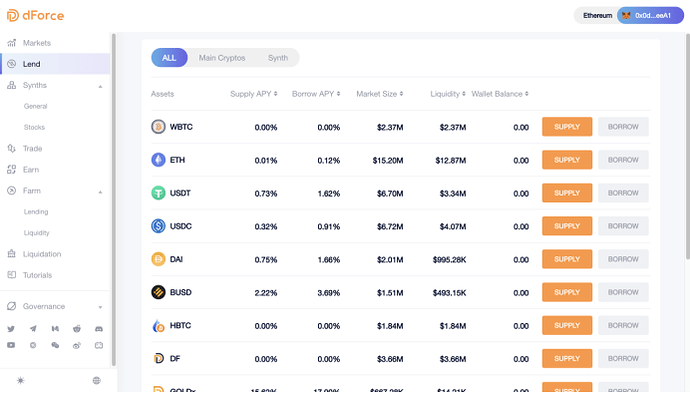

- A global pool-based general lending protocol, with instant lending and borrowing of crypto assets from the pool managed by smart contracts in an open, permission-less, and decentralized manner.

- With built-in multisided lending support, users are able to mint synthetic assets, including stablecoins and other synthetic asset, against yield-on collaterals, which effectively improve capital efficiency and robustness of the system with unlimited collateral and synthetic capabilities.

In other words, this combo allows to retain the flexibility and asset scalability of a lending protocol, significantly expand the funding source of the synthetic assets, and give you unlimited, uncensored, and instant access to any asset imaginable, subject to governance approval by DF holders.

Click (https://medium.com/dforcenet/a-tale-of-three-protocols-unifying-lending-stablecoin-synthetic-protocols-1cb9a0b720d6) to read the long form.

(Source: (https://app.dforce.network/#/lending/Markets/mainnet?AssetsType=Lend¤tPool=general)

dForce’s Summer Vibe Liquidity Mining Initiative

The Summer Vibes initiative will include rewards on lending and borrowing activities, minting synthetic stablecoins, as well as providing liquidity for dForce synthetic assets. The revamped DF liquidity mining will be carried out on both Ethereum and BSC, however, for Ethereum, liquidity mining will only be activated for lending activities and minting synthetic stablecoins.

DF liquidity mining will be carried out in three forms, namely:

- For lending : DF rewards will be distributed evenly between lending (50%) and borrowing activities (50%), with a fixed amount for respective asset.

- For minting : minting synthetic stablecoins (USX, EUX) will get rewarded. Please note that minting USX and EUX, require to pay interest rate accrued on an annual basis (aka an over-collateralized loan, borrowers need to pay the protocol for the opportunity to mint synthetic stablecoins).

- For liquidity providing (only on BSC) : Pancake LPs will receive DF rewards by providing liquidity for supported pairs on Pancake.

The first phase of Summer Vibes liquidity mining initiative will start on 4th June and end on 18th June. We may adjust the plan based on further assessments in order to continuously improve it.

Click (https://medium.com/dforcenet/dforces-summer-vibes-liquidity-mining-initiatives-2d2c4cff1ce7) to see the detailed distribution schedule.

Beta Test

Around 3,500 addresses participated in the Beta Test of dForce Lending & Synthetic Asset Protocol from April 28 to May 11 on Kovan testnet, with more than $120m equivalent of faucet tokens distributed. We will continuously optimize dForce protocol based on feedbacks and suggestions collected, including (not limited to):

- Synthetic Assets: Synthetic Pool and Stock Pool will be integrated into one for the purpose of simplicity. So, there will be two pools upon formal launch: General Pool (to mint synthetic stablecoin and synthetic cryptos) and Stock Pool (to mint synthetic stocks).

- Synthetic Stocks: minting synthetic stocks will be halted when the traditional stock market is closed to ensure robustness of the system.

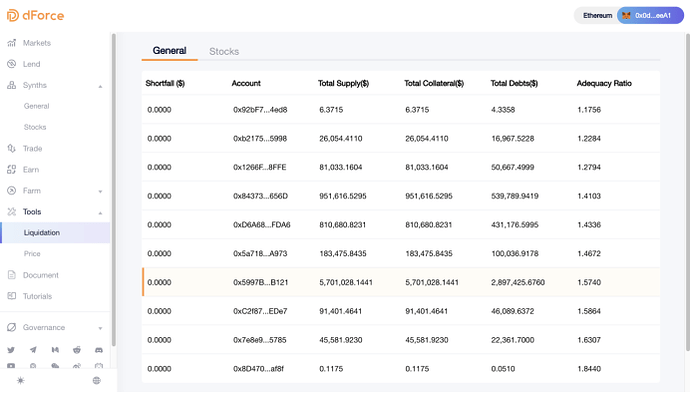

- Risk Monitor Bot: we will introduce a ‘One-Click Repay ’ function and Risk Monitor Bot which can help users to keep watch on Adequacy Ratio to avoid loan default and liquidation of collateral assets.

As a bonus, we simulated a large-scale drop to the prices of supported assets on dForce (except stablecoins), simulating the Black Swan Event of March 12, 2020. It serves the purpose of reminding everyone of the importance to keep your Adequacy Ratio above 1 to avoid unnecessary losses. Users should remember to borrow within the Safe Max, and top up your collaterals or repay some of your loans in case of a black swan event.

In this simulation event, over 500 addresses with over $3.6m loans got liquidated. Liquidators participated in this event received a bonus ranging from 7% to 20% of liquidated assets. Click (https://docs.dforce.network/risk/parameters) to check on liquidation bonus for each pool.

We strongly encourage users to actively participate in liquidation of default loans. The liquidator helps to avoid default debts in dForce protocol, thereby maintaining the solvency of the system and the safety of depositors’ funds. The liquidator can also obtain liquidation fines as an incentive.

Extended Readings

dForce Lending V2 Beta Test Event

dForce Testnet Event – Simulating 312 Black Swan Event

Liquidation

On dForce Protocol, anyone can participate in liquidation and earn bonus for their efforts to maintain the solvency of the system. Click “Liquidation” on the sidebar to enter the page, where all outstanding loans are listed with respective Adequacy Ratio . It greatly reduces the threshold for users of common level to participate in liquidation. Click ([Liquidation] How to participate in dForce liquidation?) for a hand-on guide.

(Liquidation interface: https://app.dforce.network/#/lending/Liquidation)

Product Development

Lending & Synthetic Asset Protocol

- Launched on Ethereum and BSC

- Stock price solutions during stock market close

- Integrate Chainlink to provide prices for all assets supported (except DF)

- Launched revamped liquidity mining since 4 June, 2021

dForce Trade ( Aggregator)

- Added support to Pancake v2, MDEX, Belt, Unisave on BSC

UI/UX

- All-in-one interface upgrade to integrated with dForce Trade (Trade) and dForce Yield Markets (Earn)

Others

- Assess layer 2 solutions including Arbitrum and a couple of others.

- Back-end service migration to Graph in process

dForce Community Call

On May 13, dForce held a community call for Chinese audiences. Mindao Yang, Founder of dForce, gave a detailed introduction on the soon-to-be-launched dForce Lending & Synthetic Asset Protocol, and why it is different from a number of other similar products in the market. Mindao also mentioned about our plan of implementing layer 2 solutions which will take a much-needed load off the Ethereum network, which will offer faster and cheaper transactions for users.

Then dForce project lead also shared our takeaways from the testnet event. We will continuously optimize dForce protocol based on feedbacks and suggestions collected.

We also received lots of questions from the community regarding future development, tokenomics, governance, etc. We’d love to hear your voice at each community meeting!

Integrations

dForce Announces Partnership with Deri to Promote USX

dForce is now partner with Deri protocol, a decentralized derivative protocol, to promote the soon-to-be-launched dForce synthetic assets. USX, an over-collateralized stablecoin minted from dForce Lending & Synthetic Asset Protocol, will be added to Deri’s base token list to be used as deposit for derivatives trading.

Deri Protocol is a Uniswap-style pool facilitating trade of derivatives in a decentralized manner. The pool works as liquidity medium and makes base token (i.e., USX) transactions with traders and liquidity providers.

Extended Readings

dForce Announces Partnership with Deri to Promote USX

Governance

DIP009 – Proposal to Launch Stablecoin and Synthetic Asset Protocol [Passed]

The proposal is for the introduction of native stablecoin and synthetic assets features into dForce lending, so users can deposit assets as collateral and mint a variety of supported synthetic assets. This proposal applies to both Ethereum and BSC deployment.

DIP010 – Proposal of Risk Parameter Adjustments to dForce Lending [Passed]

With the launch of our Synthetic Asset Protocol, we propose to adjust some of the risk parameters and standardize across both Ethereum and BSC.

Marketing

On May 27, Mindao, Founder of dForce attended the on-line panel hosted by Binance Smart Chain, together with CREAM protocol and AUTOFARM, and share his views on how DeFi protocols should evaluate and mitigate collateral risks, isolate risks from multiple protocol interactions, and avoid risks of flash loans and liquidity pools, etc. Click HERE to watch the replay.

dForce Governance Token (DF)

Currently, over 30 exchanges support trading of DF, including:

Binance (https://www.binance.com/en/trade/DF_ETH)

Huobi (https://www.huobi.com/zh-cn/exchange/df_usdt/)

Gate.io (https://www.gate.io/trade/DF_USDT)

MXC Exchange (https://www.mxc.com/trade/easy#DF_USDT)

HBTC Exchange (https://www.hbtc.com/exchange/DF/USDT)

Hotbit (https://www.hotbit.io/exchange?symbol=DF_USDT)

Friendly reminder: The dForce Ecosystem Update aims to help our community get up-to-date on the latest progress and product developments of dForce. Information provided does not constitute, and should not be construed as, investment advice or a recommendation to buy and sell cryptocurrency. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.