Flashback

On March 12, 2020, the cryptocurrency market suffered a sharp decline. The price of Bitcoin quickly dropped from $7,900 to $3,600 (a drop of more than 50%). On this day, various DeFi protocols also encountered the largest liquidations in its history.

In order to help our users better deal with and fully understand the market risks of DeFi, dForce will host a market simulation event on the Kovan test network at 8 am, 12 am, and 2 pm (UTC+8) on May 10th (Monday).

dForce Lending and Synthetic Asset Protocol will simulate a large-scale drop to the prices of BTC-type assets, ETH-type assets, and some other assets, simulating the Black Swan Event of March 12, 2020. This will test the protocol’s risk management capabilities, and at the same time help users better understand how to deal with extreme market situations.

What is Liquidation?

When users apply for a loan through a DeFi protocol, most protocols are designed to require users to provide mortgage assets exceeding a certain percentage (usually ranging from 120% to 150%) of the loan amount as a guarantee (also commonly known as the “mortgage rate”). When the black swan event occurred, the price of mortgage assets dropped sharply, causing the value of borrower’s mortgage assets to fall below the mortgage rate, resulting in insolvency. In such event, if the borrower fails to repay the loan in time or top up the mortgage assets, the liquidation process will be triggered.

The liquidator can obtain the mortgaged assets of the borrower at a discount below the market price by repaying the loan to the system for the borrower, commonly known as the liquidation penalty, which is usually 7% to 10% of the liquidation amount. This part of the loss usually needs to be borne by the borrower. The liquidator helps to avoid default debts in the DeFi protocol, thereby maintaining the solvency of the system and the safety of depositors’ funds. The liquidator can also obtain liquidation fines as an incentive.

How do I check the safety of my mortgaged assets?

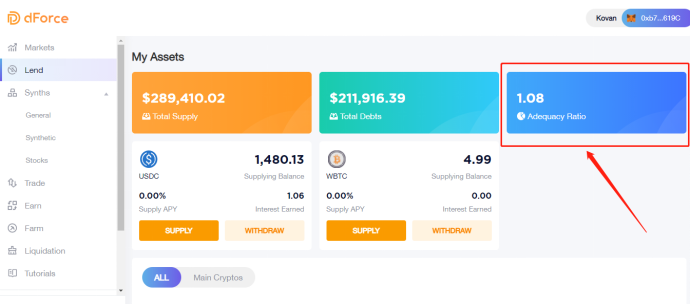

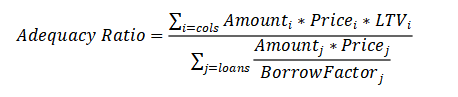

In the dForce Lending and Synthetic Asset Protocol, click on “Lending”, and on the far-right side of the “My Assets” column (dark blue tab), you can see the Adequacy Ratio. When the asset adequacy ratio is less than 1, the borrower would face insolvency. If the collateral is not replenished in time to bring the asset adequacy ratio back to 1 or above, it will face the risk of liquidation of the mortgaged assets.

The following is the formula for calculating the asset adequacy ratio:

How to avoid liquidation?

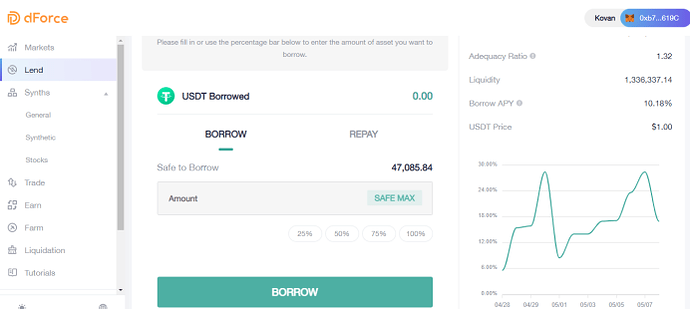

The first step to prevent assets from being liquidated is to control borrowing within a safe threshold. On the lending page, you can see the “Safe to Borrow Amount”. We strongly recommend that the user’s loan amount does not exceed this safety threshold to better resist market risks and help ensure the security of mortgage assets.

Secondly, the borrower can also deposit more collateral, that is, by increasing the value of the collateral to ensure that their assets are greater than their liabilities, thereby avoiding the liquidation of the mortgaged assets.

Who can participate in liquidation?

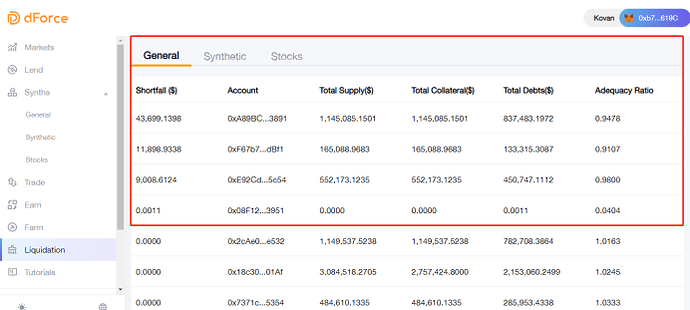

In the dForce Lending and Synthetic Asset Protocol, anyone can participate in the liquidation and earn liquidation penalties. In order to facilitate users to participate in the liquidation, we provide a one-click entry. Find “liquidation” in the sidebar, click to enter, and you can see the current asset adequacy ratio of all loans on the page, which greatly reduces the participation threshold of liquidators.

As shown in the picture below, the asset adequacy ratio of the first four addresses is less than 1, which means that anyone can repay the debt for the borrower and obtain the mortgaged assets of the borrower at a discounted price, i.e. a liquidation. For a detailed explanation of how liquidation works, please read dForce Lending & Synthetic Assets Protocol Liquidation Guide

Easter egg rewards

The liquidation of dForce Lending and Synthetic Asset Protocol is completely based upon the market. Anyone can participate in the liquidation of default loans. We also encourage users to actively participate. This will help further reduce the system’s bad debt ratio and maintain a healthy operation of the network.

This event aims to help users better understand and resist unforeseeable market risks and ensure the safety of their funds. We will issue a dForce Genesis NFT as an Easter egg reward to the addresses with the highest amount of liquidation on May 10, from 8 am to 5 pm (UTC+8). The details of collecting NFTs will be announced later.

dForce Lending & Synthetic Assets Protocol testnet event will end on May 11, 10 am (UTC+8).

If you have any questions or suggestions, we welcome you to join our community to ask us anything:

dForce Official Website: https://dforce.network/

dForce Forum: https://forum.dforce.network/

Twitter: https://twitter.com/dForcenet

Telegram: Telegram: Contact @dforcenet

Medium: dForce – Medium