Summary

This approval seeks to add collateral support to Lido’s wstETH, allowing users to borrow against wstETH.

Background

stETH is a token that represents staked ETH with Lido, allowing users to earn ETH 2.0 staking yield without locking Ethers (aka liquid staking Ether). Users who stake with Lido will receive daily rewards in the form of stETH balance, which accrues automatically over time. stETH can be traded or transferred at any time.

wstETH stands for wrapped stETH, a DeFi-compatible version of the stETH token which allows for easier integrations with DeFi protocols. As most DeFi protocols require a constant balance mechanism for tokens, Lido lets you ‘wrap’ your stETH into wstETH to keep your balance of stETH fixed. Instead of updating daily, wstETH uses an underlying share system to reflect your earned staking rewards.

Lido is a decentralized liquid staking solution built on Ethereum 2.0’s Beacon chain and is governed by the Lido Decentralized Autonomous Organization (DAO).

Proposal

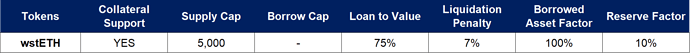

It is proposed to extend collateral support to wstETH with proposed parameters and risk analysis scores.

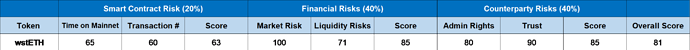

Risk Analysis: wstETH [Overall Score: 81]

Smart Contact Risk

The Lido code is open-sourced, audited and covered by extensive bug bounty program. wstETH records 80K verifiable on-chain transactions since its launch in February 2021.

Financial Risk

stETH is the dominant liquid staking solution for ETH with a market capitalization of $6.5 billion, accounting for 88.1% of the total staked ETH. The stETH/ETH pool on Curve facilitates a daily volume of $11K.

Counterparty Risk

Lido is a DAO. Decisions in the Lido DAO are made through proposals and votes - community members manage protocol parameters, node operators, oracle members and more. The Lido staking infrastructure for stETH consists of 9 node operators, with a focus on decentralization.

Lido relies on a set of oracles to report staking rewards to the smart contracts. Their maximum possible impact is limited by the recent upgrade, and the operators of oracles are all well-known entities including Stakefish, Certified One, Chorus, Staking Facilities and P2P.

Propose Risk Parameters

This approval, once approved, will allow users to borrow against collateralized wstETH, however, wstETH can NOT be borrowed from the protocol (borrow cap is zero).

The onboarding of new asset and collateral will be applicable to all blockchains deployed with dForce protocols.

Click here to read more about the community proposal.