Welcome to another dForce monthly update. We keep our community up-to-date about what to expect in the coming months.

Highlights

- In December, dForce protocol kickstarted the grand V3 upgrade. In a series of articles dForce V3 — the Grand Upgrade and Tokenomics Flywheel, dForce Protocol V3 Features — Deep Dive, and The Tokenomics Flywheel, we revealed some core protocol features and a complete revamp to $DF’s Tokenomics.

- Through the 3-part Tokenomics flywheel upgrade (DF Staking, Treasury-Active-Liquidity-Operation (TALO), and Treasury-Bonding-Buyout (TBB)), DF token’s value accrual mechanism has been greatly enhanced.

- Key protocol features of dForce V3 include vaults, Bridge, Direct Liquidity Provision, PDLP (Protocol-Direct-Liquidity-Provision), and POO (Protocol-Owned Operator), which will facilitate a huge boost to TVL.

- dForce added collateral support to wstETH.

- Dual liquidity mining with DODO on Arbitrum extended to January 27, 2022 for DF/USX and USDC/USX pairs.

Overview

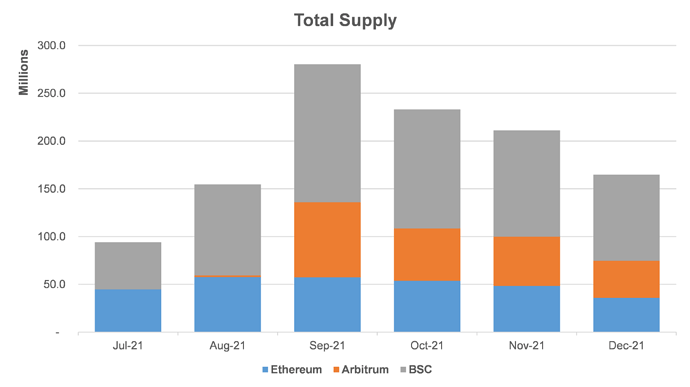

In December, dForce recorded a total supply of $164.8m. Ethereum constituted 21.8%, Binance Smart Chain 54.7%, and Arbitrum 23.5% of this figure.

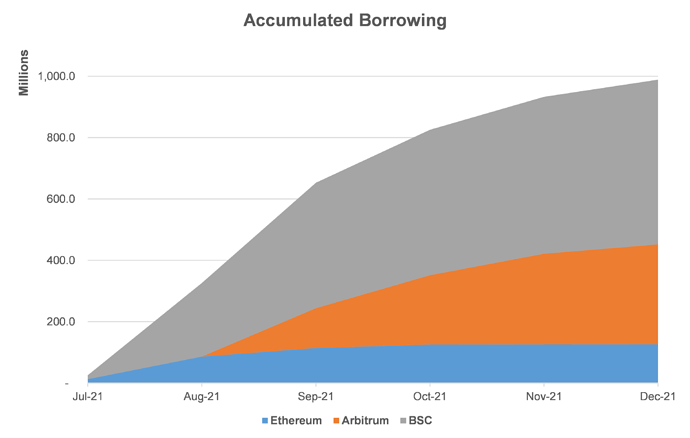

dForce recorded a total accumulated borrowing of $988.8m, representing an upward trend of whopping $56.2m in new loan originations.

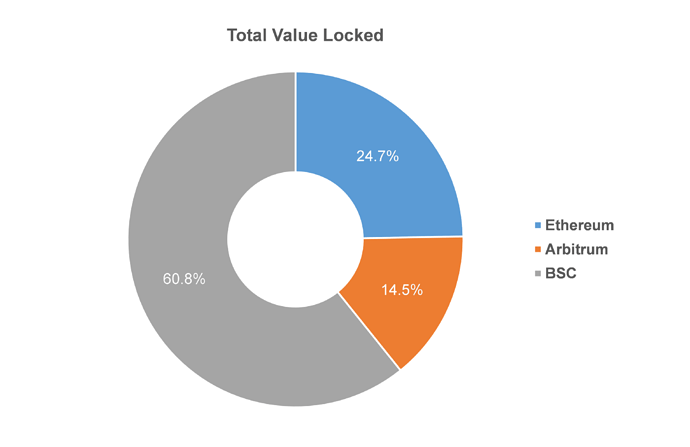

Total value locked on dForce across Ethereum, Arbitrum, and Binance Smart Chain amounted to $95.5m. Out of which, 60.8% is parked on Binance Smart Chain, 14.5% on Arbitrum, and 24.7% on Ethereum.

Revenue Breakdown

- Platform Revenue: the total of interest paid by borrowers and fees generated from minting stablecoins (USX and EUX).

- Protocol Revenue: the total of reserves (interest spread between lending and borrowing) and fees generated from minting stablecoins (USX and EUX), which will be used to facilitate DF repurchase subject to future governance approval.

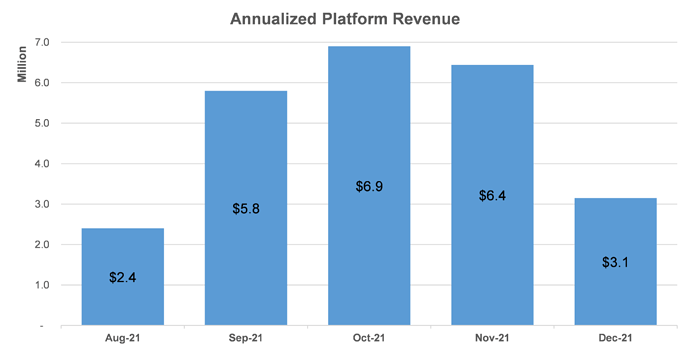

In December, dForce recorded a projected Annualized Platform Revenue of $3.1m, contributed by interest paid by borrowers (on dForce Lending) and stablecoin minting fee (on dForce & Liqee).

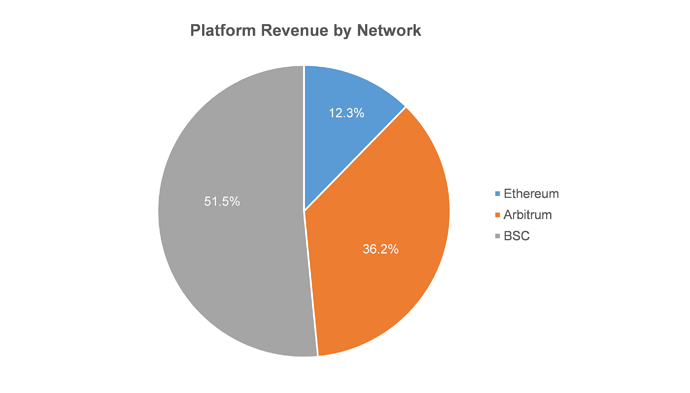

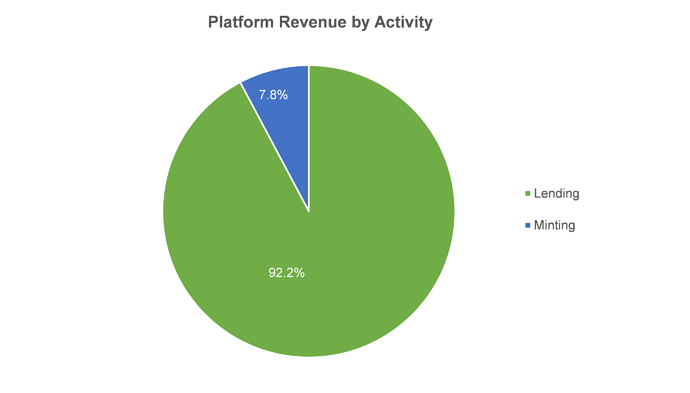

Looking at the Platform Revenue,

- By network: 12.3% from Ethereum, 51.5% from Binance Smart Chain, and 36.2% from Arbitrum.

- By activity: 92.2% from lending (interest paid by borrowers), 7.8% from stablecoin minting.

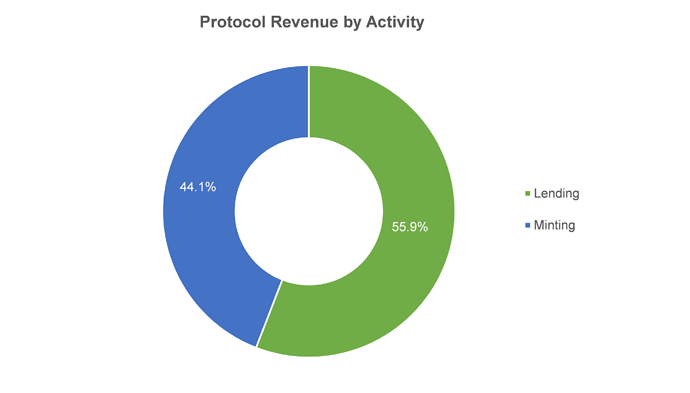

For Protocol Revenue, approximately 55.9% were contributed by lending activities (interest spread), 44.1% from minting.

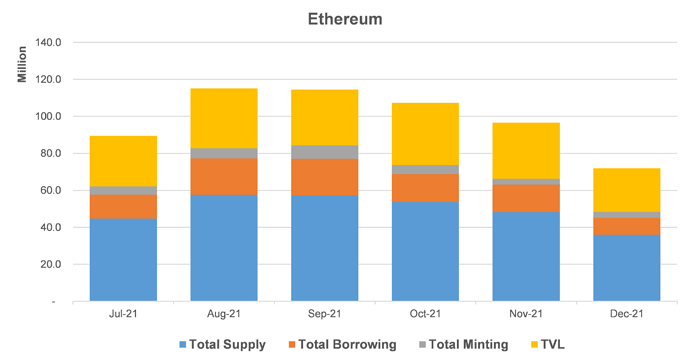

Ethereum

By end of December, dForce Lending achieved a Total Supply of $35.9m, a Total Borrowing of $9m, $3.2m in Total Minting and $23.6m in Total Value Locked on Ethereum.

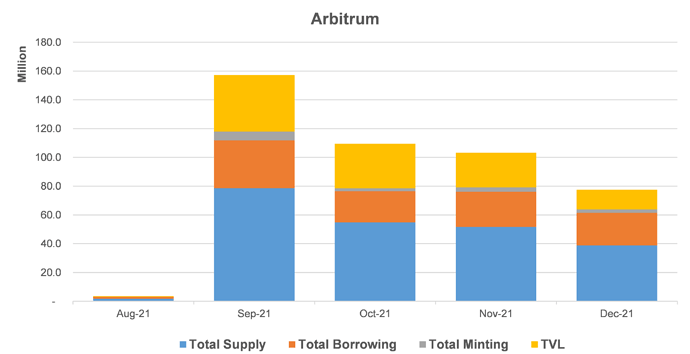

Arbitrum

On Arbitrum, dForce Lending achieved a Total Supply of $38.8m, Total Borrowing of $22.6m, Total Minting of $2.3m, with a Total Value Locked of $13.8m in December.

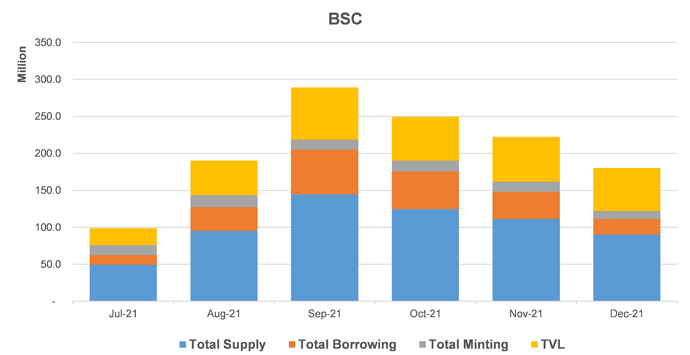

Binance Smart Chain

On Binance Smart Chain, dForce Lending achieved a Total Supply of $90m, Total Borrowing of $21m, and Total Minting of $11m, with a Total Value Locked of $58m in December.

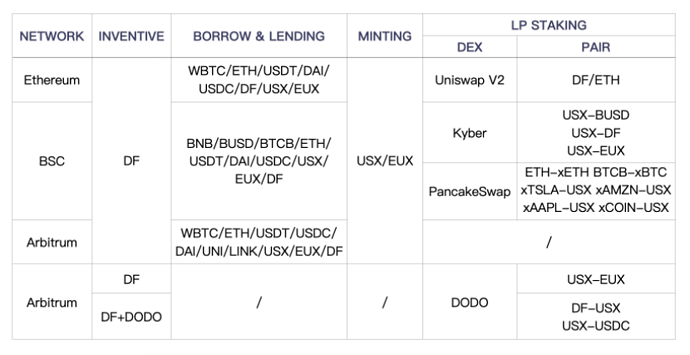

Liquidity Mining

dForce launched liquidity mining initiatives on Ethereum, Arbitrum, and Binance Smart Chain simultaneously, and worked with DODO to offer dual incentives to participants on Arbitrum. Please visit dForce Forum to view the gauge (update on a weekly basis). Click here to see related tutorials.

Product Development

- dForce Vaults (launched)

Accept a wider variety of assets as collateral with a new risk model and independent pool to mint USX. The first batch of supported collateral assets are iUSDT, iUSDC, and iDAI.

- DF Staking (expected launch in January)

The DF staking system allows users to stake DF token in exchange for vDF token, which can be used to propose and vote on critical protocol decisions, capture value directly from dForce protocols, and receive inflationary rewards from staking, etc. Coming soon!

- Cross-Chain Bridge (expected launch in January)

A toolkit facilitating immediate swap for dForce native stablecoins across Ethereum, Arbitrum, Optimism and BSC. It will soon support all cross-chain services for dForce’s native stable assets between Ethereum, Arbitrum, Binance Smart Chain, and Optimism.

- PDLP (launched)

Accept interest-bearing tokens as collateral to mint dForce-backed stablecoins, effectively combating liquidity shortage for whitelisted protocols integrated with USX and EUX.

- POO (expected launch in January)

Leverage treasury assets and act as counterparty and super user to ensure supply and demand are in equilibrium with optimized efficiency.

- Dashboard (expected launch in January)

The Dashboard will give users an easy-to-read form of key information relating to the protocol performance, including TVL, revenue, assets, etc.

- Others

- Extend lending and collateral support to wstETH on dForce.

- New BUSD-USX pool with DODO on BSC.

- dForce added collateral support to wstETH! This allows users to borrow against collateralized wstETH. wstETH stands for wrapped stETH, a DeFi-compatible version of the stETH token which allows for easier integrations with DeFi protocols. As most DeFi protocols require a constant balance mechanism for tokens, Lido lets you ‘wrap’ your stETH into wstETH to keep your balance of stETH fixed. Instead of updating daily, wstETH uses an underlying share system to reflect your earned staking rewards.

Extended Readings: How to get wstETH

Governance

DIP017 — Add Collateral Support to wstETH [Passed]

This approval seeks to add collateral support to Lido’s wstETH, allowing users to borrow against wstETH.

DIP018 — Proposal for the Deployment of EntroFi Vault[Passed]

This proposal seeks approval to extend USX facility to EntroFi, serving the purpose of providing liquidity to crypto trading firms, with dForce’s representative entity or appointed entity acting as fund custodian.

DIP019 — Proposal for the Implementation of PDLP and POO[Passed]

It is proposed to implement PDLP (Protocol-Direct-Liquidity-Provision) and introduce protocol-owned liquidity to lending protocols integrated with USX and EUX. It is also proposed to implement POO (Protocol-Owned Operator) and leverage treasury liquidity to further boost supply and demand.

Marketing

-

On December 16th, Eve, Chief of Global Operations participated in AMA hosted by Go Pocket in their telegram community.

-

dForce was listed on LATOKEN.

-

dForce held 2 exciting activities to celebrate Christmas with $DF reward giveaway. Click here for full details.

We welcome you to join our community to participate in related discussions.