dForce is a decentralized stablecoin protocol powered by an integrated DeFi matrix (assets, lending, trading, and bridge). dForce is currently available on nine different blockchains (Ethereum, Arbitrum, Optimism, BSC, Polygon, Avalanche, KAVA, Conflux eSpce, zkSync, and now also Base) and boasts around $200 million in Total Assets. dForce is a community-driven project, with major protocol changes driven by the community and jointly decided by dForce token (DF) holders through governance.

dForce is backed by a world-class investor consortium including Multicoin Capital, CMBI and Huobi Capital, with a TVL of $320m across all supported chains. dForce Lending is now the largest lending protocol on Arbitrum, and the 3rd largest on BSC by TVL. dForce’s smart contracts are audited by Trail of Bits, ConsenSys Diligence, Certik, and Certora, with a bug bounty launched through Immunefi.

Core Protocols

Stablecoin USX

USX is the first decentralized stablecoin natively integrated with dForce’s DeFi matrix.

USX’s pegging mechanism is mainly maintained by the Liquidity Stability Reserve (LSR). LSR is a stability module of USX, allowing users to use USDC, USDT, and DAI to 1:1 mint USX and redeem for reserve stablecoins. Reserve stablecoins will be automatically supplied to dForce Lending, which can be lent out to earn interest - this mechanism ensures that USX minted through the LSR module are always over-collateralized.

USX is also powered bythe Protocol-Direct-Liquidity-Provision (PDLP), a module to enhance USX liquidity in the open market.

USX can be bridged across all supported L1/L2s at near-to-zero cost, making it an ideal conduit to facilitate cross-chain liquidity. USX has a proven track record of being stable, permission-lessness, non-custody, high capital efficiency, and multi-chain.

dForce Lending

A non-custodial lending protocol that supports multiple collaterals with market-driven dynamic interest rates. Simply put, it is a platform where users can frictionlessly supply crypto as collateral to borrow other crypto assets based on interest rates set by real-time supply and demand.

dForce Lending has undergone extensive code reviews and security audits by Trail of Bits, ConsenSys Diligence, CertiK, Certora (formal verification), with a bug bounty launched through Immunefi. dForce Lending has been deployed for over 1 year and is well battle-tested.

- How to supply assets?

- How to borrow assets?

- How to repay your loan?

- How to liquidate a default loan? 1

dForce Bridge

The dForce Birdge enables instant and low-cost transfers of USX and DF across all supported L2s and blockchains.

Base Token Contracts

USX: 0xc142171B138DB17a1B7Cb999C44526094a4dae05

Connect to Base

- Visit https://app.dforce.network to open the dForce DApp.

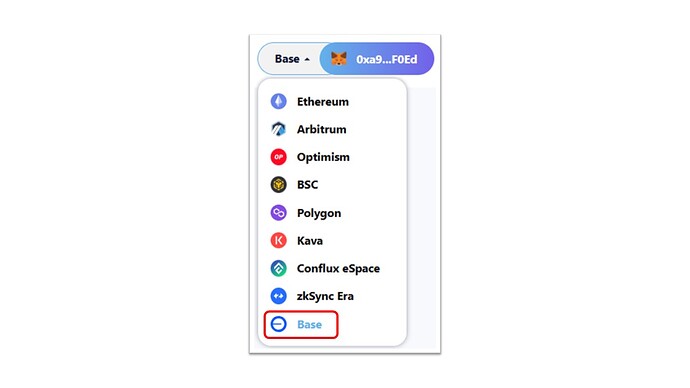

- Click on the top-right corner and switch the chain to Base.

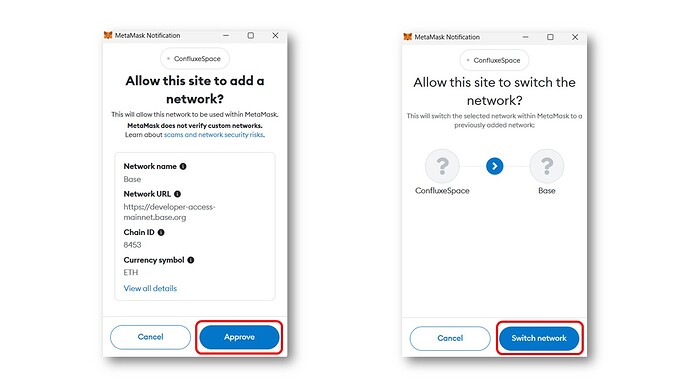

- If it is the first time you connect your wallet to Base, then Metamask will ask for your consent to add the chain. Click on “Approve”, and then on “Switch Network”.

If you have already added Base to Metamask, then you only need to click on “Switch Network” once the Metamask pop up appears.

- Done! You can now bridge DF and USX to and from Conflux through dForce bridge, use our Lending platform, mint USX through the LSR mechanism, participate to the governance and more!

Have questions? Reach us out on Discord or Telegram, all the useful links are below.

Useful Links:

- Website: https:// s://medium.com/dforcenet

- App: https://app.dforce.network/ 4

- Docs: https://docs.dforce.network/

- Forum: https://forum.dforce.network/

- Medium: dForce - Medium

- Twitter: https://twitter.com/dForcenet

- Discord: dForce

- Telegram: Telegram: Contact @dforcenet