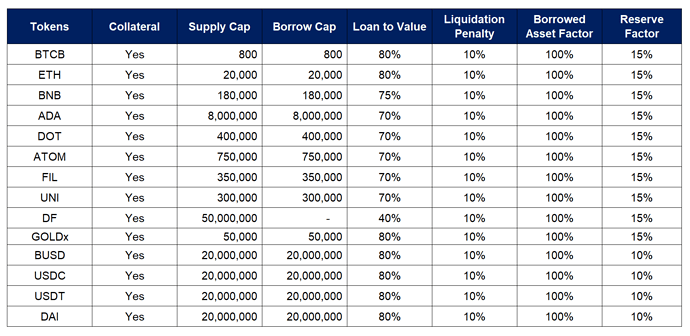

Risk Parameters for Proposed Assets on BSC

Highlights of Main Assets Supported by dForce Lending on BSC

BTC (BTCB) is the first decentralized cryptocurrency that uses peer-to-peer technology to facilitate instant payment, without the intermediation of a third party. Bitcoin (BTC) was created to as a reward for miners to maintain the public ledger that records bitcoin transactions. BTC is the oldest, most liquid, and most well-known cryptocurrency by far, with a total circulating market capitalization of $1 trillion and 24h trading volume of $50 billion.

ETH is the native token of the Ethereum network. Users need to pay gas fee denominated in ETH while interacting with smart contracts. A majority number of decentralized applications are currently built on Ethereum, with ETH accounting for the biggest slice of pie of the total funds staked in DeFi projects. ETH is the second largest cryptocurrency with a total circulating market capitalization of $208 billion and 24h trading volume of $23 billion.

BNB is the native token of the Binance Chain and powers the entire Binance Ecosystem. BNB can be used to fuel transactions on Binance Chain and Binance Smart Chain, pay transaction fees on Binance Exchange, and settle in-store payments. BNB ranks is the third largest cryptocurrency with a total circulating market capitalization of $44 billion and 24h trading volume of $8.6 billion.

ADA is the native token of the Cardano network, a decentralized open-source project that runs a public blockchain platform for smart contracts, providing secure and sustainable environment for decentralized applications. ADA is used for transacting and paying for smart contract operations. ADA ranks #5 on CMC with a circulating market capitalization of $37 billion and 24h trading volume $5.4 billion.

DOT is the native token of the Polkadot network, serving three distinct purposes: governance, staking and bonding. Polkadot is an open-source multichain network that facilitates interoperability between public blockchains, with a target to power the cross-blockchain transfer of tokens, data, and any type of assets. DOT ranks #6 on CMC with a circulating market capitalization of $35 billion and 24h trading volume of $3 billion.

ATOM is the native token of the Cosmos network, used for staking, transaction payment, and governance voting. Cosmos, widely known as ‘Internet of Blockchains’, launched mainnet in March 2019. It aims to tackle the lack of interoperability across different blockchains and functions as a bridge for blockchains to communicate with each other in a seamless manner. ATOM ranks #20 on CMC with a circulating market capitalization of $4.2 billion and 24h trading volume of $775 million.

FIL is the native token powering the Filecoin network, which launched mainnet in October 2020. Filecoin is a distributed network that leverages the power of blockchain technology to provide a peer-to-peer system facilitating file storage, sharing and retrieval. Filecoin users pay miners for storage, retrieval, and distribution of data, while miners get FIL rewards for providing such services. FIL ranks #41 on CMC with a circulating market capitalization of $2.4 billion and 24h trading volume of $629 million.

UNI is the governance token of Uniswap, a decentralized exchange allowing for automated and permission-less token exchange on Ethereum and the most popular Dapp by far. Uniswap logs more than $1 billion in daily trading volume, with a total market capitalization of more than $17 billion.

DF is the utility and governance token of dForce, facilitating governance, risk buffer and interest alignment across the dForce network, which advocates for building an integrated and interoperable open finance and monetary protocol matrix covering asset, trading and lending. dForce protocols are open-sourced and permission-less. Everyone with internet connection can participate with the same level of access, without interventions of intermediaries. DF logs more than $3 million in daily trading volume, with a total market capitalization of more than $41 million. DF is also supported by dForce Lending on Ethereum.

In consideration of the relatively low market capitalization and trading volume, we propose a Collateral Ratio of 40%, Supply Cap of 50 million DF and Borrow Cap of 0 DF.

GOLDx is a gold token denominated in grams and launched by dForce. As a synthetic gold token backed by gold token reserves (currently with PAXG as its sole constituent, which is adjustable through on-chain governance), GOLDx is featuring zero transaction fees (excluding fee levied by Paxos for on-chain transactions of PAXG)) and is 100% compatible with all DeFi protocols. GOLDx is also supported by dForce Lending on Ethereum.

PAXG is a gold token regulated by NYDFS and is 100% back by London Good Delivery physical gold bar certified by the London Bullion Market Association.

Stablecoin Assets Supported by dForce Lending on BSC

In addition to captioned assets listed above, we also propose to add 4 types of most widely adopted stablecoins, including BUSD, USDC, USDT, and DAI, which are also supported by dForce Lending on Ethereum.