Welcome to the March dForce Ecosystem Update — a dive into the past month and new releases around the corner!

Overview

dForce Lending & Synthetic Asset Protocol

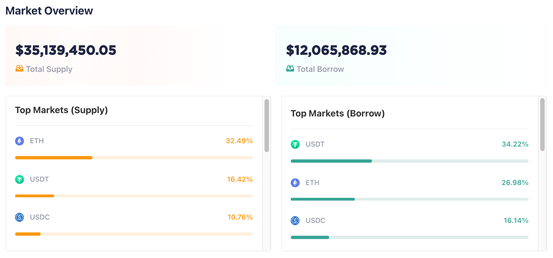

Following the soft launch of dForce Lending V1, a pool-based lending protocol with tightened risk control, we have achieved a total supply of $35m and a total borrow of $12m during the first month. We are in the process of adding new handler and strategy support for dForce Yield Markets to connect liquidity pools with dForce Lending.

( 数据来源 : https://app.dforce.network/#/lending/Markets/mainnet)

In the soon-to-be-launched dForce Lending V2, we will be introducing a built-in synthetic asset protocol and will kick off dForce yield farming to bootstrap initial liquidity and further grow TVL.

Revamped tokenomics with staking reward and more important features of DF token will be disclosed soon.

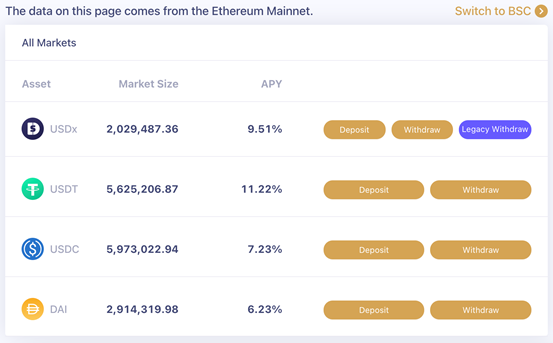

dForce Yield Markets

Stablecoin saving interest on dForce Yield Markets ranges from 6.23% to 11.22% APY. As a yield aggregator, dToken only allocate collected funds to long-standing lending protocols for risk-adjusted yield. Saving yield and liquidity (available for instant withdrawal) is subjected to underlying DeFi protocols, including Compound and Aave on Ethereum, CREAM and dForce Lending on Binance Smart Chain.

GOLDx

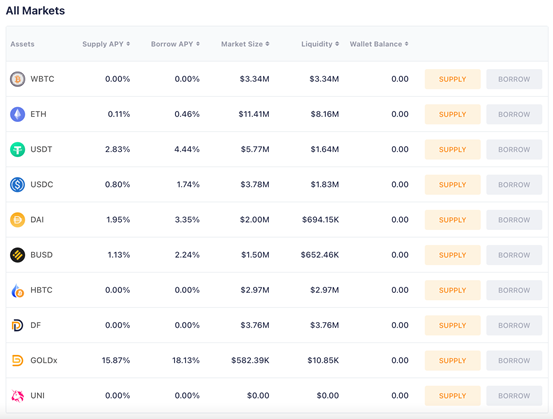

It is worth noting that the listing of GOLDx makes it the first blockchain-issued gold to earn interest in the DeFi space. dForce Lending is also the first DeFi protocol that provides a yield market for gold and accepts gold as collateral to support crypto loans, taking a bold step forward in pushing DeFi to the masses.

Supply APY on GOLDx is 15.87% on dForce Lending, with a compound investment return of around 22.8% by leveraged borrowing (click here to learn more) – this is in addition to the price appreciation of underlying gold.

(数据来源: https://app.dforce.network/#/lending)

dForce (DF) Farming

At the time of writing, dForce offers yield farming for dForce Yield Markets, GOLDx, and DF, with APY ranging from 11.84% to 32.17%.

With the maturity of DeFi mining in effectively attracting liquidity and growing TVL, we plan to revamp dForce mining through different pilot initiatives to bootstrap different combination of protocols, especially dForce Lending & Synthetic Asset Protocol. More details will be disclosed in the next month or so. Stay tuned!

Product

Lending & Synthetic Asset Protocol

• Lending protocol recently added 5 assets and will soon expand to the Binance Smart Chain ecosystem.

• Following Certik and Certora, smart contract audit has been completed for V2 (covering Synthetic Asset Protocol) by Trail of Bits, with all identified vulnerabilities fixed. Continued security review of the 4th round by Consensys Diligence in process.

• Formal verification in process to ensure rigorousness of the design during implementation.

• UI/UX optimization with a consolidated interface of all dForce native protocols.

• Expected V2 launch in May.

dForce Trade

• AMM development completed.

• Verification in process.

• About to kick off smart contract audit in the next few weeks.

dForce Farming

• Revamped incentivization will be distributed based on TVL or liquidity contributions.

• Revamped tokenomics will introduce DF staking yield and many other critical features (details to be disclosed soon, stay tuned)

Integrations

dForce has recently announced the integration with Chainlink on mainnet. dForce will utilize a variety of Chainlink Price Feeds for both its lending protocol as well as its upcoming synthetic asset protocol. This integration will support dForce’s multi-chain ecosystem, using Chainlink Price Feeds natively on Ethereum and Binance Smart Chain (BSC).

Extended Readings:

dForce Integrates with Chainlink Oracle on Mainnet as the Oracle to Secure Its Lending and Synthetic Asset Protocol

Governance

DIP007 – Proposal for the 2nd Batch of Assets to be Supported by dForce Lending (Passed)

It got approved by governance DIP007 that UNI, BUSD, DF, GOLDx, and HBTC be listed as the 2nd batch of assets supported on dForce Lending. Under dForce’s Risk Assessment Guideline, each asset will have different test scores, risk parameters, and risk analysis, which can be viewed here.

DIP008 – Proposal for the deployment of dForce Lending on Binance Smart Chain (BSC) and Asset Listing (Passed)

DIP008 was passed with agreed deployment of dForce Lending on Binance Smart Chain (BSC) and the listing of BTCB, ETH, BNB, ADA, DOT, ATOM, FIL, UNI, DF, GOLDX, BUSD, USDC, USDT, and DAI, as the 1st batch of assets supported. dForce adopts a different risk policy catering to different non-Ethereum blockchains. Risk assessment for each asset can be viewed here.

Marketing

On 12 March, Mindao Yang, Founder of dForce participated in a panel discussion hosted by Digital Week Online and talked about the frenzy of NFT.

On 22 March, Mindao was invited to an AMA hosted by Binance Smart Chain, and introduced dForce Lending and the soon-to-be-launched Synthetic Assets Protocol. According to Mindao, dForce aims to become the infrastructure of open finance, with lending playing a critical role in the matrix. With the approaching launch of Synthetic Asset Protocol, it is expected to further reduce friction and achieve higher capital efficiency for our users.

On 30 March, Mindao shared his views on possible impacts on DeFi 2.0 by a number of recently-introduced public chains backed by major crypto exchanges, during a panel hosted by CANDAQ.

On 31 March, Mindao was invited to ‘51% with Mable Jiang’, a podcast backed by Multicoin Capital, where he specifically shared how his understanding of finance guided the roadmap of dForce, and how dForce continuously aims to improve the scalability and capital efficiency across different DeFi protocols.

dForce Token (DF)

Currently, over 30 exchanges support trading of DF, including:

• Binance (https://www.binance.com/en/trade/DF_ETH)

• Huobi (https://www.huobi.com/zh-cn/exchange/df_usdt/)

• Gate.io (https://www.gate.io/trade/DF_USDT)

• MXC (https://www.mxc.com/trade/easy#DF_USDT)

• HBTC (https://www.hbtc.com/exchange/DF/USDT)

• Hotbit (https://www.hotbit.io/exchange?symbol=DF_USDT)