Summary:

Based on community’s feedback and expressed interests, we performed risk assessments in accordance with dForce Risk Framework for a number of cryptoassets, and hereby propose to list UNI, DF, GOLDx, BUSD and HBTC (with proposed risk parameters) as the second batch of assets to be supported by dForce Lending.

Background:

With a vision to build dForce Lending into the most secure and adaptable lending protocol catering to diversified use cases, we want to give users greater choices with a wide range of cryptoassets with the highest security standard. All proposed assets need to meet a minimum score of above 60 according to dForce Risk Framework.

For asset listing in the future, community is welcome to nominate assets they want to support in our Forum, dForce team will perform initial risk assessments for the most popular assets proposed (including risk parameters), and formulate proposal on-chain. The final decision remains in the hands of DF token holders and can only be accepted upon the approval of governance proposal through Snapshot.

Further reading: dForce’s Risk Assessment Guideline

Proposal:

We propose to list UNI, DF, GOLDx, BUSD and HBTC as the second batch of assets to be supported by dForce Lending with test scores as below:

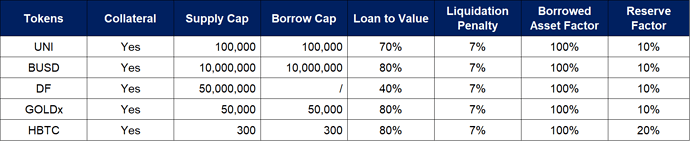

Risk parameters for proposed assets are as below:

Risk Analysis per Asset:

UNI [Overall Score: 81]

UNI is the governance token of Uniswap, a decentralized exchange allowing for automated and permission-less token exchange on Ethereum and the most popular Dapp by far. Uniswap logs more than $1 billion in daily volume, with a total market capitalization of more than $17 billion.

We propose a Collateral Ratio of 70%, Supply Cap and Borrow Cap at 100,000 UNI, respectively.

UNI Smart Contract Risk: 58

Uniswap was founded in 2018 but UNI came live on Ethereum since 16 September 2020, with 2 million verifiable on-chain transactions since deployment.

UNI Financial Risk: 91

Uniswap is the largest decentralized exchange with a market capitalization of more than $17 billion and 24h trading volume of $1.5 billion. It ranks #48 on CoinMarketCap in terms of market capitalization.

UNI Counterparty Risk: 82

Uniswap is a DEX allowing buyers and sellers to exchange ERC-20 tokens in a trustless and permission-less manner, and do not rely on intermediaries to facilitate the process.

BUSD [Overall Score: 83]

BUSD is a regulated digital dollar launched by Binance in partnership with Paxos. BUSD can be purchased and redeemed at 1 BUSD for 1 US dollar. Paxos Trust Company is the fiat reserve custodian of BUSD.

We propose a Collateral Ratio of 80%, Supply Cap and Borrow Cap at 10,000,000 BUSD, respectively.

BUSD Smart Contract Risk: 70

BUSD has steadily been gaining traction since its deployment on Ethereum network on 10 September 2019. Despite the relatively short history, BUSD continues to grow its DeFi offerings as an emerging player with great potentials.

BUSD Financial Risk: 98

With $2.9 billion market capitalization and $3.7 billion trading volume in 24h, BUSD is now the third largest stablecoin on the market.

BUSD Counterparty Risk: 75

BUSD is a 1:1 USD-backed stablecoin approved by the New York State Department of Financial Serves (NYDFS), issued by Binance in partnership with Paxos. Paxos Trust Company maintains custodian service for USD reserves of BUSD.

DF [Overall Score: 72]

dForce Token (DF) is the utility and governance token of dForce, which facilitates governanvece, risk buffer and interest alignment across dForce network, which advocates for building an integrated and interoperable open finance and monetary protocol matrix covering asset, trading and lending.

In consideration of financial risks associated, we propose a Collateral Ratio of 40%, Supply Cap of 50 million DF and Borrow Cap of 0 DF.

DF Smart Contract Risk: 73

dForce Token (DF) was audited by PeckShield and has been deployed on Ethereum for more than one year with 46K verifiable on-chain transactions.

DF Financial Risk: 63

DF is a ERC20 token deployed on Ethereum since July 2019, with a circulating market capitalization of $73.7 million and 24h trading volume of $4.8 million. Since the circulating market cap and trading volume are smaller than other assets accepted, we apply a relatively lower score.

DF Counterparty Risk: 80

dForce protocols are open-sourced and permission-less. Everyone with internet connection can participate with the same level of access, without interventions of intermediaries.

GOLDx [Overall Score: 75]

GOLDx is a gold token denominated in grams and launched by dForce. As a synthetic gold token backed by gold token reserves (currently with PAXG as its sole constituent, which is adjustable through on-chain governance), GOLDx is featuring zero transaction fees (excluding fee levied by Paxos for on-chain transactions of PAXG)) and is 100% compatible with all DeFi protocols.

PAXG is a gold token regulated by NYDFS and is 100% back by London Good Delivery physical gold bar certified by the London Bullion Market Association.

We propose a Collateral Ratio of 80%, a relatively lower Supply Cap of 50,000 GOLDx (equivalent of $2.7 million) and Borrow Cap of 50,000 GOLDx.

GOLDx Smart Contract Risk: 55

GOLDx became available on Ethereum since July 2020, with smart contract security audit completed by SlowMist.

GOLDx Financial Risk: 79

As a wrapper of PAXG, GOLDx tracks the spot price of gold from LME (London Metal Exchange) and is always redeemable for real gold through PAXG, which has a circulating market capitalization of $124 million with $9.4 million trading volume in 24h. The market risk is correlated to gold price.

GOLDx Counterparty Risk: 80

GOLDx is currently 100% backed by PAXG. Anyone can use the protocol to mint GOLDx with PAXG, or burn GOLDx to get back your PAXG deposit.

Paxos is a chartered trust company regulated by the New York State Department of Financial Services (NYDFS). It has opened accounts with Brink’s bullion vaults in London, which will maintain the vault or vaults for storage of allocated gold corresponding to PAXG.

HBTC [Overall Score: 74]

HBTC is a Ethereum-based BTC launched by Huobi Global (the largest crypto exchange in China) and is 100% backed by BTC reserves. It is currently the second largest BTC-pegged token on Ethereum in terms of market capitalization.

Similar to WBTC, HBTC has a lower score on counterparty risk due to its reliance on central entity’s custody, hence we propose a Collateral Ratio of 80%, a relatively lower Supply Cap of 300 HBTC and Borrow Cap of 300 HBTC.

HBTC Smart Contract Risk: 63

HBTC was deployed on Ethereum on 9 December 2019 by Huobi Global, who provides custodian service for BTC reserves and ensures full redemption of HBTC through Huobi Exchange.

HBTC Financial Risk: 93

HBTC has gained a market cap of US$1.2 billion with around US$400 million trading volume in 24h.

HBTC Counterparty Risk: 60

HBTC is launched by Huobi Global, a leading global digital asset exchange. Since the custody of BTC reserves is also maintained by Huobi Global, we apply a lower score.

Vote through Snapshot.