Summary

This proposal seeks to add collateral support for stETH Senior Perpetual Yield Tranches (PYTs) with 80% LTV, benefiting from the higher protection grade provided by this asset.

Motivation

Idle DAO partnered with Lido to bootstrap stETH Perpetual Yield Tranches (PYTs).

The PYT primitive is epochless (no locking periods) and is composed of fully-composable Junior and Senior Tranches. Senior Tranches have a first lien on the assets — they’re in line to be repaid first, in case of default.

This feature provides higher-quality collateral, protecting dForce’s liquidity providers thanks to the built-in fund protection mechanism.

Senior Tranches enable lending protocols to integrate new yield sources with limited exposure to counterparty risks, providing a higher LTV ratio and opening their doors to new liquidity.

Lido’s stETH is already listed as a collateralized asset with a 75% LTV ratio, thus Idle DAO proposes the listing of stETH Senior PYT with 80% LTV

The integration of the proposed collateral would enable Idle liquidity providers to use dForce as the primary market to take out loans using their stETH Senior PYT deposits.

Liquidity

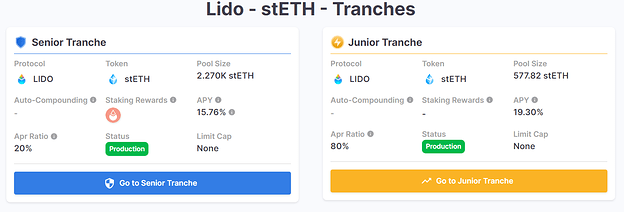

stETH PYTs manages approximately 2800 ETH: 80% is deposited on the Senior Tranche and 20% on the Junior one.

About PYTs

With Perpetual Yield Tranches, LPs can earn a higher share of yield by taking more risk (with Junior Tranche), or they can hedge risk by depositing their assets into an inherently protected tranche (with Senior Tranche).

Idle DAO launched PYTs in late December, after 4 months of guarded launch. Idle PYTs’ smart contracts have been audited by two different professional auditing firms before the release (Consensys Diligence and Certik). All the related and previous audits for the Idle protocol are available here.

PYTs are:

- Epochless, flexible, with no locking periods: you can deposit or withdraw your liquidity at any time;

- Fully fungible and composable ERC-20: other DeFi protocols and integrators can offer tailored products based on PYTs;

- High-quality yield-bearing collateral: the built-in fund protection mechanism available on Senior Tranches makes them more resilient against default scenarios and can benefit from higher LTV.

About Idle

Idle DAO is a decentralized organization that builds financial infrastructure for Web3. Businesses of every size – from brand new DeFi protocols to public companies – use our protocol to optimize capital efficiency and manage their treasuries with DeFi. We believe that everyone deserves the best for their idle funds, both in terms of returns and risks.

Since 2019, Idle has rolled out the features and services that allowed us to battle-test our products throughout the years and become one of the most resilient protocols in the space.

To learn more about our products and services:

Informal Poll

- For - Approve stETH Senior PYT as collateral with 80% LTV

- For - Approve stETH Senior PYT as collateral with 75% LTV

- Against - Do nothing

0 voters