Summary

This approval seeks to add collateral support to Lido’s stETH, allowing users to lend and borrow against stETH.

Overview of stETH and Lido

stETH is a token that represents staked ETH with Lido, allowing users to earn ETH 2.0 staking yield without locking Ethers (aka liquid staking Ether). Users who stake with Lido will receive daily rewards in the form of stETH balance, which accrues automatically over time. stETH can be traded or transferred at any time.

Lido is a decentralized liquid staking solution built on Ethereum 2.0’s Beacon chain and is governed by the Lido Decentralized Autonomous Organization (DAO).

Liquidity

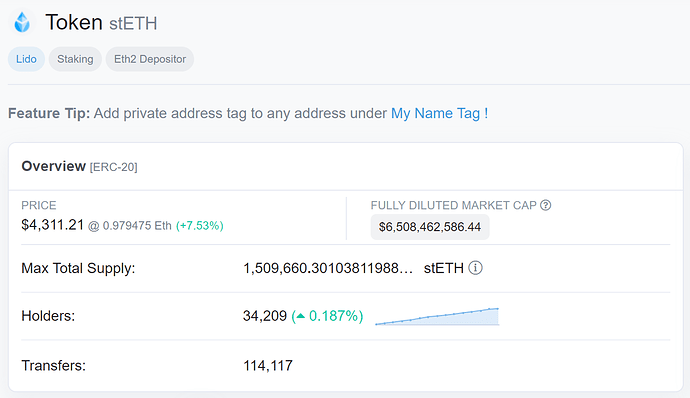

Total supply of stETH stands at 1,509,660 with a market capitalization of $6.5 billion, 34,209 holders and 114K verified transactions on-chain.

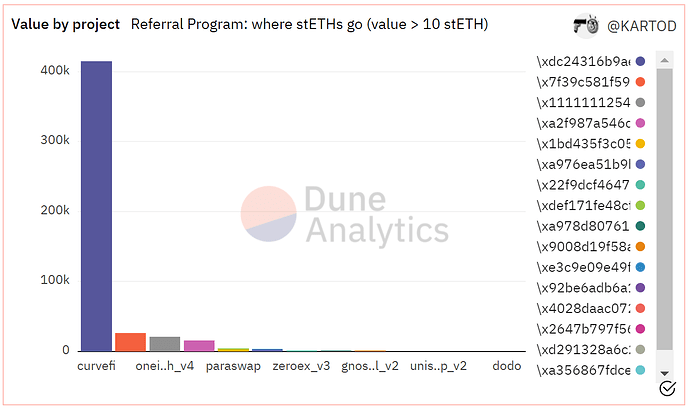

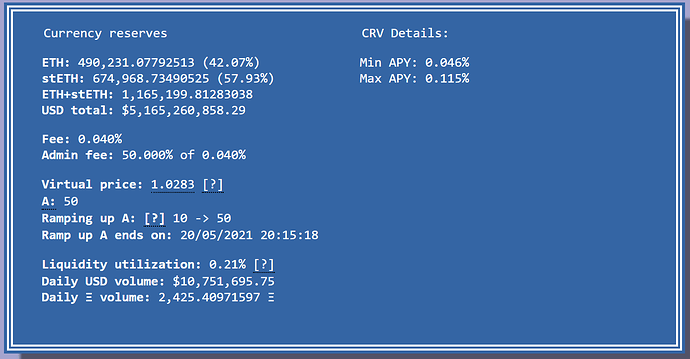

stETH is primarily traded on Curve’s stETH/ETH pool, which currently holds $5.2 billion worth of stETH and ETH with daily trading volume standing at $10 million.

Security Audits

Lido’s smart contracts are audited by Sigma Prime and Quantstamp.

Potential Risks

There exist a number of potential risks when staking with Lido, mainly including:

-

Smart contract security

Smart contract bugs and vulnerabilities. -

Slashing risk

Lido stake across multiple professionals and node operators with heterogenous setups. -

DAO key management risk

ETH staked with Lido DAO is held across multiple accounts backed by a multi-signature threshold scheme to minimize custody risk.

Motivation

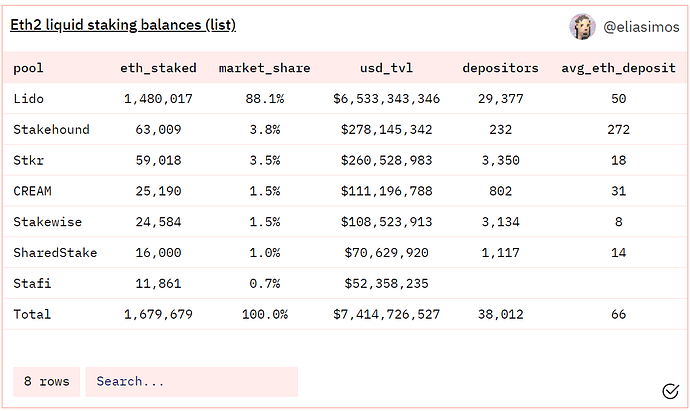

Liquid staking solutions provide an approach for average investors to stake without the need to lock assets into a future, acquire technical skills, or maintain related infrastructures. There has been increased interest in staking ETH, with Lido dominating the booming market with a market capitalization of $6.5 billion, accounting for 88.1% of the total staked ETH.

By staking ETH through Lido Protocol, user will receive stETH in return with staking rewards accrued through growing balance of stETH on a daily basis. stETH removes liquidity crisis associated with ETH staking, meaning that you can transfer, trade, redeem for underlying ETH at any time.

It is proposed to onboard stETH as collateral on dForce, so that we can engage in a broader range of DeFi activities to earn additional returns on staked ETH. For example, deposit stETH to borrow ETH for leveraged staking yields, or borrow to capture the value of the next-best alternative.

Smart contract risk

The Lido code is open-sourced, audited and covered by extensive bug bounty program. stETH records 114K verifiable on-chain transactions since its launch in December 2020.

Financial risk

stETH is the dominant liquid staking solution for ETH with a market capitalization of $6.5 billion, accounting for 88.1% of the total staked ETH. The stETH/ETH pool on Curve facilitates a daily volume of $11K.

Counterparty risk

Lido is a DAO. Decisions in the Lido DAO are made through proposals and votes - community members manage protocol parameters, node operators, oracle members and more. The Lido staking infrastructure for stETH consists of 9 node operators, with a focus on decentralization.

Lido relies on a set of oracles to report staking rewards to the smart contracts. Their maximum possible impact is limited by the recent upgrade, and the operators of oracles are all well-known entities including Stakefish, Certified One, Chorus, Staking Facilities and P2P.

Informal Poll

Do you support onboarding stETH to dForce as collateral?

- Yes

- No

0 voters