We have performed stringent risk assessments aligned with the dForce Risk Methodology for assets chosen by the dForce community, and would like to share with everyone the proposed risk parameters and assessment result for each asset.

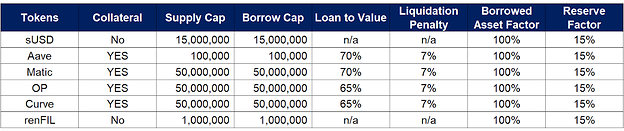

Risk Parameters for Proposed Assets

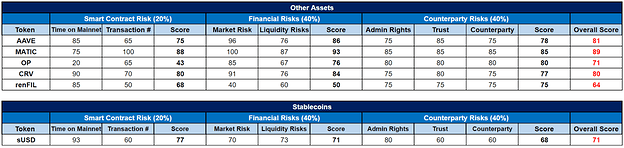

Risk per Asset:

AAVE (Aave)

AAVE is the native token of the Aave platform, which is an open-sourced and non-custodial liquidity protocol, enabling users to borrow crypto assets and earn on deposits. It was one of the first Ethereum-based lending platforms on the market when it was launched under the name ‘EthLend’ back in 2017 before rebranding to Aave. Today, Aave is one of the largest DeFi lending platforms in the industry, powered by AAVE token as a community-driven DAO token.

- Smart Contract Risk

AAVE was deployed on Ethereum in October 2020 and has undertaken multiple audits by Trail of Bits, Certora, OpenZeppelin, Sigma Prime, Peckshield, ABDK. Aave also launched a safety module backed by AAVE token, as well as a bug bounty program to incentivize disclosure of bugs.

- Financial Risk

Today, AAVE is one of the top 50 assets by market capitalization with a daily trading volume of over 1 million dollars. It has 1.5 million verifiable transactions on the Ethereum network with 114k holders.

- Counterparty Risk

Aave is governed in a decentralized manner by AAVE token holders who contribute actively to the development of Aave, collectively managing the level of risks and rewards in Aave’s money market.

MATIC (Polygon)

Polygon, previously known as Matic Network, is a decentralized Ethereum scaling platform that enables developers to build user-friendly apps with low transaction fees. MATIC is the native cryptocurrency that powers the Polygon Network, which can be used to pay transaction fees and participate in proof-of-stake consensus.

- Smart Contract Risk

Polygon launched as Matic Network in 2017 and rebranded to Polygon Network in February 2021. It holds more than 1,810m on-chain transactions with 149m unique addresses and has gained significant traction with hundreds of protocols contributing to the network.

- Financial Risk

MATIC records a market capitalization of $3,693m with $900m trading volume in 24 hours, and is available on many centralized & decentralized exchanges with high liquidity.

- Counterparty Risk

Polygon has a community with tens of thousands of developers, validators, token holders, creators, builders and believers alike. The MATIC token is designed to enable network governance where token holders can vote on Polygon Improvement Proposals (PIPs).

OP (Optimism)

Optimism is one of the layer 2 scaling solutions powered by Optimistic rollups technology, which bundle large amounts of transaction data into digestible batches. Optimism is much cheaper to use than Ethereum, and it’s increasingly becoming popular along with other layer 2s, such as Arbitrum. OP is the native cryptocurrency of the Optimism network, giving holders participation rights in the governance system.

- Smart Contract Risk

Optimism is currently one of the most popular Ethereum layer 2 solutions with a total of $280 million locked into its smart contracts. It records 13.5m verifiable transactions on-chain with 1.2m unique addresses.

- Financial Risk

OP has a market capitalization of $115m with a 24h trading volume of $107m. It is currently traded on many centralized & decentralized exchanges with a decent volume.

- Counterparty Risk

Optimism network adopts a two-tier governance system composed of ‘Token House’ and ‘Citizens House’. The two parties mostly oversee different objectives with the Token House tasked with project incentives, protocol upgrades and treasury funds, while the Citizens’ House is focused on retroactive public goods funding.

CRV (Curve)

Curve is a decentralized exchange liquidity pool specially designed for swapping between stablecoins with low fees and slippage. CRV is used to participate in the CurveDAO, a time-weighted voting system that favors long-term liquidity with added incentives.

- Smart Contract Risk

Curve Finance launched the CRV token in August 2020. The contract has been reviewed by 3 audit firms including Trail of Bits, Quantstamp and MixBytes.

- Financial Risk

As one of the top performing DeFi projects, CRV has a market capitalization of $354m. Today, about 30% of the CRV tokens have been locked into Voting Escrow Curve (veCRV), the rest are available on top exchanges with a 24h trading volume of $103m.

- Counterparty Risk

Curve Finance is fully decentralized - they launched CurveDAO to manage changes to their protocol. Anyone with a minimum number of veCRV (Voting Escrow Curve) tokens is able to propose an update to the Curve protocol. Holders vote to reject or accept a proposal by locking up CRV tokens. The longer the CRV token is locked up, the more voting power it has.

renFIL (renFIL)

The Ren protocol (previously Republic Protocol) is designed to provide interoperability by allowing people to transfer cryptocurrency across different blockchains. Users can convert Filecoin’s FIL to an ERC-20 or BRC-20 token using the RenBridge and convert it back to FIL. 1 renFIL represents 1 FIL on Filecoin network.

- Smart Contract Risk

The Ren protocol has completed audits by ChainSecurity, Consensys Diligence and Trail of Bits. 187k renFIL tokens have been minted on Ethereum since October 2020 with 9k verifiable transfers on-chain.

- Financial Risk

Users can use RenBridge to mint or redeem renFIL at any time. FIL has a market capitalization of $1.2 billion with 24h hour trading volume of $109m.

- Counterparty Risk

Ren protocol is governed entirely by code, the RenVM network is also trustless, meaning there is no central authority that can stop users from minting or redeeming renFIL tokens.

sUSD (SUSD)

Synthetix is a protocol for the issuance of synthetic assets that tracks and provides returns for another asset without requiring you to hold that asset. sUSD is the synthetic stablecoin asset on the Synthetix platform, whose value tracks that of the US Dollar.

- Smart Contract Risk

sUSD was launched by Synthetix protocol in June 2018. The Synthetix protocols have gone through multiple audits by Iosiro. Today, sUSD records 877k on-chain transactions with 14k holders on Ethereum.

- Financial Risk

sUSD has a market capitalization of $142m with a 24h trading volume of 58m. Most of the trades take place on decentralized exchanges including Uniswap V2 & V3, Curve, Sushiswap, etc. sUSD’s price remains quite constant at $1.

- Counterparty Risk

Synthetix is one of the oldest DeFi projects that has a decentralized governance structure through the SynthetixDAO, which has several key governing bodies co-existing and aligned by SNX tokens to enable the decentralized nature of the Protocol.