Welcome to another dForce monthly update. We keep our community up-to-date about what to expect in the coming months.

Highlights

- dForce launched a Liquid Stability Reserve (LSR) module to $USX in addition to the existing pool and vault-based minting model. Learn More.

- $sUSD, $AAVE, $MATIC, $OP, $CRV, and $renFIL are supported on dForce Lending. Learn More.

- dForce is now a top 50 validator on Cosmos, further aligning our DeFi strategies and the interests of the dForce community with the broader blockchain ecosystem. Learn More.

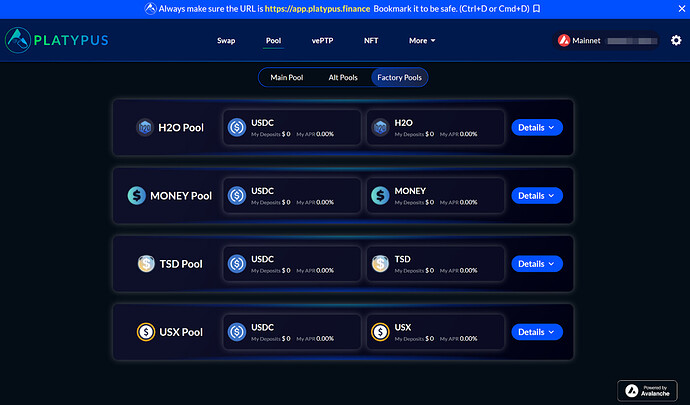

- USX/USDC pool launched on Platypus. Learn More.

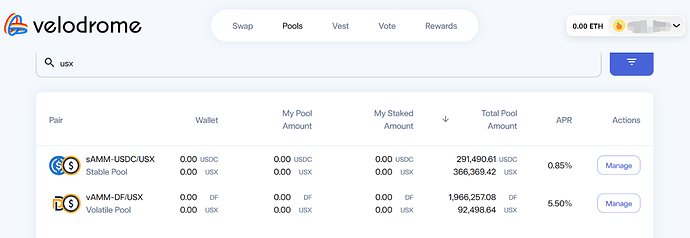

- DF/USX and USX/USDC pools launched on Velodrome. Learn more.

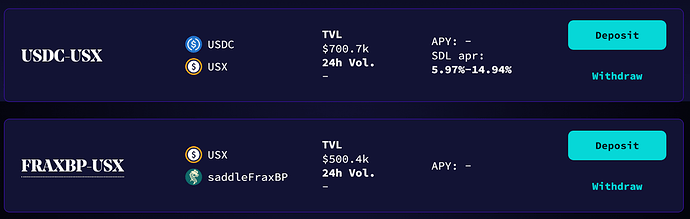

- USX/USDC and USX/FRAXBP pools launched on Saddle Finance. Learn more.

- dForce conducted a Chinese Community Call on Twitter space. Listen to the recording here. Recording1,Recording2

- dForce put together Handbook Guides for different blockchains’ communities to utilize dForce protocol.

- DeFiLama is now tracking dForce pools on the yield dashboard. Learn More.

Overview

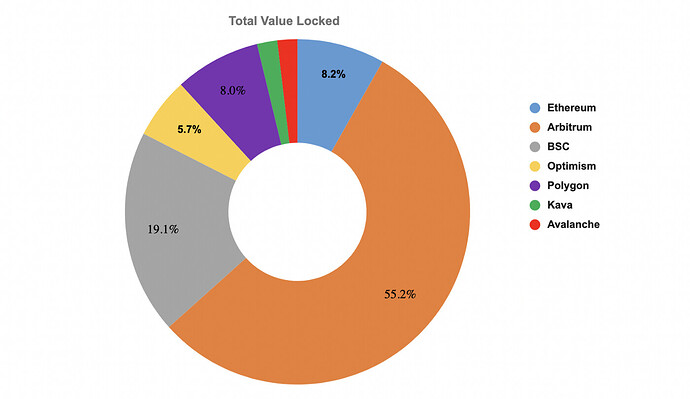

In July, dForce recorded a TVL of $211.9m, with 55.2% parked on Arbitrum, 19.1% on Binance Smart Chain, 8.2% on Ethereum, 8.0% on Polygon, 5.7% on Optimism, 1.9% on Kava, and 1.9% on Avalanche.

USX

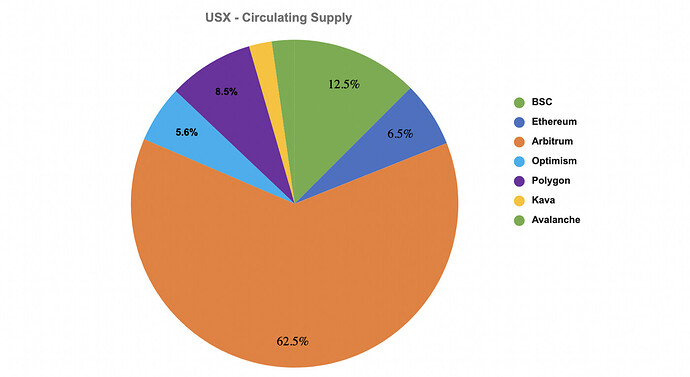

As of 31st July 2022, the total circulating supply of USX is $178.1m, with 62.5.5% of liquidity currently parked on Arbitrum, 12.5% on BSC, 8.5% on Polygon, 6.5% on Ethereum, 5.6% on Optimism, 2.2% on Kava, and 2.2% on Avalanche.

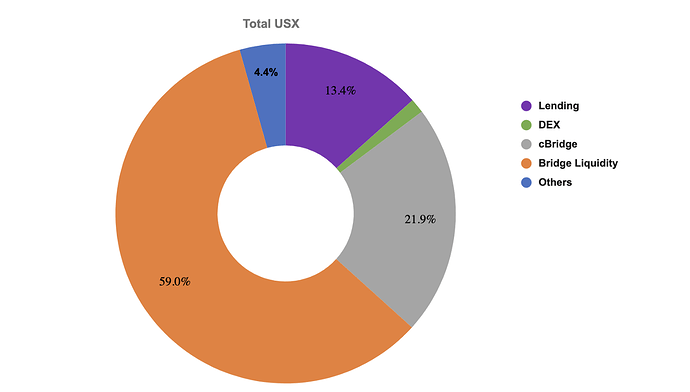

Approximately 59.0% of USX liquidity are parked on Arbitrum, BSC and Optimism to facilitate cross-chain expansions, 21.9% on cBridge (cross-chain swap), 13.4% on lending, 4.4% sitting in wallets with market participants, and 1.4% on DEXes.

Lending

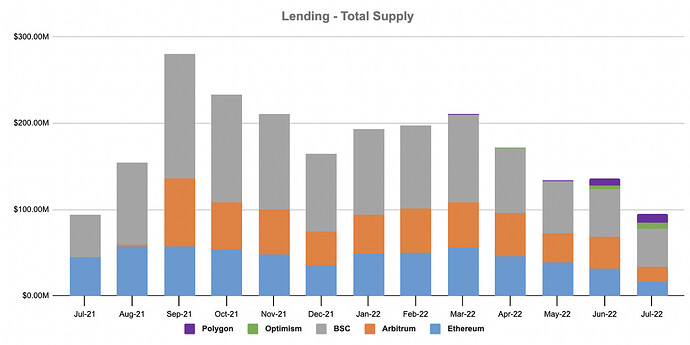

In July, dForce Lending recorded a total supply of $94.9m, with Binance Smart Chain constituting 45.67%, Aribitrum 19.0%, Ethereum 16.8%, Polygon 10.7%, and Optimism 7.6%.

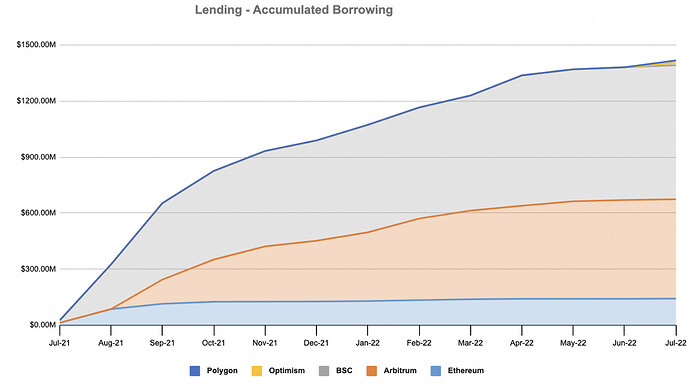

Total accumulated borrowing grew to $1.3b, representing an increase of 0.8% from the previous month in new loan originations.

Revenue

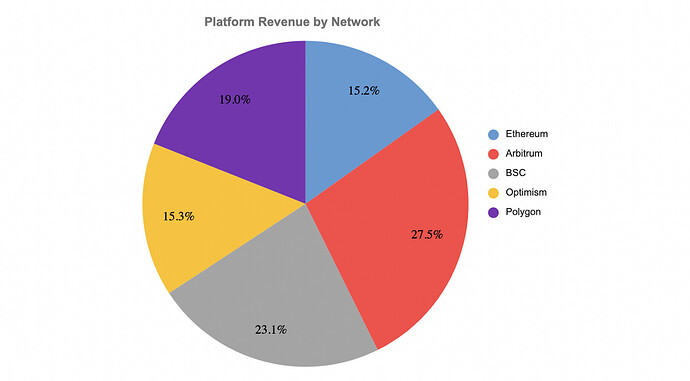

dForce recorded an Annualized Platform Revenue of $935K in July, with 27.5% generated on Arbitrum, 23.1% on Binance Smart Chain, 19.0% on Polygon, 15.3% on Optimism, and 15.2% on Ethereum.

Liquidity Mining

dForce has ongoing liquidity mining initiatives on Ethereum, Arbitrum, Polygon, Optimism, and Binance Smart Chain. Please visit dForce Forum to view the gauge (update on a weekly basis) and click here to see related tutorials.

Product Development

We’ve had some exciting product updates in July, including:

- dForce Lending now extends lending support to $sUSD, $AAVE, $MATIC, $OP, $CRV, and $renFIL.

- POO strategy is deployed on Optimism to power DF/USX liquidity.

- A new USX Peg Stability Module, LSR (or Liquid Stability Reserve Module) was launched on BSC, Polygon, and Optimism to further defend USX’s price peg and

- USX liquidity mining was launched on Optimism, BSC, and Polygon.

There are also some exciting developments in progress. Namely:

- dForce Trade: aggregate liquidity through off-chain and on-chain routings to ensure the best price (expected launch in Q3)

- Oracle upgrade: redefine the oracle framework, add price validity checks, and be compatible with multi-chain configurations (expected launch in Q3)

- dForce protocol’s POO will support and power EUX liquidity on secondary market (in process)

Governance

DIP026 — New Asset Onboarding to dForce Lending [Passed]

This proposal seeks approval on the following:

- Add collateral support to AAVE, MATIC, OP, CRV across all networks dForce supports.

- Add lending support to sUSD, renFIL across all networks dForce supports.

DIP027 — Proposal to Introduce Liquid Stability Reserve to USX [Passed]

This proposal seeks approval on the following:

This DIP seeks to introduce a LSR module that allows users to use supported stablecoins including USDC, BUSD, USDT, DAI, USDP as collaterals to mint USX (or redeem USX for supported stablecoins) at 1:1 rate — USX’s full collateralization will remain intact.

DeFi Integrations

USX/USDC pool launched on Platypus.

DF/USX and USX/USDC pools launched on Velodrome.

USX/USDC and USX/FRAXBP pools launched on Saddle Finance.

Marketing

This month was exciting, packed with many marketing events.

One of such was the Chinese Community Call. dForce conducted a Chinese Community Call on Twitter space, updating the community on what’s been up in 1H22. We gave out $100 AMA rewards to community members who participated — learn more here.

Missed the call? Don’t worry — here’s a recording for you curious minds. Listen to the recording here. Recording1,Recording2

dForce put together multiple ‘Handbooks’ for different blockchains. These handbooks were designed to help community members of each blockchain navigate their way around dForce’s protocols. Link to the documents are below:

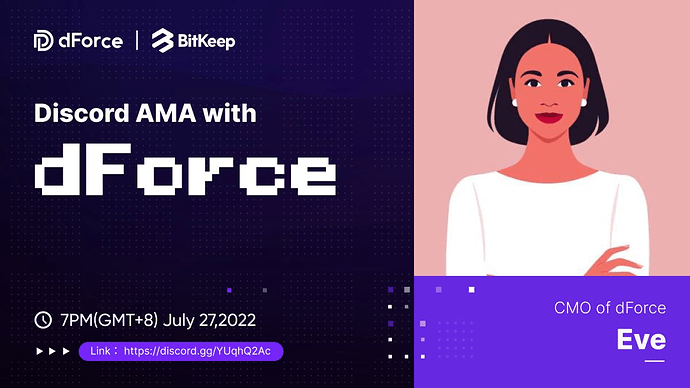

Eve, CMO of dForce participated in an AMA conducted by Bitkeep in their Discord community. The engagement was targeting to introduce dForce to BitKeep community. The event included a $500 AMA airdrop.

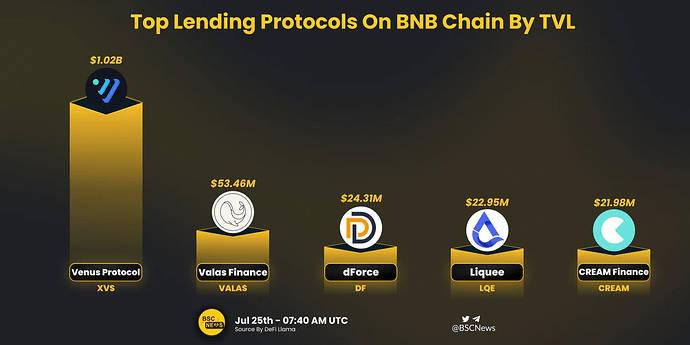

At the time of writing, dForce was the #3 lending protocol on Binance Smart Chain by TVL: Learn More

We welcome you to join our community to participate in related discussions.